Tag: ETFs

- 1.01.2022

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Biotech, ETFs, GERM, IBB, XBI

- 26.12.2021

- Categories: Investment ideas, News, Personal finance

- Tags: ETFs, Housing, Labor, SPX, Unemployment

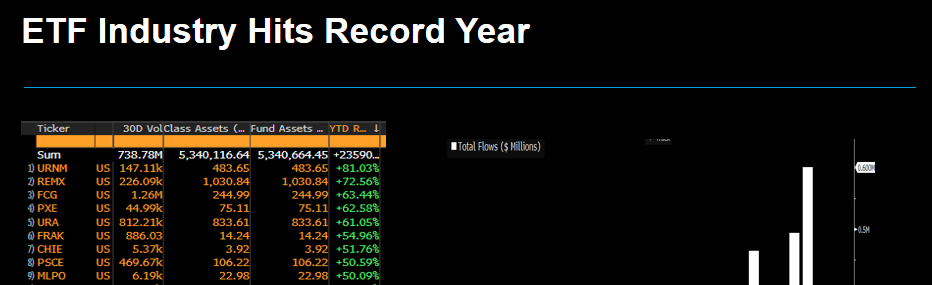

Ray Dalio suggests gifting gold coins for Christmas, while investors set records for ETF inflows in 2021. ESG ETFs grew while IPO ETFs underperform. Markets sold off in December providing a bullish setup in two pet supply companies as put/call ratios roll over to buy signals for the S&P 500 index. Beware of mid-term US …

Friday Investment Talk: Christmas Gifts, ETF Inflows, Housing, and US Population Read More »

- 20.09.2021

- Categories: Investment ideas, News

- Tags: ARCH, ETFs, Natural Gas, SPX

After visiting the Money Show annual conference in Las Vegas, we review Bloomberg’s ‘Hot ETFs’ list – ETFs likely to grab investors attention through the rest of 2021. Then we turn to Europe to look how natural gas prices have soared this year, putting pressure on European households headed into the winter months. Back in …

Friday Investment Talk: ETFs, Natural Gas, US Markets Read More »

- 22.05.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EEM, emerging markets, ETFs, GLD, Seasonality, SLV, Valuations

- 7.05.2021

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News, Personal finance

- Tags: COPX, CPER, DIA, ETFs, GLD, IWM, QQQ, Seasonality, SPX, XLU

- 17.01.2021

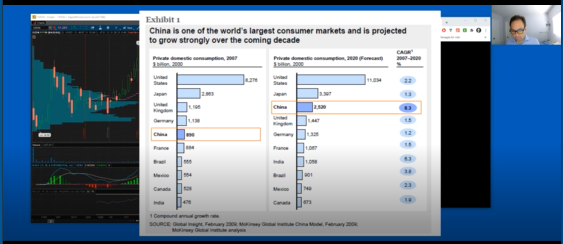

- Categories: Investment ideas, News, Personal finance

- Tags: bitcoin, china, ETFs, OZON, Russell 2000, russia, Seasonality, SPCE

- 4.10.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, Elections, ETFs, GLD, market trends, Stocks

As US elections approach we take a look at how election results move markets. We go through 10 lessons for all investors who are nervous going into the elections. History shows that there is nothing to be afraid of except uncertainty. Markets look bullish for October based on the AAII Investors Sentiment Survey and several …

Friday Investment Talk: US Elections, Market Bullishness, and Fintech Read More »

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

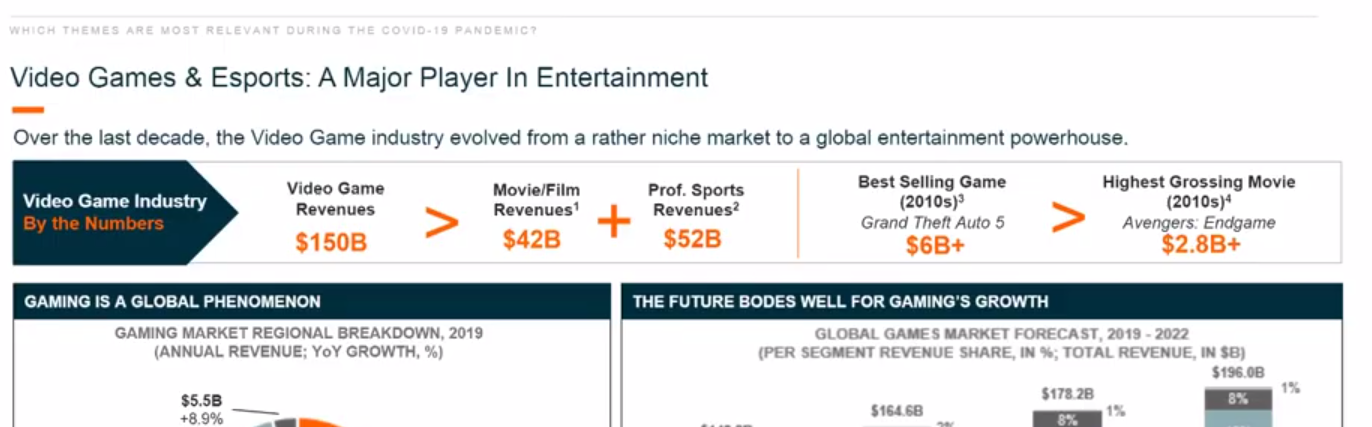

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 22.06.2020

- Categories: Analytics, News, Personal finance

- Tags: COVI-19, ESG, ETFs, NDX, SPX, Unemployment

This Friday we follow up on our ESG webinar from Wednesday. ESG ETFs have witnessed explosive growth in terms of AUM and number of listings. ESG outperfomance vis-a-vis SPX and even the NDX is evident lately. Certain institutional investors have pushed this stretched trend recently. Many market indicators (both fundamental and technical) are very overbought. …

Friday Investment Talk: ESG, Corporate Debt, and Fundamental Weakness Read More »

- 17.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: dividend, ETFs, MLPs