Tag: TLT

- 12.12.2021

- Categories: News, Personal finance

- Tags: Commodities, COVID, DJIA, inflation, NASDAQ, Russell 2000, SPX, TLT

US markets were top performers in 2021. Fed tapering became the year's theme as inflation began showing up in the Spring. Bonds sold off, and yields rose. Chinese companies suffered as a crackdown on foreign listed stocks erupted in Q3. The US maintains its top ranking of all equity markets going into 2022.

- 26.08.2021

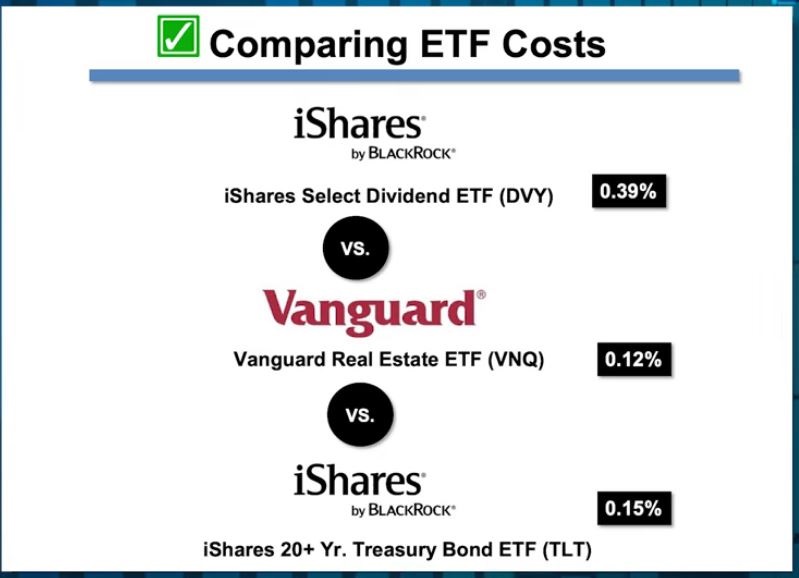

- Categories: Analytics, Investing basics, Investment ideas

- Tags: dividend, DVY, REITs, TLT, VNQ

- 15.05.2021

The debate on the sustainability of inflation is alive! Markets react and traders battle out their Feds next move. Retail and consumer discretionary stocks look weak, while semiconductors and car resellers could bounce. Biotech sits on support.

- 1.03.2021

- Categories: Investment ideas, News, Personal finance

- Tags: $DKNG, inflation, interest rates, TLT, TNX, TSLA

- 21.02.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Biotech, bonds, inflation, interest rates, Medtech, Semiconductors, TBT, TLT

- 13.01.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: interest rates, TLT, TNX

- 31.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: FTSE100, Seasonality, Sectors, SPX, TLT, XLI

Stocks are still bullish from a technical point of view - the Put/Call ratio is overbought, but not yet negative.

All time highs for percentage of stocks above their 50-day moving averages (95%).

Seasonality is generally weak in summer months, but summers are better in election years than other months in election years, and better than in summer months in non-election years. Research from Bank of America,

Cylicals could take the lead in the summer, as social media and tech companies under polical pressure.

- 24.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EWJ, EWY, FXI, GLD, SPX, TLT

We have a just launched the first session of our new weekly "Friday Investment Talk" series. This week Alan, Mike, and I discuss the continuation of the bull market's posture. Mike speaks of how client's 'fear of missing out' leads to overly concentrated portfolios. Alan highlights how the recent Chinese sell off could be a buying opportunity, as other Asian markets look strong.

- 20.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance, Подписка AVC Про

- Tags: DJIA, Seasonal Strategy, SPX, TLT

So far, April has regained some of this years losses - in fact the NASDAQ is again positive for 2020.

What should investors do now that markets are entering the weakest period of the year? How bad could this year be, actually?

To access this post, you must purchase Subscription Plan – AVC Pro.