Category: Analytics

The copper-gold ratio recently climbed out of a visible trough whiile interest rates have generally trended upwards too – this adds credibility to the higher for longer narrative.

Investors likley want to see a soft landing more than they want to see rate cuts.

- 17.02.2024

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Investment ideas

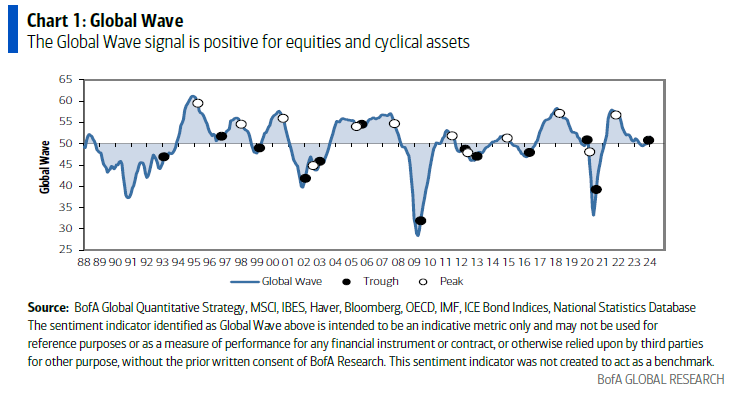

Last week, BoA published two articles that seemingly opposing forecasts for global equity markets. After closer look, BoA puts forth a strong case for sector rotation, as the global economy performs a soft-landing.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 27.12.2023

- Categories: Analytics, Investing basics

- Tags: Santa Claus Rally, Seasonality

- 21.12.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: Seasonality

When looking at the seasonal patterns for election years, like 2024, mostly bullish patterns appear for the US markets. The most bullish scenario is when there is a sitting president running for reelection. In those years, NASDAQ has averaged a full-year gain of 19.14%. This is much stronger than the 12.73% average gain in all …

Election Years: Importance of Incumbant Read More »

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.12.2023

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Seasonality, TAX

A list of stocks likely to bounce after tax loss harvesting.

To access this post, you must purchase Subscription Plan – AVC Pro.

We examine differences in AI-related funds and highlight some names you might not consider to be AI-related. Even though artificial intelligence (AI) continues to make headlines, not all AI-related investments have seen the same price action over the last few months. The fresh headlines from the weekend discussed Sam Altman being ousted as the CEO …

- 21.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

December is better than November in Pre-election years for the most part. Weakness in the beginning will lead to a good run in the end of the month.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 9.11.2023

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: IWM, Russell 2000, S&P 500, Seasonality, SPX

November marks the beginning of the bullish season for stocks, especially small caps. As the market moves to bullishness we have witnessed a huge rally.

To access this post, you must purchase Subscription Plan – AVC Pro.

September is historically one of the weakest months for equities, and so far, the month is living up to its reputation. Through 9/15, the S&P 500 (SPX) is down about 1.3%, but for the month that holds the “weakest month of the year” title that seems a bit tame. Studies show that it has historically …

- 1.09.2023

- Categories: Analytics, AVC Pro Subscription

- Tags: DJIA, IWM, NASDAQ, Seasonality, SPX

September gets no respite from positive pre-election year forces. Positive year returns going into what becomes a bad August leads to a better chance of September being a decent month, however.

To access this post, you must purchase Subscription Plan – AVC Pro.