Tag: XLB

- 10.10.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: IWM, IYT, XLB, XLI

- 13.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DOW, SPX, XLB

- 14.10.2019

We lay out the buy points and stop losses for the Tactical ETF Portfolios based on the the Seasonal Trade Strategy

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.09.2019

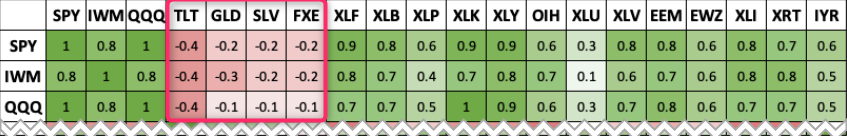

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …

- 3.07.2019

July starts strong, but often finishes weaker. The week after Options Expiration week – this year starting on the 22nd – can be particularly volatile. July ends the NASDAQ’s best eight months, and starts its worst four months . We will provide notification when the NASDAQ sell signal comes.

To access this post, you must purchase Subscription Plan – AVC Pro.