Tag: GLD

- 11.06.2022

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas, Personal finance

- Tags: BITO, DIA, FXI, GLD, KWEB, QQQ, SLV, SPX

- 6.03.2022

A hot war has created hot commodity prices. Wheat was a big gainer this week, but also oil and non-ferrous metals took off. Brazil has shown strength this year as its relative strength outperforms many sectors. Healthcare companies such as our favorite BMY have a made a huge comeback this year. Selling continues everywhere else, …

- 19.02.2022

- Categories: Investment ideas, News, Personal finance

- Tags: GLD, PXD, SPX, XOM, XOP

Markets were again weak with the $SPX falling 1.6% during the usually bullish options expirations week. European markets and gold showed strength, while energy stocks stay on their 2022 roll. Inflation fears has caused JP Morgan to look for 7 interest rate increase in 2022, yet none greater than 25 bps. Bank of America sees …

Friday Investment Talk: Europe, Inflation, Interest Rates Read More »

- 29.01.2022

- Categories: Investment ideas, Personal finance

- Tags: Energy, GLD, SPY, vix

Markets were on a wild ride in January, especially this last week. We expected this would be the 4th negative week for the markets, but strength in the last few hours turned this week positive. On many levels and by many measures the market is extremely oversold, but so far few buy signals have developed. …

Friday Investment Talk: Fear and Market Suffering Read More »

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

- 22.05.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EEM, emerging markets, ETFs, GLD, Seasonality, SLV, Valuations

- 7.05.2021

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News, Personal finance

- Tags: COPX, CPER, DIA, ETFs, GLD, IWM, QQQ, Seasonality, SPX, XLU

- 29.11.2020

- Categories: Investment ideas, Personal finance

- Tags: Biotech, COVID, GLD, Gold, IBB, TAN, xbi

- 23.11.2020

- Categories: Investing basics, Investment ideas

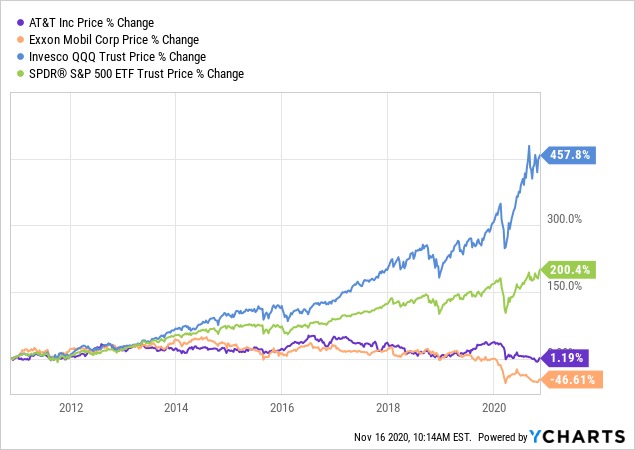

- Tags: AT&T, bitcoin, dividend, Exxon, GLD, IBM, Tech

- 4.10.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, Elections, ETFs, GLD, market trends, Stocks

As US elections approach we take a look at how election results move markets. We go through 10 lessons for all investors who are nervous going into the elections. History shows that there is nothing to be afraid of except uncertainty. Markets look bullish for October based on the AAII Investors Sentiment Survey and several …

Friday Investment Talk: US Elections, Market Bullishness, and Fintech Read More »