Tag: Tech

- 20.11.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Investing, Tech, Tesla

- 5.08.2021

- Categories: Analytics, Investing basics, Investment ideas

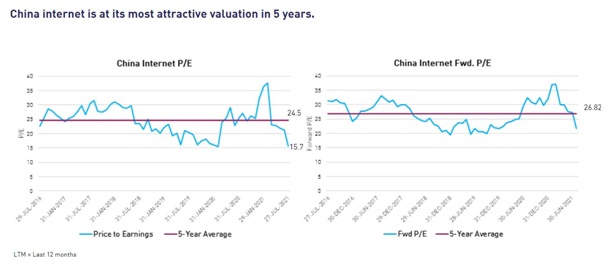

- Tags: china, Fintech, Tech

- 16.12.2020

- Categories: Investment ideas, Personal finance

- Tags: AMZN, BABA, funds, LULU, MELI, MSFT, SE, Tech

Jennison, perhaps unsurprisingly, has had a super year with its tech heavy allocations. Ecommerce, payment systems and cloud computing have led it to its top tier ranking at Citywire.

- 14.12.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: IT, Stocks, Tech

With continued support for US infrastructure spending and increasing demand for broadband access in rural areas, this stock is poised to experience growth in 2021.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.12.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Stocks, Tech

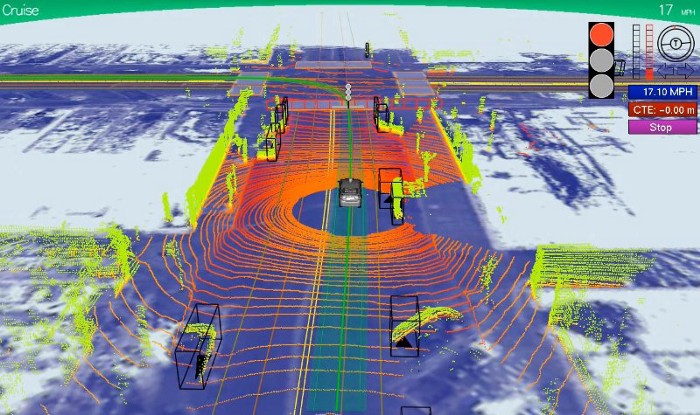

Large buyers of options accentuate the breakout in this stock today. As an emerging leader in AI for autonomous driving, the company has a longer term appeal for ESG and technology focused investors.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 23.11.2020

- Categories: Investing basics, Investment ideas

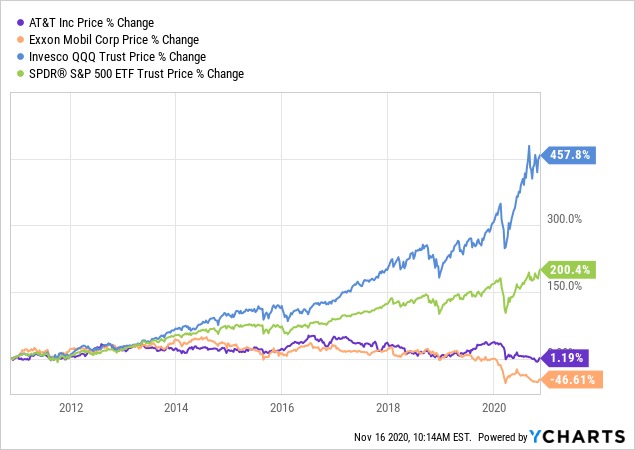

- Tags: AT&T, bitcoin, dividend, Exxon, GLD, IBM, Tech

- 18.10.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, Elections, MACD, Seasonal Strategy, SPX, Tech

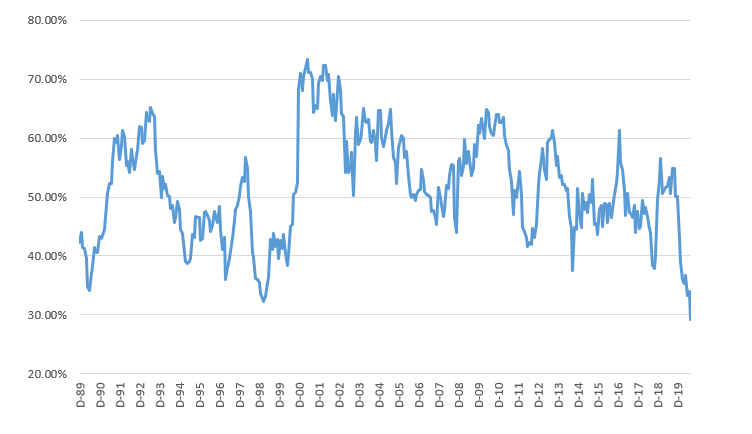

Seasonality is problematic this year, likely due to the elections and politics around another COVID stimulus package. Still, time and history work for the strategy.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.09.2020

- Categories: Analytics, Investment ideas, News

- Tags: Abenomics, Japan, NDX, Property, Real Estate, SPX, Tech

- 2.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: NASDAQ, Russell 1000, Russell 2000, Tech

US stock markets continue to see an extreme concentration of interest in a small number of stocks. Does this signal an imminent sell off or will market participation broaden?

To access this post, you must purchase Subscription Plan – AVC Pro.