Tag: IWM

- 21.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

- 9.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

- 1.09.2023

- Categories: Analytics, AVC Pro Subscription

- Tags: DJIA, IWM, NASDAQ, Seasonality, SPX

- 31.05.2022

- Categories: Investment ideas, News, Personal finance

- Tags: FB, IWM, MSFT, QQQ, SPY

- 28.01.2022

- Categories: Analytics, AVC Pro Subscription, Investing basics

- Tags: DJIA, IWM, Seasonality, SPX

- 24.12.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Earnings, IWM

- 11.12.2021

- Categories: Investing basics, Investment ideas, News

- Tags: CPI, interest rates, IWM, RSX, XLRE, XOP, XRT

High debt levels and inflation create difficulties for investors in 2022. ‘Financial Repression’ could become a household phrase. Inflationary pressures will put certain sectors in the spotlight. We watch oil and gas exploration and production, consumer staples and real estate as places for outperformance. A quick look the Russian ETF (RSX) reveals its need to …

Friday Investment Talk: Macroeconomics, Financial Repression in 2022 Read More »

- 7.11.2021

COP26 hits Glasgow ushering in a chance for governments to change corporate rules on environmental policies. Accounting standards are one area of focus. Main issues include reducing emissions (adoption of EVs and reduction of coal industries), deforestation, diet change, and new tech for emerging markets. Clean Energy Tech ETF (ICLN) looks interesting as US small …

Friday Investment Talk: Glasgow Goes Green, China’s Value and Small Caps Breakout Read More »

- 26.09.2021

- Categories: Investing basics, Investment ideas, News, Personal finance

- Tags: Bitcoin, IWM, Stocks

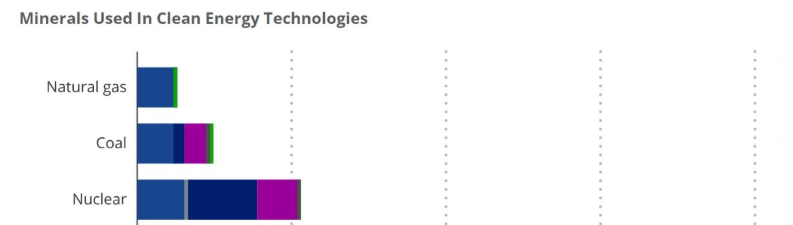

The US outlined extensive ‘Clean Energy’ priorities that will create a magnitude of change in demand for metals and rare earth minerals, such as cobalt, lithium, copper, zinc, molybdenum, etc. China is a main supplier of many of these elements key in electricity production from wind and solar power. Politics and transport issues can create …

Friday Investment Talk: Clean Energy Minerals, Cryptos, Market Pullback Read More »

- 18.07.2021