Tag: NDX

- 6.11.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, NDX, QQQ, SPX

- 31.10.2020

- 23.10.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, NDX, Russell 2000, S&P 500, SPX

- 28.09.2020

- 6.09.2020

- Categories: Analytics, Investment ideas, News

- Tags: Abenomics, Japan, NDX, Property, Real Estate, SPX, Tech

- 24.06.2020

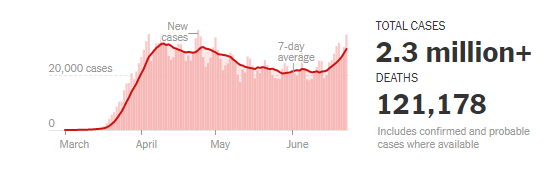

Markets are near all-time highs across the board. The NASDAQ 100 (QQQ) has outperformed all major indexes as investors flock to quality technology names such as AMZN, AAPL, MSFT, FB and GOOG. These stocks account for a full 50% of the NASDAQ’s gains since the COVID low on March 23, 2020. More COVID Cases Despite …

- 22.06.2020

- Categories: Analytics, News, Personal finance

- Tags: COVI-19, ESG, ETFs, NDX, SPX, Unemployment

This Friday we follow up on our ESG webinar from Wednesday. ESG ETFs have witnessed explosive growth in terms of AUM and number of listings. ESG outperfomance vis-a-vis SPX and even the NDX is evident lately. Certain institutional investors have pushed this stretched trend recently. Many market indicators (both fundamental and technical) are very overbought. …

Friday Investment Talk: ESG, Corporate Debt, and Fundamental Weakness Read More »

- 11.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

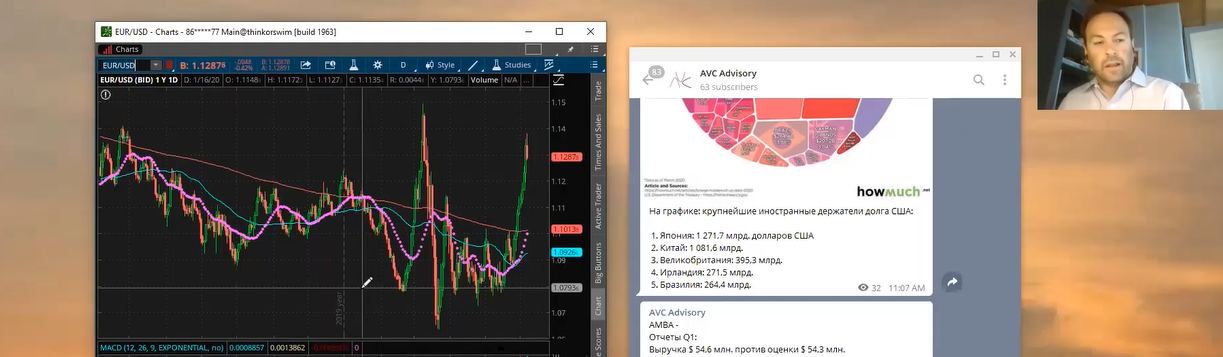

- Tags: MACD, NASDAQ, NDX, Seasonal Strategy

- 6.06.2020

- 25.11.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, IWM, NASDAQ, NDX, Russell 2000, RUT, S&P 500, Santa Claus Rally, SPX, SPY