Tag: COVID

- 21.03.2022

- Categories: Analytics, Investment ideas, News

- Tags: BABA, COVID, Fed, KWEB, Put/Call Ratios, SPX

Markets staged a massive rebound this week, led by some of the worst performing stocks including Chinese and tech names. Investors took their lead from the US Federal Reserves hawkish comments supporting sustained interest rate hikes to control inflation while not reducing GDP growth expectations. Buy signals sprouted across many indicators. Put/Call Ratios are rolling …

- 29.12.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: COVID, Seasonality

Mid-Term Januarys usually provide less than optimal market conditions for investors. They also are less prescriptive of the rest of the year's returns.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 12.12.2021

- Categories: News, Personal finance

- Tags: Commodities, COVID, DJIA, inflation, NASDAQ, Russell 2000, SPX, TLT

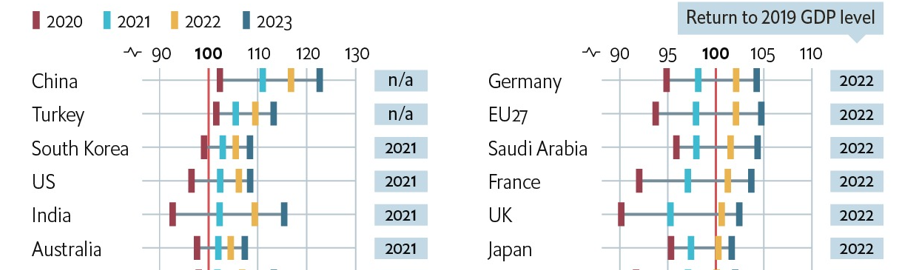

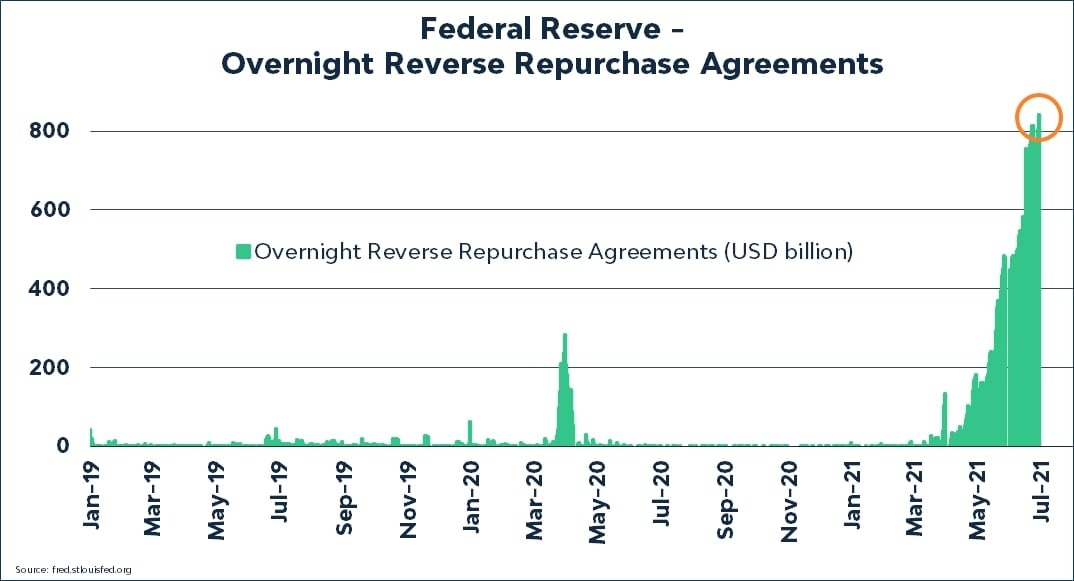

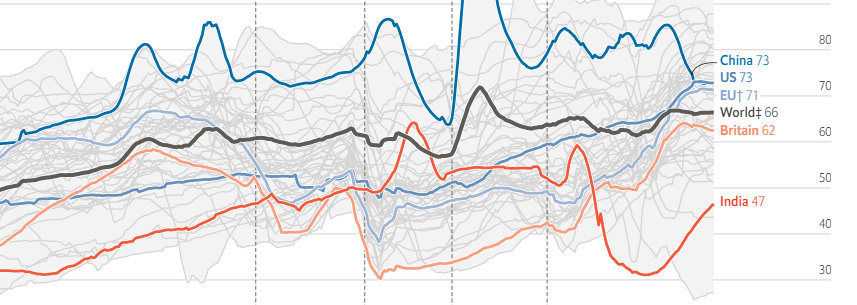

US markets were top performers in 2021. Fed tapering became the year's theme as inflation began showing up in the Spring. Bonds sold off, and yields rose. Chinese companies suffered as a crackdown on foreign listed stocks erupted in Q3. The US maintains its top ranking of all equity markets going into 2022.

- 17.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: COVID, Earnings

Investors are usually pleasantly surprised by this critical supply chain player's ability to not only pre-announce better than expected earnings estimates, but also - within weeks - beat those estimates. With increased demand after the COVID pandemic, this trend is likely to continue.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

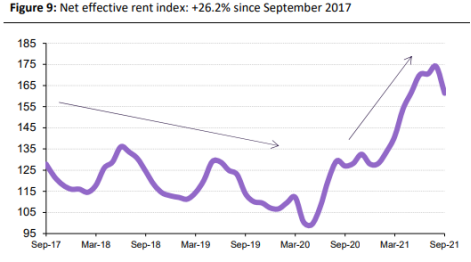

- Tags: COVID, REITs

This REIT has made some interesting acquisitions and is likely to grow robustly as self-storage trends continue as rent rates increase. Currently, the stock has pulled back to an interesting point.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.07.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: COVID, DJIA, NASDAQ, Seasonality, SPX

Technical market indicators are weakening as August approaches. Post Election Year weakness is likely to arise in the next two months.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.07.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, ECB, ESG, europe, inflation, water

- 10.07.2021

- Categories: Analytics, Investment ideas, News

- Tags: COVID, SPX

- 5.07.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: AMD, AMZN, COVID, F, GOOG, MSFT, QQQ, Scam

- 3.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, emerging markets, EMQQ, Russell 2000, S&P 500, SaaS, SPX