Tag: oil

- 6.03.2022

A hot war has created hot commodity prices. Wheat was a big gainer this week, but also oil and non-ferrous metals took off. Brazil has shown strength this year as its relative strength outperforms many sectors. Healthcare companies such as our favorite BMY have a made a huge comeback this year. Selling continues everywhere else, …

- 18.12.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Energy, oil, Real Estate, Sectors, SPX

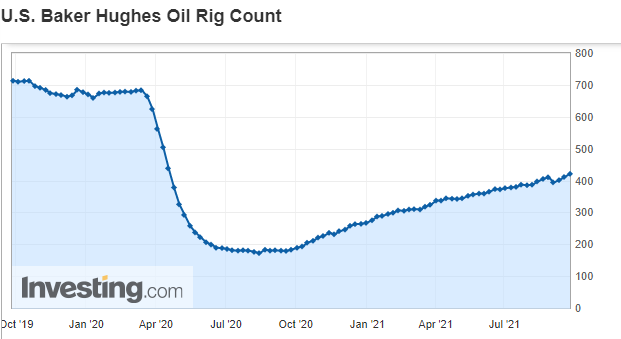

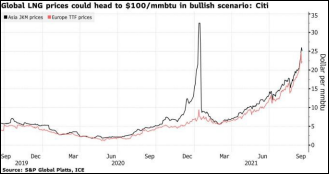

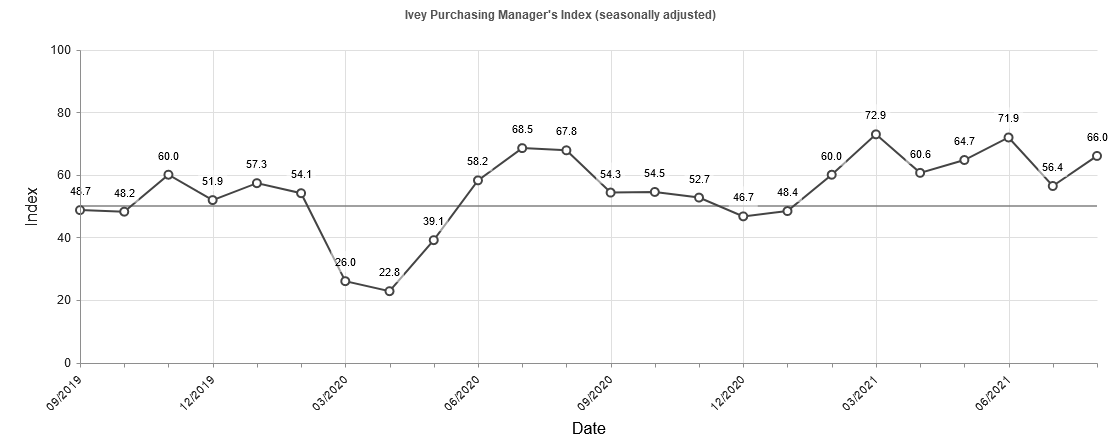

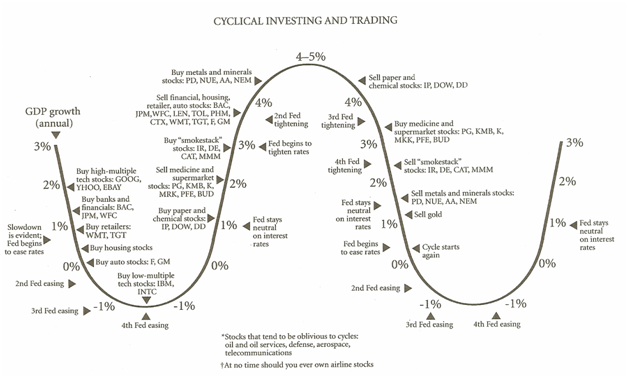

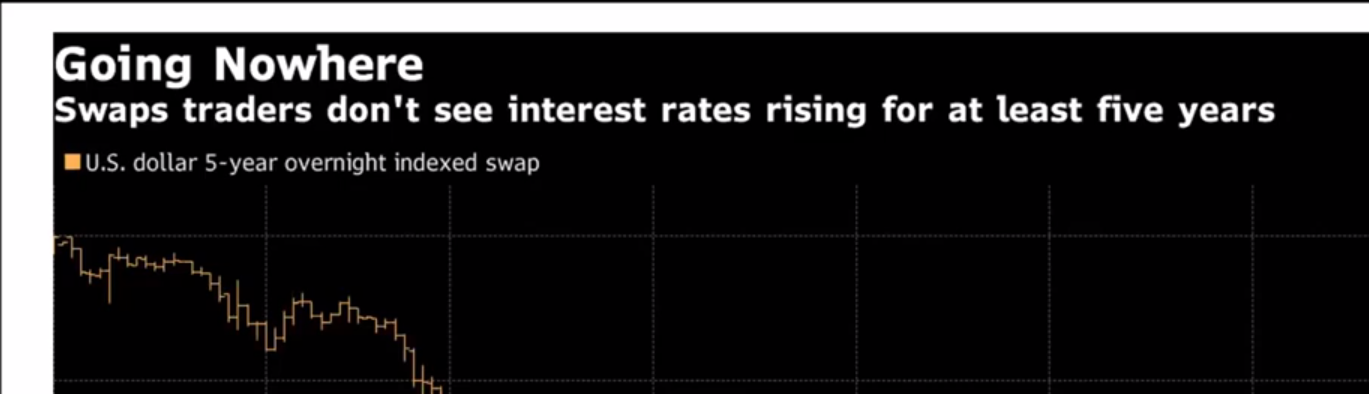

Energy markets look to be in a long term bull market with continued strength in oil prices fueling additional exploration. Real Estate prices for residential housing are rising faster than rents. Likely rents will play catch up in 2022. Sector rotation towards quality and low volatility is taking place since the Federal Reserve has began …

Friday Investment Talk: Oil and Energy, Real Estate, Sector Rotation Read More »

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

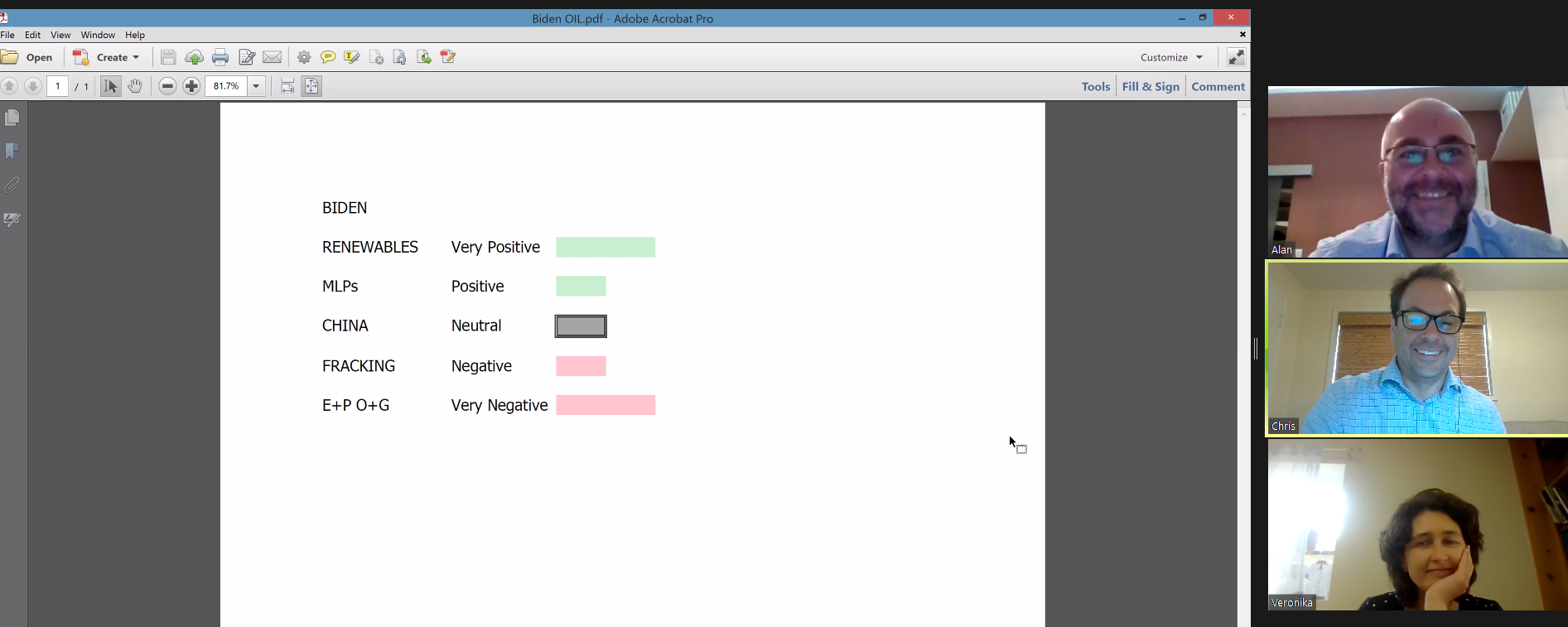

- Tags: ESG, oil

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Natural Gas, oil, REITs

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Mining, oil

- 10.05.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: oil

- 27.03.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, IWM, oil, Seasonality, usd

- 28.09.2020

- 3.08.2020

- Categories: Investment ideas, Personal finance

- Tags: $VNM, china, COVID, Gold, oil, Rubles, SLV, usd

- 9.09.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: AGG, BND, oil, SCO, Seasonal Strategy, TLT, XLP, XLU, XLV