Tag: china

Analysts have a neutral view of Alibaba (BABA) going into 2022. They see revenue across all business lines slowing from pandemic levels. But growth rates are still strong, and new business lines are just in their infancy. The negativity among analysts is palatable. Longer term, they maybe overdone.

- 7.11.2021

COP26 hits Glasgow ushering in a chance for governments to change corporate rules on environmental policies. Accounting standards are one area of focus. Main issues include reducing emissions (adoption of EVs and reduction of coal industries), deforestation, diet change, and new tech for emerging markets. Clean Energy Tech ETF (ICLN) looks interesting as US small …

Friday Investment Talk: Glasgow Goes Green, China’s Value and Small Caps Breakout Read More »

- 3.10.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, inflation, interest rates, Retirement

- 10.09.2021

- Categories: Analytics, Investment ideas, News

- Tags: china, Commodities, inflation, iron, nickel, palladium, PMI

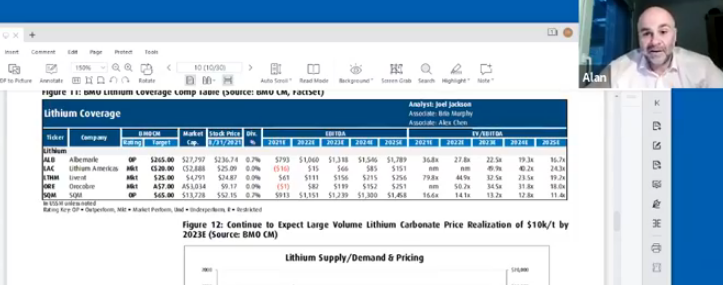

Lithium prices are set to rise over the next decade. We have previously discussed Albemarle (ALB) and Sociedad Química y Minera (SQM) as main beneficiaries of this trend. We review these again during this week’s Live Facebook chat. Other metals, like iron ore and palladium look to have peaked recently after strong runs. Chinese PMI …

Friday Investment Talk: Lithium, Iron Ore, Palladium, Inflation Read More »

- 30.08.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, Fed, xbi, XLV

- 23.08.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, dividend, emerging markets, inflation

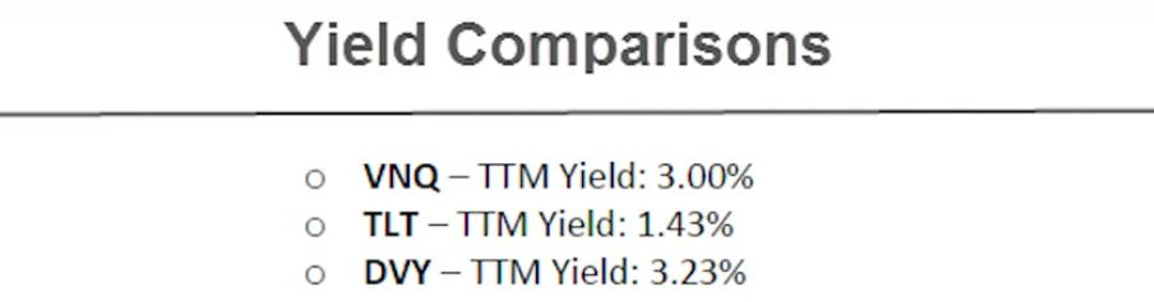

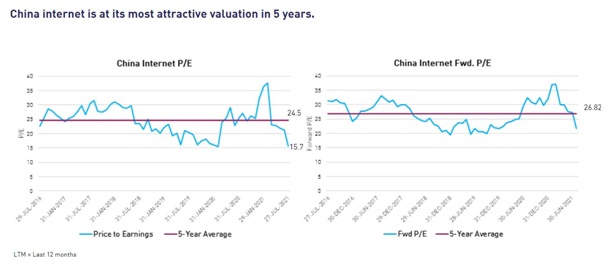

Chinese stocks have been pounded lately as Xi puts pressure on companies to provide funding for socially beneficial projects. Arm twisting seems at play, as wealthy businessmen kowtow to politicians. Emerging markets face inflation as natural disasters, COVID and supply chain issues fuel shortages. Dividend ETFs always generate attention. We compare $DVY to owning the …

Friday Investment Talk: China, EM Inflation, Dividends Read More »

- 9.08.2021

- Categories: Analytics, AVC Pro Subscription, News

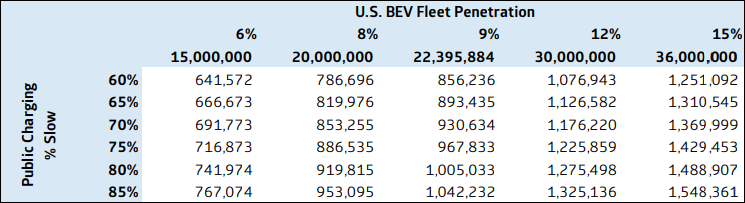

- Tags: china, EV, Infrastructure, US

- 5.08.2021

- Categories: Analytics, Investing basics, Investment ideas

- Tags: china, Fintech, Tech

- 27.03.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, IWM, oil, Seasonality, usd