Tag: emerging markets

- 23.08.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, dividend, emerging markets, inflation

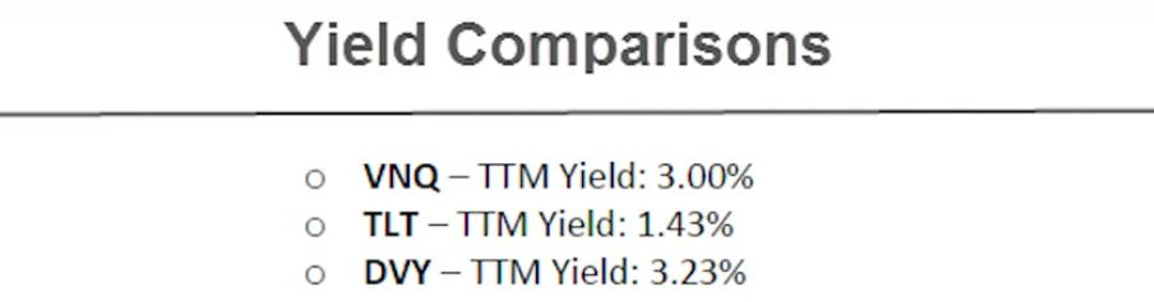

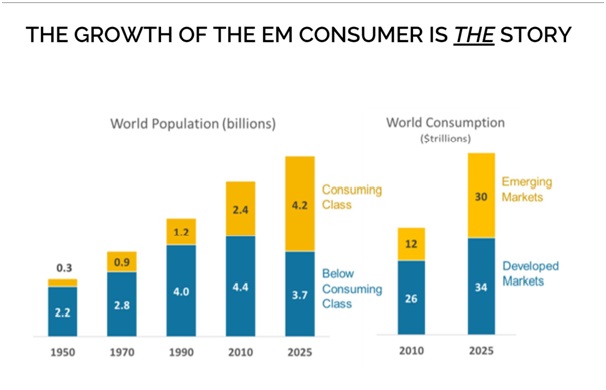

Chinese stocks have been pounded lately as Xi puts pressure on companies to provide funding for socially beneficial projects. Arm twisting seems at play, as wealthy businessmen kowtow to politicians. Emerging markets face inflation as natural disasters, COVID and supply chain issues fuel shortages. Dividend ETFs always generate attention. We compare $DVY to owning the …

Friday Investment Talk: China, EM Inflation, Dividends Read More »

- 17.08.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: emerging markets, Infrastructure, water

Equity markets look likely to slow their temp of growth, and maybe pullback. The US infrastructure bill passed. We discuss firms that will initially see inflows from increased spending, such as engineering, construction, and materials companies. Climate change offers emerging markets both headwinds and opportunities for growth. Looking at various statistics, the road ahead is …

Friday Investment Talk: Market Slowdown, Infrastructure, Climate Change Read More »

- 10.06.2021

- Categories: Investing basics, Investment ideas, Personal finance

- Tags: emerging markets, etf, Fintech, India

- 22.05.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EEM, emerging markets, ETFs, GLD, Seasonality, SLV, Valuations

- 3.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, emerging markets, EMQQ, Russell 2000, S&P 500, SaaS, SPX

- 23.08.2020

- Categories: Analytics, Investment ideas, News

- Tags: emerging markets, GLD, IWM, Rubles, SPX, TUR, Turkey

- 12.02.2018

- Categories: Analytics

- Tags: developed markets, emerging markets, market review, market trends

All the major equity markets saw extended bullish action from December lows. This continued through most of January, with only the last few days showing some weakness. The strength of the SPY really picked up in the second half of the month. The end of the month selling was weakest in the SPY. Mid-Cap US …

- 18.05.2015

- Categories: Analytics

- Tags: bonds, emerging markets, eur, market review, market trends, oil, usa, usd

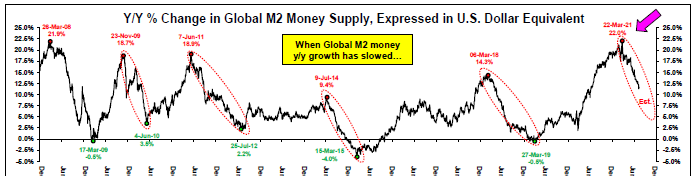

Global stocks rose modestly amid a strong rally in the energy sector. Rising oil prices, surging M&A activity and central bank stimulus measures helped to support world stock prices despite a slowdown in U.S. economic growth during the first quarter. Emerging markets rallied as market observers pushed back the timing of an increase in interest …

- 30.01.2015

- Categories: Analytics

- Tags: emerging markets, ruble, russia

This commentary was posted by our long-time colleague and friend, Chris Weafer (link to http://macro-advisory.com/about/) in an editorial on Dec 22, 2014. Chris worked for several main Russian Banks as the Chief Strategist. He has won recognition as the best Russian Investment Strategist for 2013 by Reuters. With so many people contacting us over the …