Category: Personal finance

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

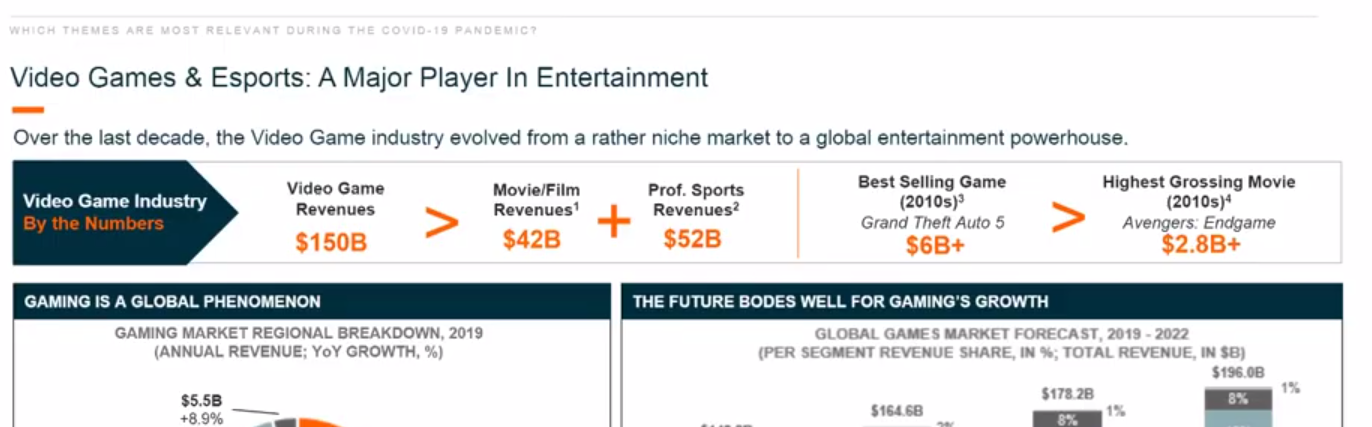

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

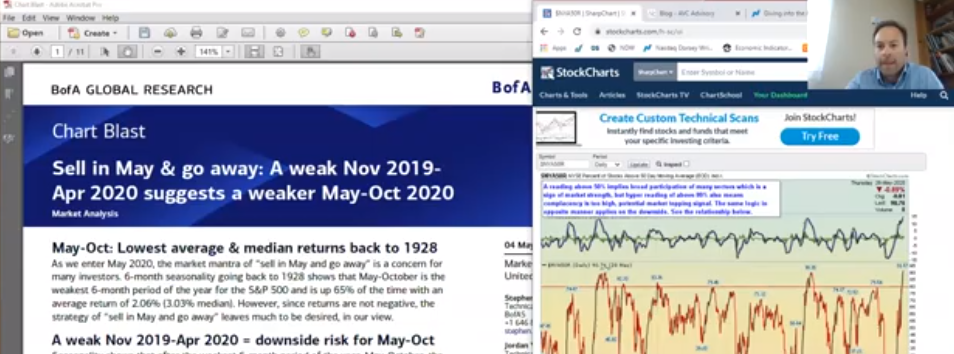

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …

- 11.07.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Gold, RCL, russia

July remains bullish as low interest rates fuel stock returns and gold gains. Russia can be viewed as a high dividend value opportunity if oil prices can remain elevated, and natural gas prices stabilize. A note from Merrill Lynch outlines the demand for hydrogen fuel cells that support natural gas (UNG) prices. China continues to …

- 4.07.2020

- 3.07.2020

- 28.06.2020

- Categories: Analytics, AVC Pro Subscription, News, Personal finance

- Tags: Elections, NASDAQ, s&p500, SPX

- 27.06.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: bonds, COVID, divdiends, MLPs, russia, taxes, Valuations

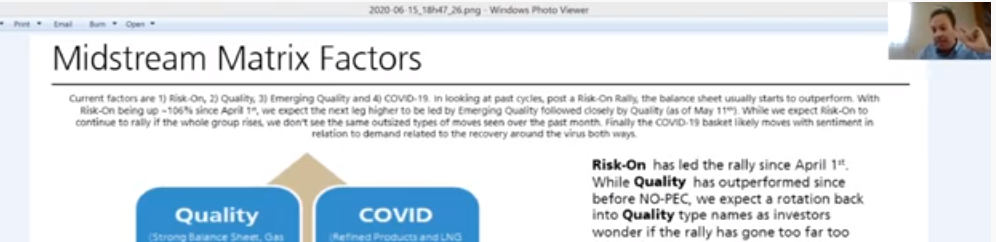

AVC partners review Veronika’s participation in the Russian Portfolio Investment Conference where she discussed our Dividend Investment Research (DIR), and the new 13 to 15% income tax for Russian non-residents, down from 30%. We reviewed the influence of recent central bank actions stocks and bond pricing. Credit quality is likely to become more of …

Friday Investment Talk: Russian Taxes, Market Valuation, MLPs and Credit Quality Read More »

- 24.06.2020

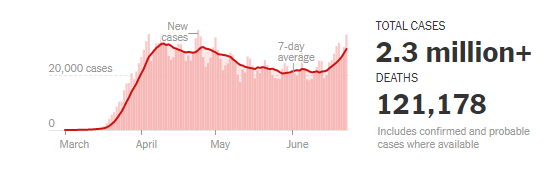

Markets are near all-time highs across the board. The NASDAQ 100 (QQQ) has outperformed all major indexes as investors flock to quality technology names such as AMZN, AAPL, MSFT, FB and GOOG. These stocks account for a full 50% of the NASDAQ’s gains since the COVID low on March 23, 2020. More COVID Cases Despite …

- 22.06.2020

- Categories: Analytics, News, Personal finance

- Tags: COVI-19, ESG, ETFs, NDX, SPX, Unemployment

This Friday we follow up on our ESG webinar from Wednesday. ESG ETFs have witnessed explosive growth in terms of AUM and number of listings. ESG outperfomance vis-a-vis SPX and even the NDX is evident lately. Certain institutional investors have pushed this stretched trend recently. Many market indicators (both fundamental and technical) are very overbought. …

Friday Investment Talk: ESG, Corporate Debt, and Fundamental Weakness Read More »

- 31.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: FTSE100, Seasonality, Sectors, SPX, TLT, XLI