Tag: GDX

- 3.07.2020

July and the second half of the year have started off consistent with historical trends and patterns. The first trading day was mostly positive with S&P 500 and NASDAQ recording gains. However, July has historically been a month of transition with gains early and weakness in the second half. Meanwhile, three seasonal tredns start in July.

- 13.06.2020

- Categories: Analytics, Investment ideas

- Tags: bonds, GDX, GDXJ, GLD, HYG, JNK, QQQ, Seasonality

AVC partners discuss corporate bonds from some surprising names now considered "Fallen Angels". Gold, inflation and the undervalued gold miners are discussed in relation to the current overbought market. Thursday's huge sell off is a set up for a last run of strength before real seasonal weakness sets in.

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 31.07.2019

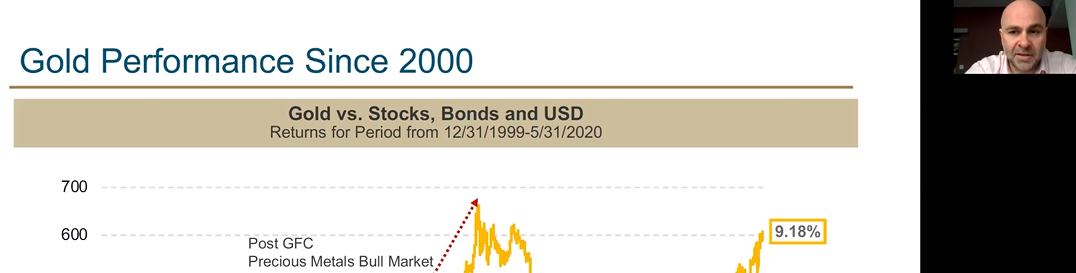

One of the bright spots in the commodities asset class, as well as the broader market this year, has been precious metals. In Q2 2019 among all alternative assets, precious metals ETFs were well represented in the top ten.

The recent rally in precious metals presents a few questions. Why this type of performance in precious metals? How have technicals improved as a result?

To access this post, you must purchase Subscription Plan – AVC Pro.