Tag: IBB

- 3.01.2022

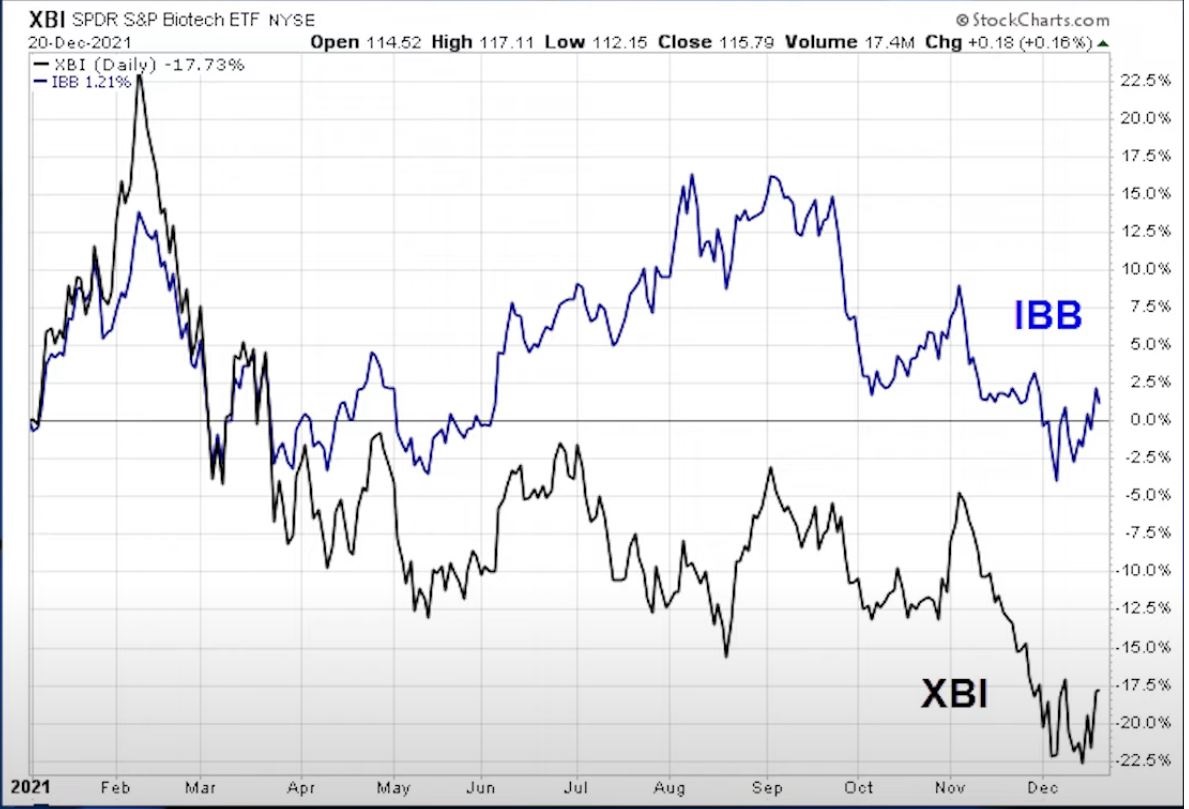

Biotech indexes are not created equally. XBI is an equal weighted smaller cap index, while IBB is market cap with large weightings in COVID vaccine producers. Their results were very divergent in 2021. Markets have grown substantially in 2021 on the back of loose monetary and fiscal policy in the US (and around the world). …

Friday Investment Talk: Biotech, 2022 Forecast, M&A, Fusion Energy Read More »

- 1.01.2022

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Biotech, ETFs, GERM, IBB, XBI

- 6.08.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AAPL, DJIA, GOOG, IBB, IYW, MSFT, NASDAQ, NVDA, SPX, xbi

July Job's Data usually is negative for the market. Seasonal bullishness in tech stocks starts soon, but the market needs to pullback for a better entry.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

Waiting for the Seasonal sell signal in the NASDAQ, other sector trades come to and end in June. Gearing up for a sideways market is the plan now, until the strong months again come later this year.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2021

The debate on the sustainability of inflation is alive! Markets react and traders battle out their Feds next move. Retail and consumer discretionary stocks look weak, while semiconductors and car resellers could bounce. Biotech sits on support.

- 17.04.2021

- 29.11.2020

- Categories: Investment ideas, Personal finance

- Tags: Biotech, COVID, GLD, Gold, IBB, TAN, xbi

Black Friday Sales are expected to be dominated by online shopping with overall sales increasing by 5% from 2019. Is this a low estimate?

Biotech and Solar ETFs breakout, while gold broke down this week.

- 3.07.2020

July and the second half of the year have started off consistent with historical trends and patterns. The first trading day was mostly positive with S&P 500 and NASDAQ recording gains. However, July has historically been a month of transition with gains early and weakness in the second half. Meanwhile, three seasonal tredns start in July.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, IBB, IWM, QQQ, SPX, SPY, XLP, XLU

The best six months of the year for certain US stock indexes has ended. A defensive stance is warranted as the summer months arrive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

Usually at this time of the year, early-April, stock markets would have had a nice seasonal rally. Well, there is nothing usual about the market or the economy this time.

As of today, the new bear market closing lows were on March 23. From their highs DJIA was down 37.1% and S&P 500 was down 33.9%.

Since then the market has rebounded to trim those losses.

Now we look to position for the worst months of the year ahead.

To access this post, you must purchase Subscription Plan – AVC Pro.