Tag: Sectors

- 18.12.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Energy, oil, Real Estate, Sectors, SPX

Energy markets look to be in a long term bull market with continued strength in oil prices fueling additional exploration. Real Estate prices for residential housing are rising faster than rents. Likely rents will play catch up in 2022. Sector rotation towards quality and low volatility is taking place since the Federal Reserve has began …

Friday Investment Talk: Oil and Energy, Real Estate, Sector Rotation Read More »

- 31.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: FTSE100, Seasonality, Sectors, SPX, TLT, XLI

Stocks are still bullish from a technical point of view - the Put/Call ratio is overbought, but not yet negative.

All time highs for percentage of stocks above their 50-day moving averages (95%).

Seasonality is generally weak in summer months, but summers are better in election years than other months in election years, and better than in summer months in non-election years. Research from Bank of America,

Cylicals could take the lead in the summer, as social media and tech companies under polical pressure.

- 6.02.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: Momentum, Relative Strength, Sectors, SPX

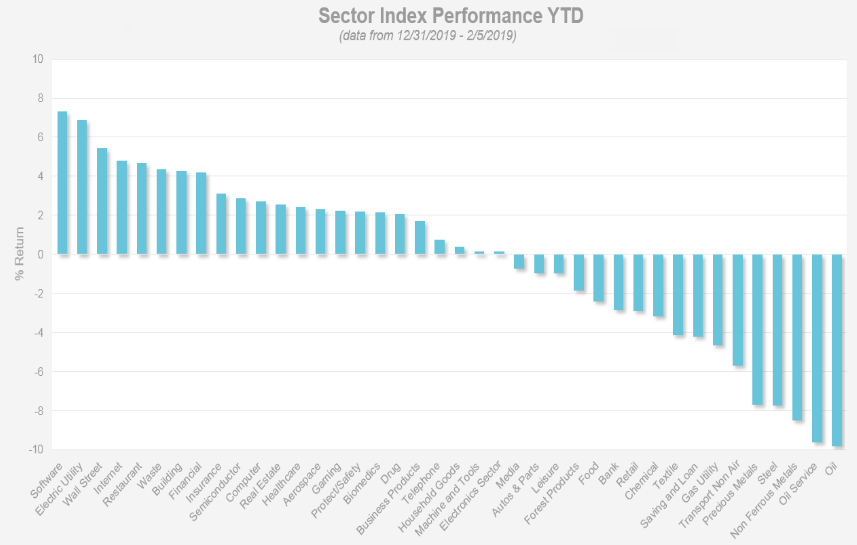

Relative strength-based investing performs best when there is a high level of dispersion between market leaders and laggards. Since the beginning of this year, this has been the case. Semicondutors, software, waste management and computer technology sectors are leading, while oil related stocks are lagging.

Using relative strength-based investing strategies can lead to significant long term market outperfomance compared to 'buy and hold' strategies.