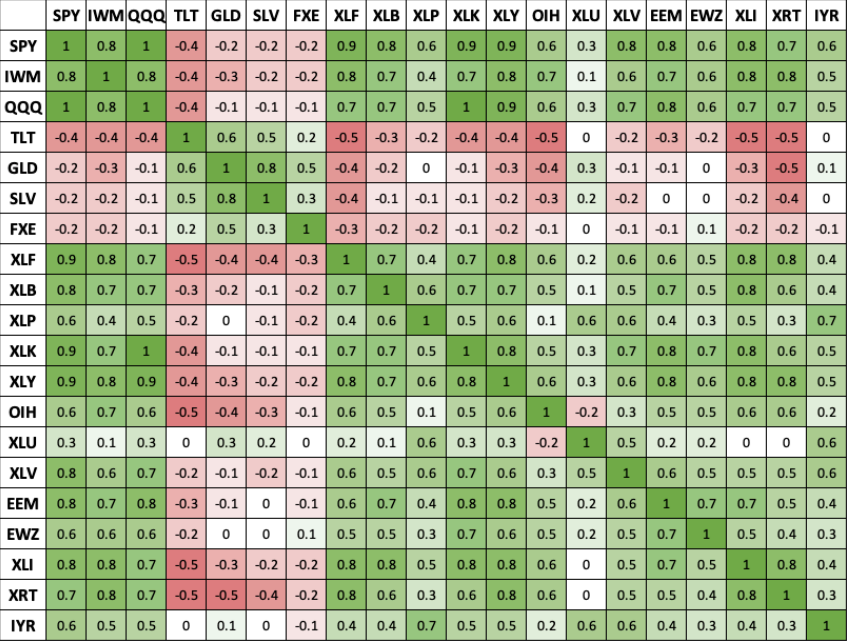

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship.

How can we use this knowledge? Two ways:

Diversification. One of the tenants of the Modern Portfolio Theory is to reduce risk by combining uncorrelated assets (two ETFs with correlation close to 0). When the market moves, the losses in some assets are covered by the gains in the others. Better results have traditionally been found to occur with the ETFs that are also displaying high implied volatility. Therefore, if your investment portoflio maintains a large exposure to the US markets through SPY, you might want to add some GLD, SLV, FXE, or XLU. This is because they have lower correlations.

Pairs trading. Pairs trading attempts to create a market neutral position — meaning the direction of the overall market does not affect the overall win or loss of the portfolio. In other words, the protfolio is non-directional. The goal then is to match two trading products that are highly correlated, trading one long and the other short when the pairs’ price ratio diverges to a price extreme. If the pair reverts to its mean trend, a profit is made on one or both of the positions. For example, SPY and QQQ have a near 1 correlation. Therefore, consider being Short QQQ and long SPY at times of large outperformance of QQQ. Yo need to adjust for the size and the volatilities, so you’ll need about 40% more QQQ than SPY.