Tag: QQQ

- 30.09.2022

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Personal finance

- Tags: DJIA, GDP, inflation, interest rates, QQQ, S&P 500, Seasonality

October is known as the 'bear killer' month. In US mid-term election years it can provide especially strong returns. With the economy faltering and inflation still too hot, investors are skeptical. We wait for confirmed bullish signals as markets set up for a bounce.

- 11.06.2022

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas, Personal finance

- Tags: BITO, DIA, FXI, GLD, KWEB, QQQ, SLV, SPX

US markets besieged by unexpected inflation data. Chinese stocks get a boost from stimulus. Gold looks bullish.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 31.05.2022

- Categories: Investment ideas, News, Personal finance

- Tags: FB, IWM, MSFT, QQQ, SPY

- 23.02.2022

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, QQQ, Russell 2000, Seasonality, SPX

In mid-term election years, US markets perform generally well in March. Leadership in small caps stocks is discernible.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.12.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DJIA, dow jones, Investment Strategy, NASDAQ, QQQ, S&P 500, SPY

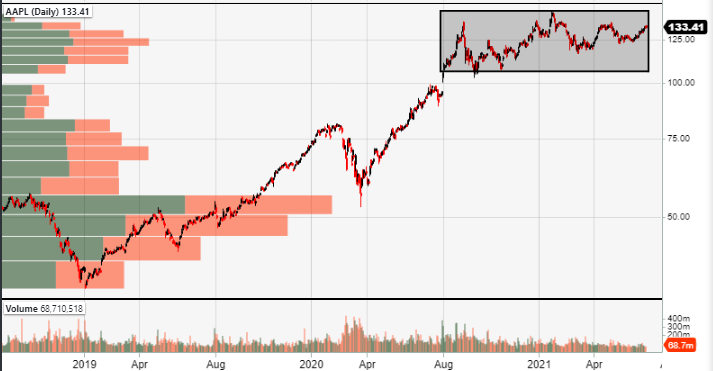

November started out very strong, but around the middle of the month small cap stocks began to struggle. Large cap stocks (especially the favored technology and consumer discretionary stocks) went on to make all time highs later in the month. However, during the generally bullish period of the year - around Thanksgiving (Thursday, November 25th) -the large cap leaders also started to sell off.

- 6.09.2021

- Categories: Investment ideas, News, Personal finance

- Tags: DJIA, inflation, NFLX, PPLI, QQQ, SPX

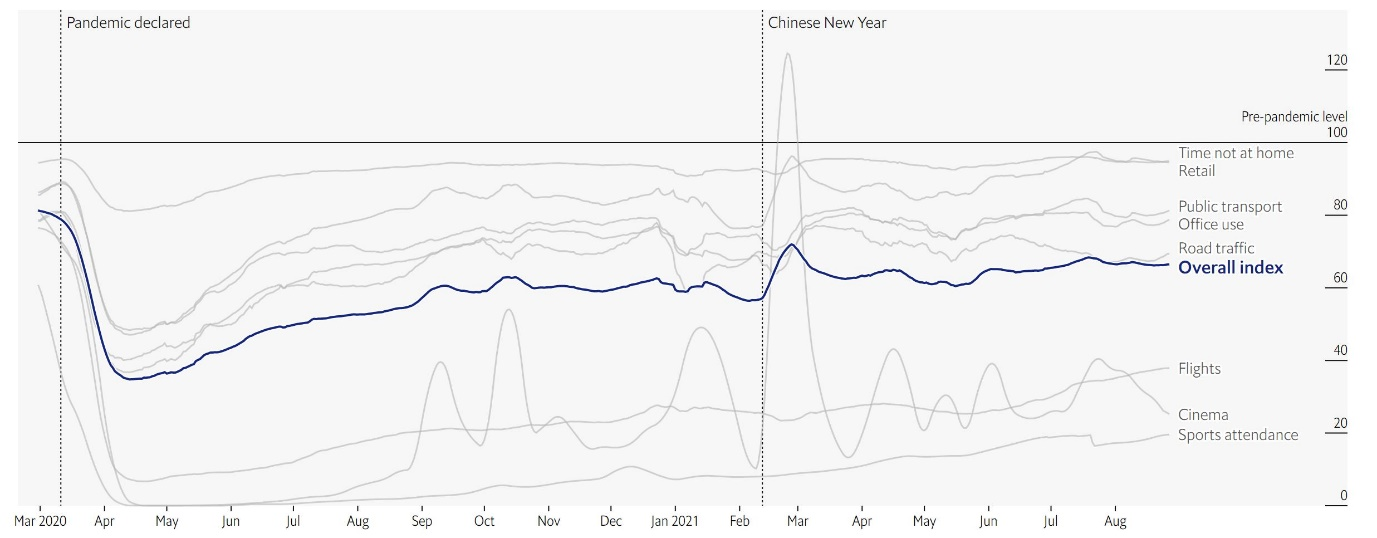

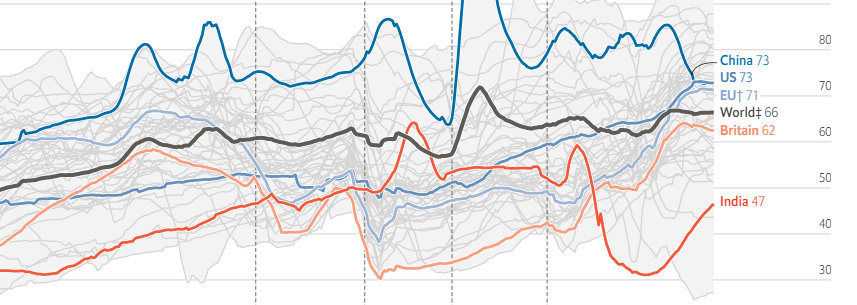

As the US and many other countries discuss raising individual income taxes, private placement life insurance comes again into focus. Its always been a mechanism to legally hide investments from taxes, but now it is receiving a renewed interest from even less wealthy individuals. A bullish fund manager feels a return to normalcy will send …

Friday Investment Talk: PPLI, US Recovery & Jobs Data Read More »

- 5.07.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: AMD, AMZN, COVID, F, GOOG, MSFT, QQQ, Scam

- 25.06.2021

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: QQQ, Seasonality, Stocks

- 13.06.2021

- Categories: Investment ideas, News, Personal finance

- Tags: BIIB, Biotech, Energy, IWM, QQQ, RUT, SPX

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

Waiting for the Seasonal sell signal in the NASDAQ, other sector trades come to and end in June. Gearing up for a sideways market is the plan now, until the strong months again come later this year.

To access this post, you must purchase Subscription Plan – AVC Pro.