Tag: SPY

- 31.05.2022

- Categories: Investment ideas, News, Personal finance

- Tags: FB, IWM, MSFT, QQQ, SPY

- 29.01.2022

- Categories: Investment ideas, Personal finance

- Tags: Energy, GLD, SPY, vix

Markets were on a wild ride in January, especially this last week. We expected this would be the 4th negative week for the markets, but strength in the last few hours turned this week positive. On many levels and by many measures the market is extremely oversold, but so far few buy signals have developed. …

Friday Investment Talk: Fear and Market Suffering Read More »

- 3.12.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DJIA, dow jones, Investment Strategy, NASDAQ, QQQ, S&P 500, SPY

November started out very strong, but around the middle of the month small cap stocks began to struggle. Large cap stocks (especially the favored technology and consumer discretionary stocks) went on to make all time highs later in the month. However, during the generally bullish period of the year - around Thanksgiving (Thursday, November 25th) -the large cap leaders also started to sell off.

- 25.11.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: NASDAQ, QQQ, Russell 1000, Russell 2000, Seasonal Strategy, SPY

December is now the number three S&P 500 and Dow Jones Industrials month since 1950, averaging gains of 1.5% on each index.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, IBB, IWM, QQQ, SPX, SPY, XLP, XLU

The best six months of the year for certain US stock indexes has ended. A defensive stance is warranted as the summer months arrive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 17.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: IWM, Russell 2000, SPX, SPY

After stocks suffer large declines, certain companies perform better during a rebound. Besides focusing on timing the bottom, investors need to know what is likely to perform best. We show some historical statistics to get investors ready.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.02.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, s&p500, SPX, SPY, Stocks

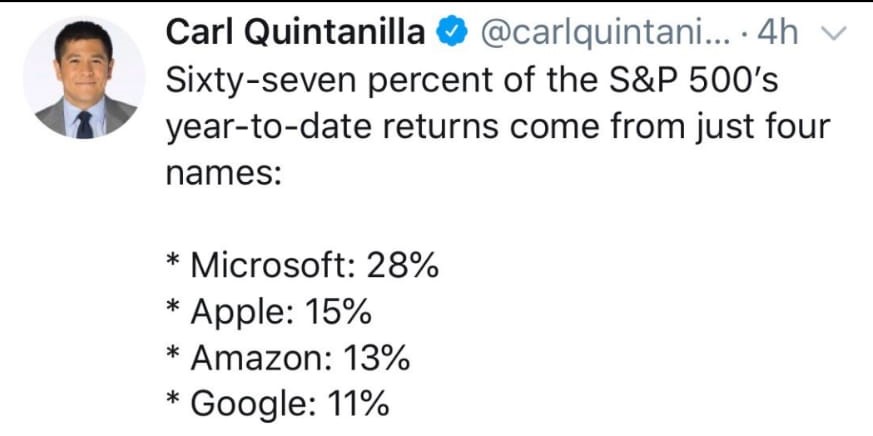

Large Cap stocks make up most of the gains this year, far outpacing smaller stocks. A reversal of this trend could come soon, in March even.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.11.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, IWM, NASDAQ, NDX, Russell 2000, RUT, S&P 500, Santa Claus Rally, SPX, SPY

Novemeber is tracking the seasonal patterns very closely. We still expect a mild pullback early next week, but from then on we are likely to see post-Thanksgiving gains. Early December can be disappointing for bullish traders, but as Christmas approaches the bulls come back to the parade.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.10.2019

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DIA, IWM, QQQ, SPY

Suddenly, the market turns bullish. The seasonal bull run has begun and investors are jumping in.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.10.2019

- Categories: AVC Pro Subscription, Investment ideas

- Tags: AGG, BND, DIA, IWM, QQQ, SPY, TLT

The Seasonal Buy Signal is on Hold. The bull market is still in waiting.

To access this post, you must purchase Subscription Plan – AVC Pro.