Tag: bonds

- 29.03.2022

- Categories: Analytics, Investing basics, Investment ideas

- Tags: bonds, interest rates, RPV, Stocks

Bonds are now worst performers than stocks since the beginning of the year. Such pessimism in bond prices has not been seen for decades. Meanwhile, interest rate hikes are usually bullish for equities during the first few months of increases. Value stocks broke out to new highs this week as market internals turn more bullish. …

Friday Investment Talk: Bonds Weakness and Equity Strength Read More »

- 8.01.2022

- Categories: Investment ideas, News, Personal finance

- Tags: bonds, BRK/B, inflation, PCAR, Stocks, TEX

Inflation has pushed interest rates higher and wrecked havoc in bond markets. Investors turn away from SAAS towards ‘reopening stocks’ in the Industrial sector. This rotation has crimped the markets so far this year and could spell trouble for most of 2022.

- 1.11.2021

- 25.04.2021

- 25.04.2021

- Categories: Analytics, Investment ideas, News

- Tags: bonds, DIA, MACD, Seasonality, SPX

- 9.04.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: bonds, Debt, US

- 8.03.2021

- 21.02.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Biotech, bonds, inflation, interest rates, Medtech, Semiconductors, TBT, TLT

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.

- 27.06.2020

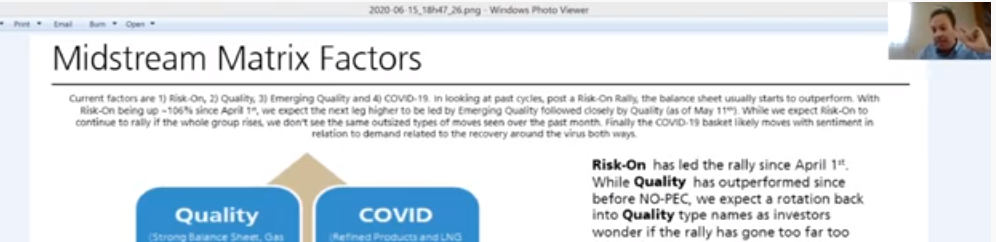

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: bonds, COVID, divdiends, MLPs, russia, taxes, Valuations

AVC partners review Veronika’s participation in the Russian Portfolio Investment Conference where she discussed our Dividend Investment Research (DIR), and the new 13 to 15% income tax for Russian non-residents, down from 30%. We reviewed the influence of recent central bank actions stocks and bond pricing. Credit quality is likely to become more of …

Friday Investment Talk: Russian Taxes, Market Valuation, MLPs and Credit Quality Read More »