Category: Personal finance

- 12.12.2021

- Categories: News, Personal finance

- Tags: Commodities, COVID, DJIA, inflation, NASDAQ, Russell 2000, SPX, TLT

US markets were top performers in 2021. Fed tapering became the year's theme as inflation began showing up in the Spring. Bonds sold off, and yields rose. Chinese companies suffered as a crackdown on foreign listed stocks erupted in Q3. The US maintains its top ranking of all equity markets going into 2022.

- 3.12.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DJIA, dow jones, Investment Strategy, NASDAQ, QQQ, S&P 500, SPY

November started out very strong, but around the middle of the month small cap stocks began to struggle. Large cap stocks (especially the favored technology and consumer discretionary stocks) went on to make all time highs later in the month. However, during the generally bullish period of the year - around Thanksgiving (Thursday, November 25th) -the large cap leaders also started to sell off.

- 29.11.2021

- Categories: News, Personal finance

- Tags: Gold, Seasonality, Turkey, usd

Markets sold off on the day after Thanksgiving in the US. What is typically a bullish period for the markets proved an undoing. The markets had their worst day of the year in 2021 and the worst Black Friday since 1931. Turkey is suffering an economic meltdown that is spreading to civic unrest. The lira …

- 24.11.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Seasonality, SPX

Post-election year Decembers are weaker than in other years. There are plenty of bullish days towards the end of the month that investors can take advantage of.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 20.11.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Investing, Tech, Tesla

- 19.11.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Put/Call Ratios, Seasonality

Sell signals have arisen on the major US markets. They need to be resolved before a further advance in 2021 can take place.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.11.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

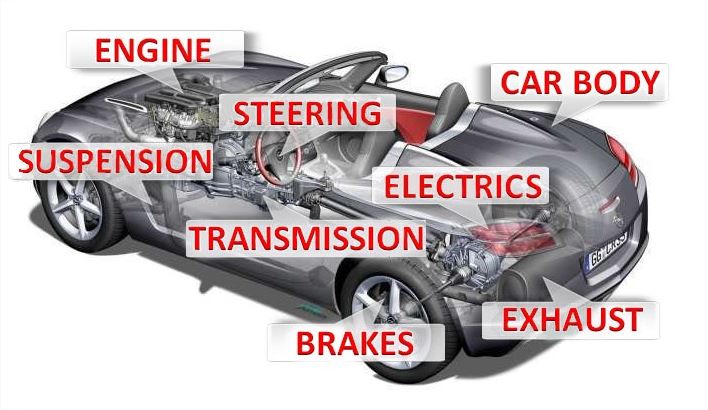

- Tags: Autos, Valuations

Bulls have been wrong on this beat up stock many times before. Things are changing for the better and now the bulls might be right. They put a great deal of money on a bet after earnings came out.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 22.10.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, S&P 500, Seasonality

November leads into the best months of the year. Trading around Thanksgiving is a bit tricky.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 16.10.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Seasonality, Stocks

As seasonality turns bullish, we look at fundamental changes in economic indicators and technical market action. We see many opportunities in equities and highlight healthcare, natural resources, and technology companies.

Buy signals in the major US equity markets have emerged on time according to typical seasonal patterns. Sales of bond funds are now appropriate as a move from defensive positioning to a more offensive risk stance is warranted.

To access this post, you must purchase Subscription Plan – AVC Pro.