Category: AVC UL Subscription

This category can only be viewed by members. To view this category, sign up by purchasing Subscription Plan – AVC Pro.

- 26.04.2024

- Categories: AVC Pro Subscription, AVC UL Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, S&P 500, Seasonality

Following 5 months of gains, April will likely end with a first negative monthly return in 2024. This provides worry for a weak May also.

- 17.02.2024

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Investment ideas

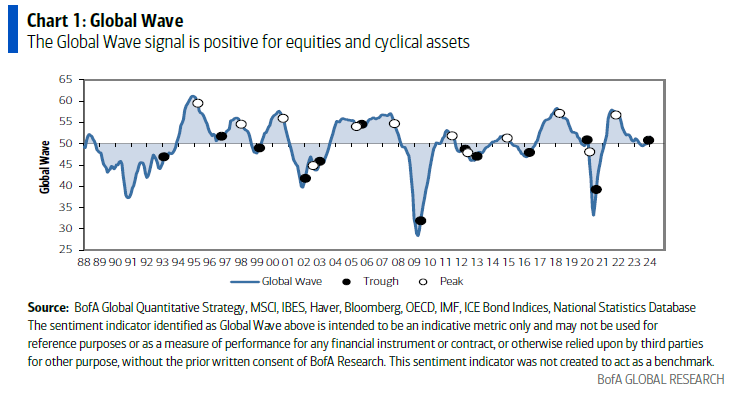

Last week, BoA published two articles that seemingly opposing forecasts for global equity markets. After closer look, BoA puts forth a strong case for sector rotation, as the global economy performs a soft-landing.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.12.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: Seasonality

When looking at the seasonal patterns for election years, like 2024, mostly bullish patterns appear for the US markets. The most bullish scenario is when there is a sitting president running for reelection. In those years, NASDAQ has averaged a full-year gain of 19.14%. This is much stronger than the 12.73% average gain in all …

Election Years: Importance of Incumbant Read More »

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.12.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas

- Tags: Healthcare, Stocks

Two companies seem poised for continued strong upside appreciation. Overall descretionary healthcare spend still increasing.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 29.11.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas

As Hyperscalers like Microsoft and Amazon develop their cloud computing, one chip stock stands to benefit as the companies build specific chips for their servers.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

December is better than November in Pre-election years for the most part. Weakness in the beginning will lead to a good run in the end of the month.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 9.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

November marks the beginning of the bullish season for stocks, especially small caps. As the market moves to bullishness we have witnessed a huge rally.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.09.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Personal finance

Usually Octobers turn back on the bullish signals for the market. In pre-election years Octobers can be very weak, however.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.06.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

Simple sell signals are appearing, including the lack of momentum in leading stocks recently. July in pre-election years is weaker than average Julys. A NASDAQ mid-July rally could occur.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 1.02.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, News

- Tags: Seasonality

In stark contrast to last year, 2023 is off to a bullish start. S&P 500 finished the month strong with a 6.2% gain. The January Barometer is positive! This is the best S&P January since 2019 which was also the last year the S&P 500 completed our bullish January Indicator Trifecta. The January Indicator Trifecta …

January’s Forecast for 2023 Read More »

To access this post, you must purchase Subscription Plan – AVC Pro.