Tag: Seasonal Strategy

- 1.10.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Seasonal Strategy, Seasonality

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

Waiting for the Seasonal sell signal in the NASDAQ, other sector trades come to and end in June. Gearing up for a sideways market is the plan now, until the strong months again come later this year.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 4.12.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: Seasonal Strategy, Seasonality

December seasonality after the November jobs report can turn weak until the later part of the month. Buying positions in bullish sectors is useful during this period. Oil and energy stocks perform well, while gold and silver enter a weak period.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.11.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: NASDAQ, QQQ, Russell 1000, Russell 2000, Seasonal Strategy, SPY

December is now the number three S&P 500 and Dow Jones Industrials month since 1950, averaging gains of 1.5% on each index.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 18.10.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

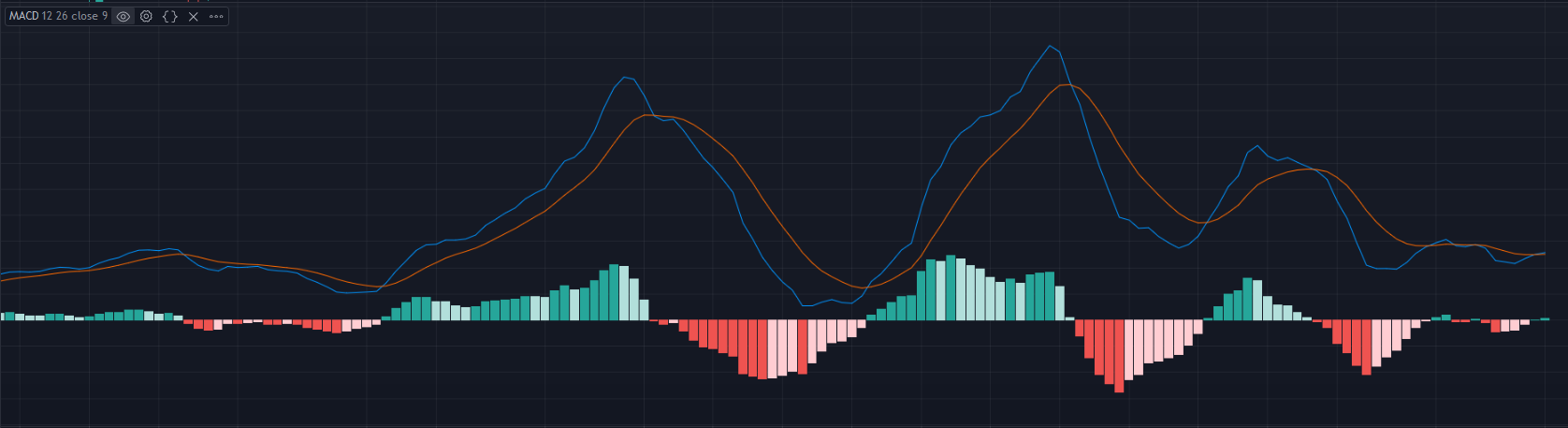

- Tags: DJIA, Elections, MACD, Seasonal Strategy, SPX, Tech

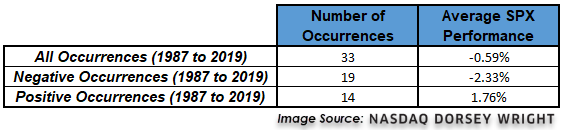

Seasonality is problematic this year, likely due to the elections and politics around another COVID stimulus package. Still, time and history work for the strategy.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.09.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: Seasonal Strategy, Seasonality, SPX

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonal Strategy, Seasonality, SPX

October can invoke fear into investors as it is usually a weak month. However, October often marks the lows for the year. Stay diligent!

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: MACD, NASDAQ, NDX, Seasonal Strategy

NASDAQ Seasonality has changed to a more negative stance after today's negative performance. Caution is warranted in tech stocks. Bonds can be added as summer months can provide weakness to stocks.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 20.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance, Подписка AVC Про

- Tags: DJIA, Seasonal Strategy, SPX, TLT

So far, April has regained some of this years losses - in fact the NASDAQ is again positive for 2020.

What should investors do now that markets are entering the weakest period of the year? How bad could this year be, actually?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

Usually at this time of the year, early-April, stock markets would have had a nice seasonal rally. Well, there is nothing usual about the market or the economy this time.

As of today, the new bear market closing lows were on March 23. From their highs DJIA was down 37.1% and S&P 500 was down 33.9%.

Since then the market has rebounded to trim those losses.

Now we look to position for the worst months of the year ahead.

To access this post, you must purchase Subscription Plan – AVC Pro.