Tag: IYW

- 8.02.2022

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AEP, D, DUK, FB, GOOG, IYW, NEE, Seasonality, SO, UTY, XLU

February has been getting lousier for investors. The first half is usually better than the second. Utilities and High Tech start bullish seasonal trends soon.

- 6.08.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AAPL, DJIA, GOOG, IBB, IYW, MSFT, NASDAQ, NVDA, SPX, xbi

July Job's Data usually is negative for the market. Seasonal bullishness in tech stocks starts soon, but the market needs to pullback for a better entry.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

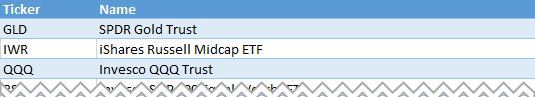

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

Waiting for the Seasonal sell signal in the NASDAQ, other sector trades come to and end in June. Gearing up for a sideways market is the plan now, until the strong months again come later this year.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.03.2020

Large daily moves in both directions of 2-5% and huge intraday swings have taken a toll on markets and psyches. But the February 28 low has held through this week’s wild swings.

According to sector seasonality, there are two sectors that begin their seasonally favorable periods in March: High-Tech and Utilities.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 22.01.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: Copper, COPX, CPER, DIA, FCG, IBB, IYW, IYZ, Natural Gas, QQQ, SOXX, SPX, UNG, VNQ, XLk, XNG

Natural Gas, Energy and Copper still have to show signs of life to fulfill their usual bullish winter runs. Meanwhile, Strong US equity markets have lead to excellent returns in the model portfolios that adhere to seasonal trade stratagies. Expect some modest seasonal weakness soon, though.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 14.10.2019

We lay out the buy points and stop losses for the Tactical ETF Portfolios based on the the Seasonal Trade Strategy

To access this post, you must purchase Subscription Plan – AVC Pro.

- 8.10.2019

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: ETFs, IYW, QQQ

- 23.07.2019

- Categories: AVC Pro Subscription, Personal finance

- Tags: AGG, BND, IWM, IYW, NASDAQ, QQQ, TLT

The slower moving MACD indicator applied to NASDAQ turned negative. Proceed with caution for the next 4 months.

To access this post, you must purchase Subscription Plan – AVC Pro.