Tag: XRT

- 11.12.2021

- Categories: Investing basics, Investment ideas, News

- Tags: CPI, interest rates, IWM, RSX, XLRE, XOP, XRT

High debt levels and inflation create difficulties for investors in 2022. ‘Financial Repression’ could become a household phrase. Inflationary pressures will put certain sectors in the spotlight. We watch oil and gas exploration and production, consumer staples and real estate as places for outperformance. A quick look the Russian ETF (RSX) reveals its need to …

Friday Investment Talk: Macroeconomics, Financial Repression in 2022 Read More »

- 15.05.2021

- 11.09.2019

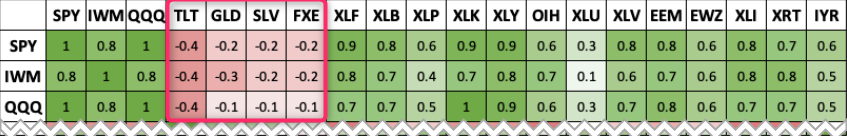

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …