Tag: SLV

- 11.06.2022

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas, Personal finance

- Tags: BITO, DIA, FXI, GLD, KWEB, QQQ, SLV, SPX

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

- 22.05.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EEM, emerging markets, ETFs, GLD, Seasonality, SLV, Valuations

- 21.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: eem, Elections, GLD, Seasonality, SLV, XLI

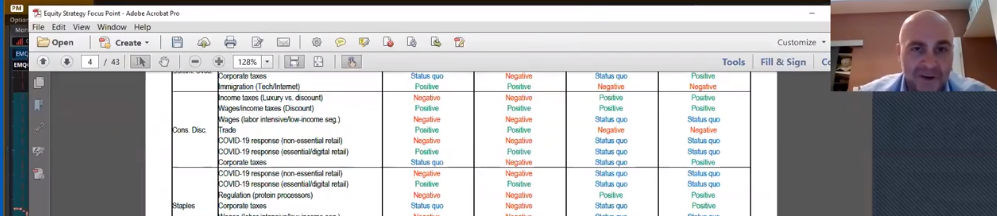

We take a first glance at Bank of America research on which sectors will benefit under the four possible election results in the US. Meanwhile, US sector rotation is visible. Investors are moving from technology to industrials. Emerging markets are holding up, also. Gold and Silver are flat. Barron’s highlights the possibility of Japan and …

Friday Investment Talk: US Elections, Seasonality, Europe, Japan and Emerging Markets Read More »

- 3.08.2020

- Categories: Investment ideas, Personal finance

- Tags: $VNM, china, COVID, Gold, oil, Rubles, SLV, usd

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

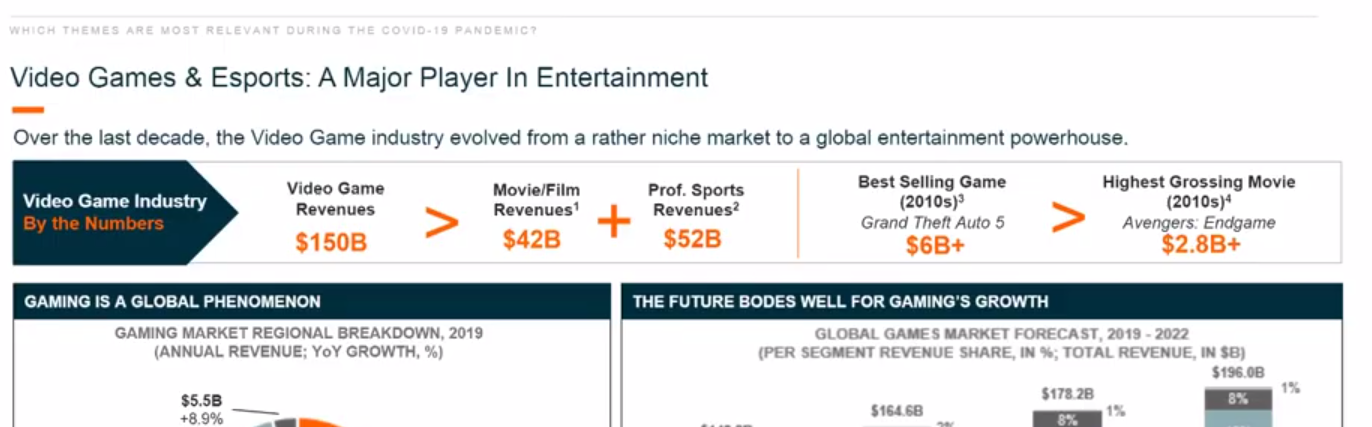

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 3.07.2020

- 3.10.2019

- 11.09.2019

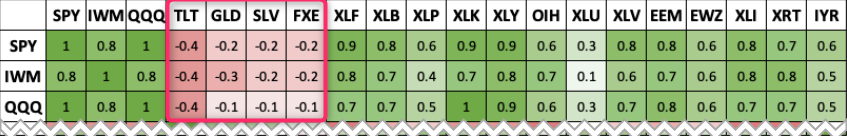

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …

- 31.07.2019