Markets are near all-time highs across the board. The NASDAQ 100 (QQQ) has outperformed all major indexes as investors flock to quality technology names such as AMZN, AAPL, MSFT, FB and GOOG. These stocks account for a full 50% of the NASDAQ’s gains since the COVID low on March 23, 2020.

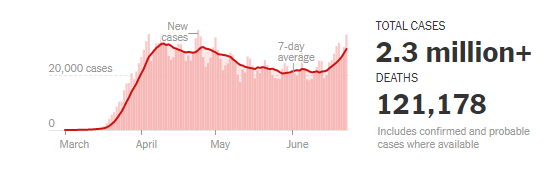

More COVID Cases

Despite lock downs, now the US is seeing increases in cases of COVID. You can follow the development on the New York Times.

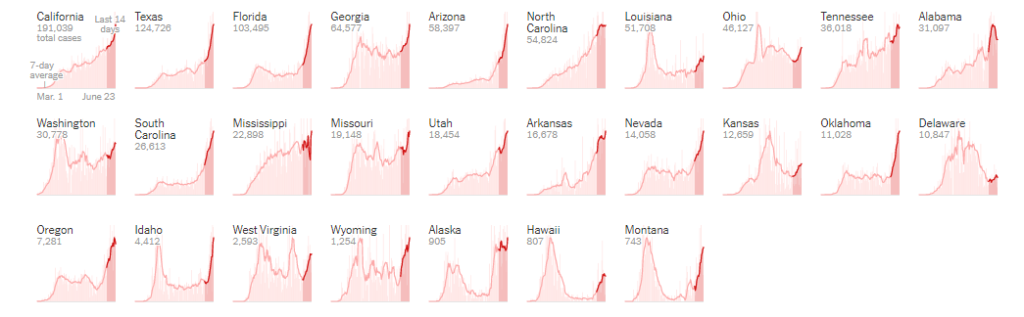

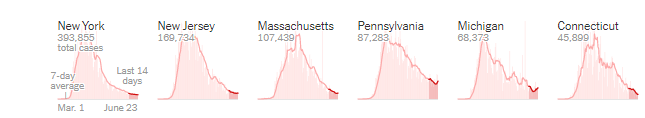

The increase is not occurring evenly in all states. These states are showing particulary large increases.

While these states are showing reduced numbers of cases and fear a second wave if borders between states remain open.

New York Governor Andrew Cuomo just today openly declared a travel ban on people from states with high numbers of COVID cases;“We’re (NY, NJ, CT) announcing today a joint travel advisory – people coming in from states that have a high infection rate must quarantine for 14 days, and we have a calibration for the infection rate.” Cuomo goes further to say the federal government has been “incompetent” in handling the pandemic.

Meanwhile, hospitals are now filling up with COVID patients. Nearly 90% of Texas and Arizona intensive care units are occupied, with major cities in those states reporting nearly 100% occupation.

China Trade Deal Worries

In the last few days, mixed messages regarding the US-China Trade Deal have surfaced. Peter Navarro, a Trump advisor, recently had to walk back his negative comments the progress of the deal after Trump when live on Twitter to denounce his comments. However, doubts of any progress on trade persist as today’s headline reads: US SEC. OF STATE POMPEO: BEIJING PRESENTED EMPTY PROMISES AT LAST WEEK”S CHINA-AFRICA SUMMIT.

Pressure on Trump

All this is hurting President Trump’s chances of re-election. His ratings are now as low as 37% approval for how he has handled the COVID crisis. Only 43% of Republican voters say ‘this country [US] is head in the right direction. Meanwhile, the White House just announced an end to federal support for COVID testing sites.

Read this news in context of how investors will move money to defensive sectors on expectations of Biden’s win in November. From Vox today: “On Wednesday morning, the NYTimes showed Biden with a massive 50-34 lead over Donald Trump. That lead is so large it’s essentially invulnerable to assumptions about the demographic composition of turnout. Trump in the Times poll has an extremely narrow 1-point lead with white voters, wins the 50-64 age bracket by 1 point, and is actually losing senior citizens by 2 points.”

Market Weakness

Summer months are usually a weak period for the stock market. We pointed out last Friday in our weekly Investment Talk that the end of June is particularly prone to corrections and have provided a full analysis of July’s historical trends.

This morning we noted that a closely watched indicator presented the case for more bearish posturing in the near term. The NYSI Summation Index (or McClellan Summation Index) gave a bear cross at the close yesterday. Usually this marks the beginning of a correction in the S&P.

We are still waiting for other inidcators to provide sell signals, but so far there are not many out there. So, although the fundamental background seems to be worsening, investment sentiment remains solid. Its hard to be bearish when everytime the markets witness some selling a Federal Reserve member supports futher intervention. Today we saw this pattern again when the Chicago Federal Reserve Preseident Charles Evans added that while fiscal and monetary policy support have helped, “more may be necessary.”