Category: Personal finance

- 8.02.2022

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AEP, D, DUK, FB, GOOG, IYW, NEE, Seasonality, SO, UTY, XLU

- 7.02.2022

- Categories: Investment ideas, News, Personal finance

- Tags: AMZN, FB, PXD, SPX, TNX, XOM

European interest rates rising, while the US is geared up for 5 hikes of 25 basis points in 2022. The market has shown extreme volatility lately as the interest rate hikes don’t jive with corporate earnings and future guidance.

- 29.01.2022

- Categories: Investment ideas, Personal finance

- Tags: Energy, GLD, SPY, vix

Markets were on a wild ride in January, especially this last week. We expected this would be the 4th negative week for the markets, but strength in the last few hours turned this week positive. On many levels and by many measures the market is extremely oversold, but so far few buy signals have developed. …

Friday Investment Talk: Fear and Market Suffering Read More »

- 8.01.2022

- Categories: Investment ideas, News, Personal finance

- Tags: bonds, BRK/B, inflation, PCAR, Stocks, TEX

Inflation has pushed interest rates higher and wrecked havoc in bond markets. Investors turn away from SAAS towards ‘reopening stocks’ in the Industrial sector. This rotation has crimped the markets so far this year and could spell trouble for most of 2022.

- 3.01.2022

- Categories: News, Personal finance

- Tags: pension, UK

- 1.01.2022

- Categories: Analytics, Investment ideas, Personal finance

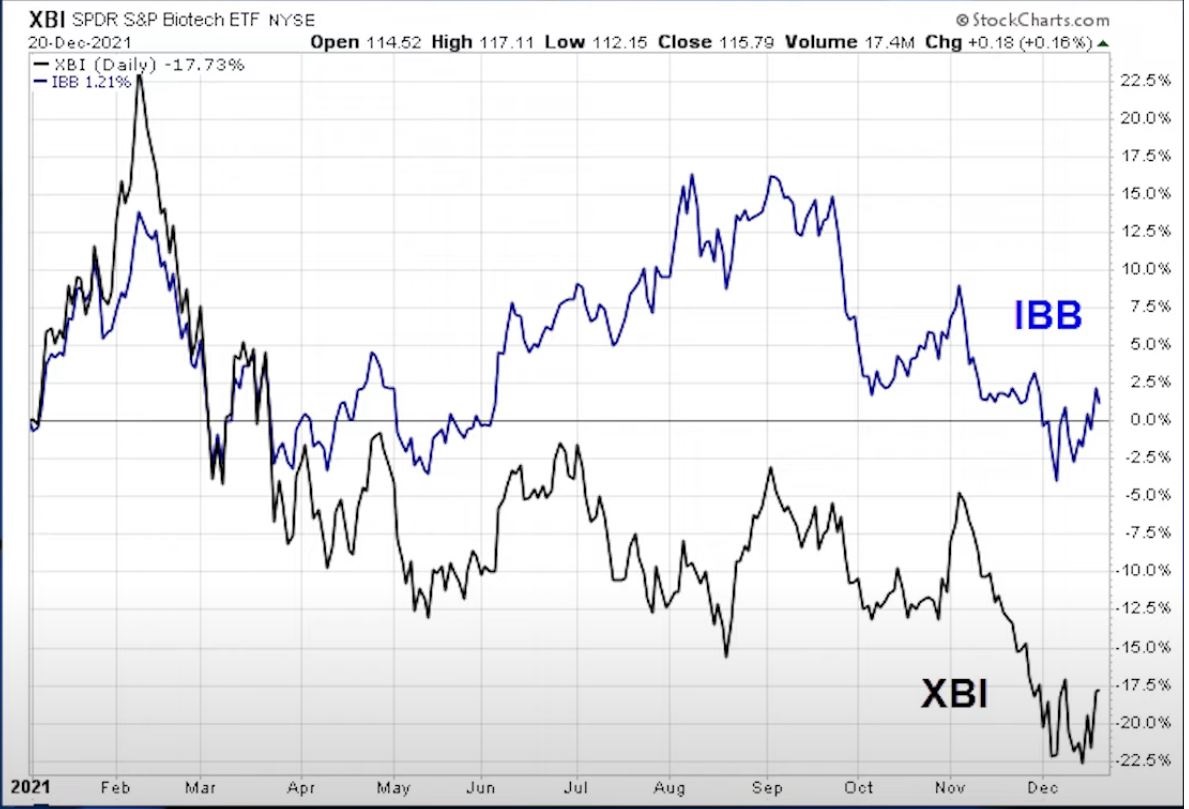

- Tags: Biotech, ETFs, GERM, IBB, XBI

- 29.12.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: COVID, Seasonality

- 26.12.2021

- Categories: Investment ideas, News, Personal finance

- Tags: ETFs, Housing, Labor, SPX, Unemployment

Ray Dalio suggests gifting gold coins for Christmas, while investors set records for ETF inflows in 2021. ESG ETFs grew while IPO ETFs underperform. Markets sold off in December providing a bullish setup in two pet supply companies as put/call ratios roll over to buy signals for the S&P 500 index. Beware of mid-term US …

Friday Investment Talk: Christmas Gifts, ETF Inflows, Housing, and US Population Read More »

- 18.12.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Energy, oil, Real Estate, Sectors, SPX

Energy markets look to be in a long term bull market with continued strength in oil prices fueling additional exploration. Real Estate prices for residential housing are rising faster than rents. Likely rents will play catch up in 2022. Sector rotation towards quality and low volatility is taking place since the Federal Reserve has began …

Friday Investment Talk: Oil and Energy, Real Estate, Sector Rotation Read More »