Tag: XLk

- 22.01.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: Copper, COPX, CPER, DIA, FCG, IBB, IYW, IYZ, Natural Gas, QQQ, SOXX, SPX, UNG, VNQ, XLk, XNG

Natural Gas, Energy and Copper still have to show signs of life to fulfill their usual bullish winter runs. Meanwhile, Strong US equity markets have lead to excellent returns in the model portfolios that adhere to seasonal trade stratagies. Expect some modest seasonal weakness soon, though.

- 10.01.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: SPX, XLC, XLE, XLF, XLk

With the new year and new decade already here, the markets closed on one of the strongest years for the US equity market in the past decade. The S&P 500 (SPX) was up nearly 29% in 2019 - the second best year in the 2010s, only 2013’s return of just over 29% beat it. All broad sectors produce gains last year, with nine out of the 11 broad sector SPDR ETFs posting gains greater than 20%. The top three sectors, using SPDR ETFs as proxies, were technology (XLK), communication services (XLC, basically a technology ETF), and financials (XLF), returning 47.90%, 29.92%, and 29.22%, respectively. Energy (XLE), on the other hand, was

- 14.10.2019

We lay out the buy points and stop losses for the Tactical ETF Portfolios based on the the Seasonal Trade Strategy

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.09.2019

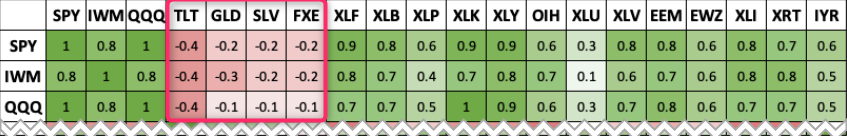

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …

- 2.07.2019

With the end of Friday's trading session, we closed out Q2 2019. As we do each quarter, we wanted to take this opportunity to summarize the performance of various asset classes using ETF proxies.

To access this post, you must purchase Subscription Plan – AVC Pro.