Category: Personal finance

- 3.10.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, inflation, interest rates, Retirement

- 1.10.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Seasonal Strategy, Seasonality

- 26.09.2021

- Categories: Investing basics, Investment ideas, News, Personal finance

- Tags: Bitcoin, IWM, Stocks

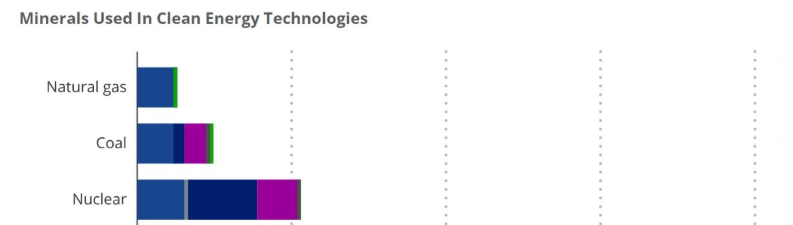

The US outlined extensive ‘Clean Energy’ priorities that will create a magnitude of change in demand for metals and rare earth minerals, such as cobalt, lithium, copper, zinc, molybdenum, etc. China is a main supplier of many of these elements key in electricity production from wind and solar power. Politics and transport issues can create …

Friday Investment Talk: Clean Energy Minerals, Cryptos, Market Pullback Read More »

- 6.09.2021

- Categories: Investment ideas, News, Personal finance

- Tags: DJIA, inflation, NFLX, PPLI, QQQ, SPX

As the US and many other countries discuss raising individual income taxes, private placement life insurance comes again into focus. Its always been a mechanism to legally hide investments from taxes, but now it is receiving a renewed interest from even less wealthy individuals. A bullish fund manager feels a return to normalcy will send …

Friday Investment Talk: PPLI, US Recovery & Jobs Data Read More »

- 30.08.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, Fed, xbi, XLV

- 27.08.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Seasonality

- 25.08.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: market trends, Momentum, Relative Strength

- 25.08.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, Seasonality, SPX

- 23.08.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, dividend, emerging markets, inflation

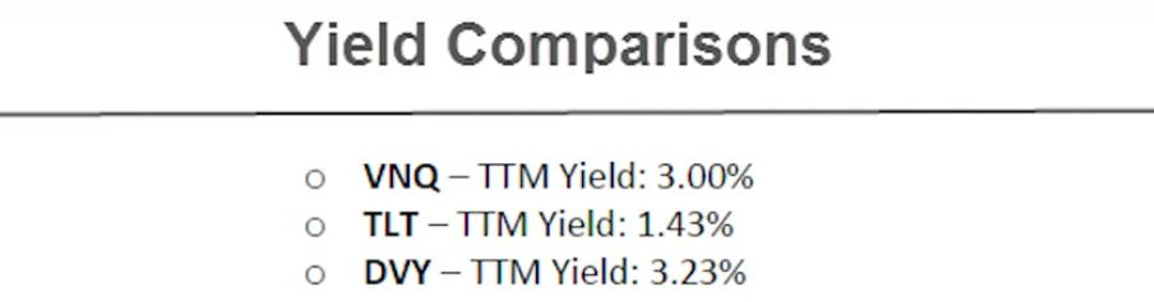

Chinese stocks have been pounded lately as Xi puts pressure on companies to provide funding for socially beneficial projects. Arm twisting seems at play, as wealthy businessmen kowtow to politicians. Emerging markets face inflation as natural disasters, COVID and supply chain issues fuel shortages. Dividend ETFs always generate attention. We compare $DVY to owning the …

Friday Investment Talk: China, EM Inflation, Dividends Read More »

- 17.08.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: emerging markets, Infrastructure, water

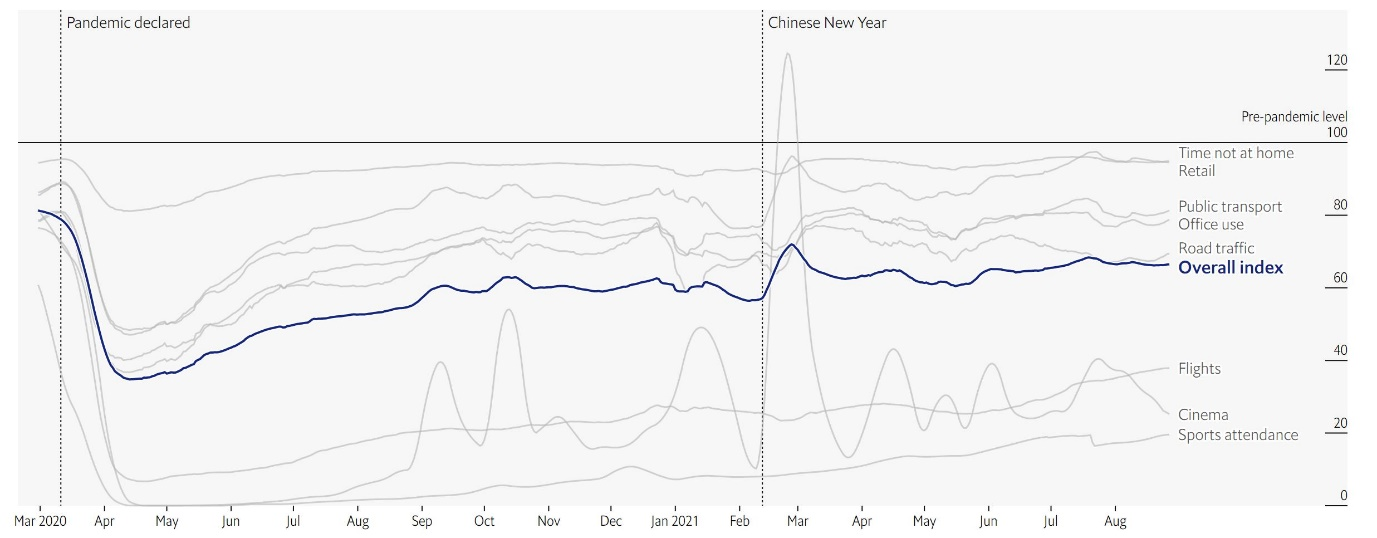

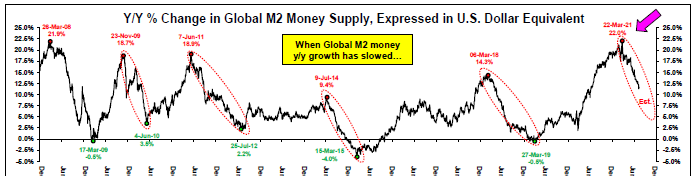

Equity markets look likely to slow their temp of growth, and maybe pullback. The US infrastructure bill passed. We discuss firms that will initially see inflows from increased spending, such as engineering, construction, and materials companies. Climate change offers emerging markets both headwinds and opportunities for growth. Looking at various statistics, the road ahead is …

Friday Investment Talk: Market Slowdown, Infrastructure, Climate Change Read More »