Tag: usd

- 29.11.2021

- Categories: News, Personal finance

- Tags: Gold, Seasonality, Turkey, usd

Markets sold off on the day after Thanksgiving in the US. What is typically a bullish period for the markets proved an undoing. The markets had their worst day of the year in 2021 and the worst Black Friday since 1931. Turkey is suffering an economic meltdown that is spreading to civic unrest. The lira …

- 27.03.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, IWM, oil, Seasonality, usd

- 12.12.2020

- Categories: Investment ideas, Personal finance

- Tags: GBP, LLY, PFE, Stocks, usd

- 24.10.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: IWM, NASDAQ, SPX, usd, UUP

US elections rule the headlines while stimulus package hopes keep the markets afloat. Goldman Sachs likes shorting the USD, but a risk off approach heading into the bullish part of the year should dwarf any currency devaluation issues.

- 3.08.2020

- Categories: Investment ideas, Personal finance

- Tags: $VNM, china, COVID, Gold, oil, Rubles, SLV, usd

- 18.05.2015

- Categories: Analytics

- Tags: bonds, emerging markets, eur, market review, market trends, oil, usa, usd

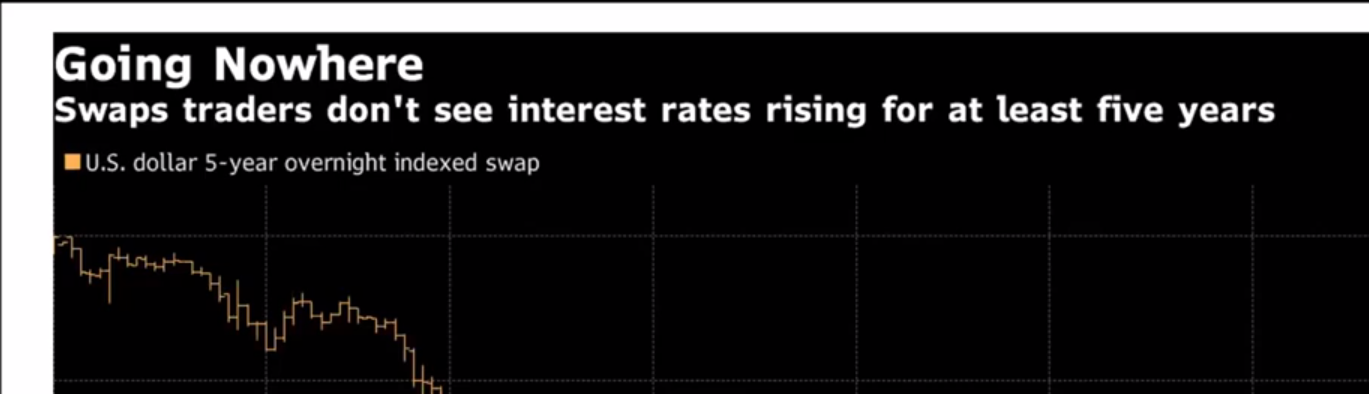

Global stocks rose modestly amid a strong rally in the energy sector. Rising oil prices, surging M&A activity and central bank stimulus measures helped to support world stock prices despite a slowdown in U.S. economic growth during the first quarter. Emerging markets rallied as market observers pushed back the timing of an increase in interest …