Category: Investment ideas

- 17.02.2024

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Investment ideas

- 15.12.2023

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Seasonality, TAX

A list of stocks likely to bounce after tax loss harvesting.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.12.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas

- Tags: Healthcare, Stocks

Two companies seem poised for continued strong upside appreciation. Overall descretionary healthcare spend still increasing.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 29.11.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas

As Hyperscalers like Microsoft and Amazon develop their cloud computing, one chip stock stands to benefit as the companies build specific chips for their servers.

To access this post, you must purchase Subscription Plan – AVC Pro.

We examine differences in AI-related funds and highlight some names you might not consider to be AI-related. Even though artificial intelligence (AI) continues to make headlines, not all AI-related investments have seen the same price action over the last few months. The fresh headlines from the weekend discussed Sam Altman being ousted as the CEO …

- 2.12.2022

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Investment ideas

- Tags: DJIA, NASDAQ, S&P 500, Seasonality

With greater than 5% gain in the main US indexes in both October and November this year, December is expected to start slow and then gain steam as the Santa Clause Rally comes to town.

To access this post, you must purchase Subscription Plan – AVC Pro.

With the Dow up over 14% so far in October 2022, US markets are on pace to record their best October performance ever going back to 1901. While many retail investors remain bearish (see the AAII Sentiment Poll results below), we feel a new bull market is emerging – at least for the near term. …

To access this post, you must purchase Subscription Plan – AVC Pro.

- 8.02.2022

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AEP, D, DUK, FB, GOOG, IYW, NEE, Seasonality, SO, UTY, XLU

February has been getting lousier for investors. The first half is usually better than the second. Utilities and High Tech start bullish seasonal trends soon.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 1.01.2022

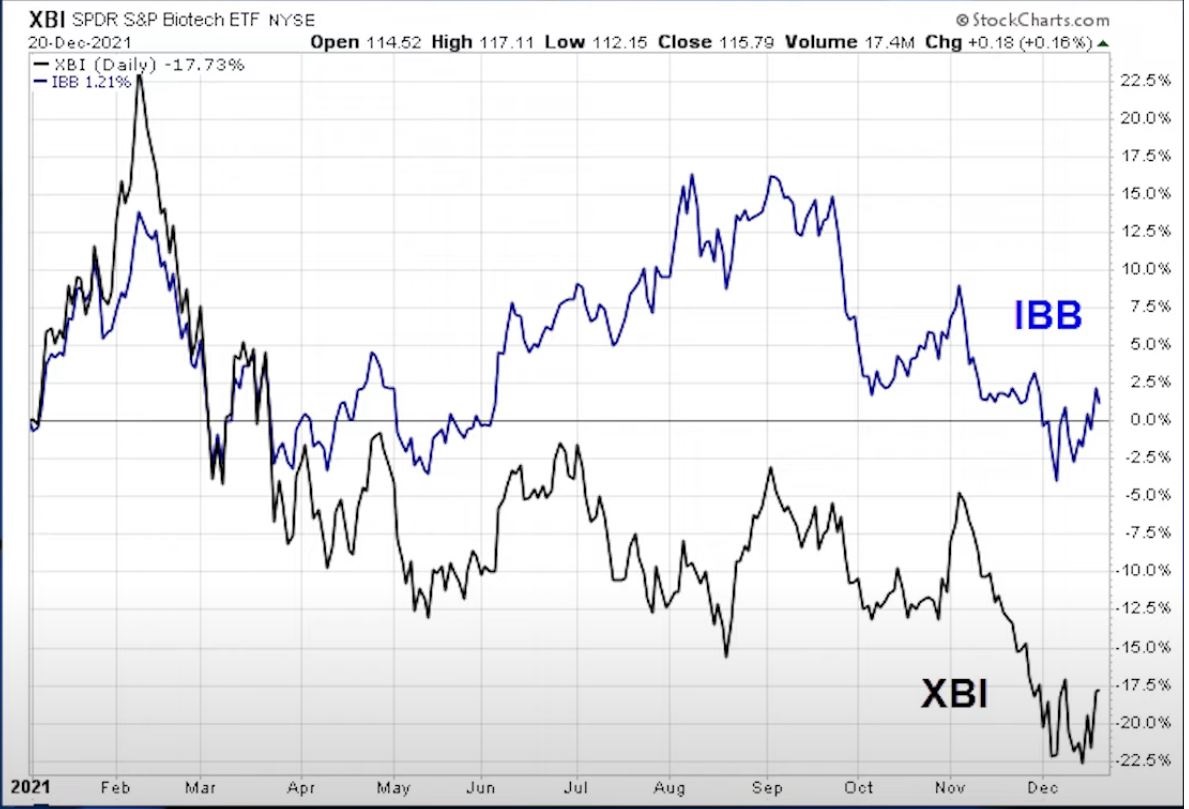

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Biotech, ETFs, GERM, IBB, XBI

Analysts have a neutral view of Alibaba (BABA) going into 2022. They see revenue across all business lines slowing from pandemic levels. But growth rates are still strong, and new business lines are just in their infancy. The negativity among analysts is palatable. Longer term, they maybe overdone.