Category: Personal finance

- 14.09.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: GRPN, Market Timing, RCL, Risk, SPX

The key to a successful investment strategies involve three main elements: what to buy, when to buy, and how much to buy. We will look at each of these elements individually as we focus on creating successful investment strategies.

- 13.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DOW, SPX, XLB

- 27.08.2020

- Categories: Investing basics, Personal finance

- Tags: diversification, dollar cost averaging, ruble, russia

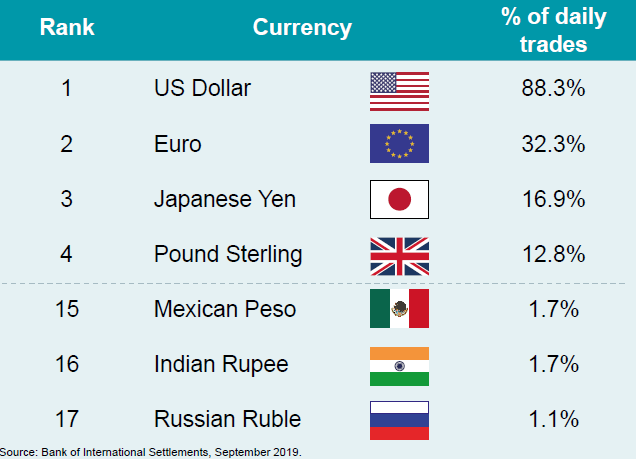

Wherever you are in the world, the strength of your country's local currency can be adversely affected by many different factors. Uncertainty encourages many investors to look outside of their local savings and investment markets, in a bid to access products that provide the opportunity to invest in ‘hard currencies’, specifically USD, GBP and EUR. Certain products enable investors to secure their savings in a long term financial secure manner.

- 21.08.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, S&P 500

Portfolio managers returning to work after Labor Day tend to clean house. Since 1950, September is the worst performing month of the year. A bullish election-year does little to improve on September’s poor overall performance.

S&P 500 has declined 9 of the last twelve years on the first trading day. Options Expiration week (Triple Witching for September) is usually bullish, but beware after that!

To access this post, you must purchase Subscription Plan – AVC Pro.

- 14.08.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, SPX

As we discussed at the end of July, the August rally in US small cap stocks has taken hold. Can this continue as major indexes close in on all time record levels?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

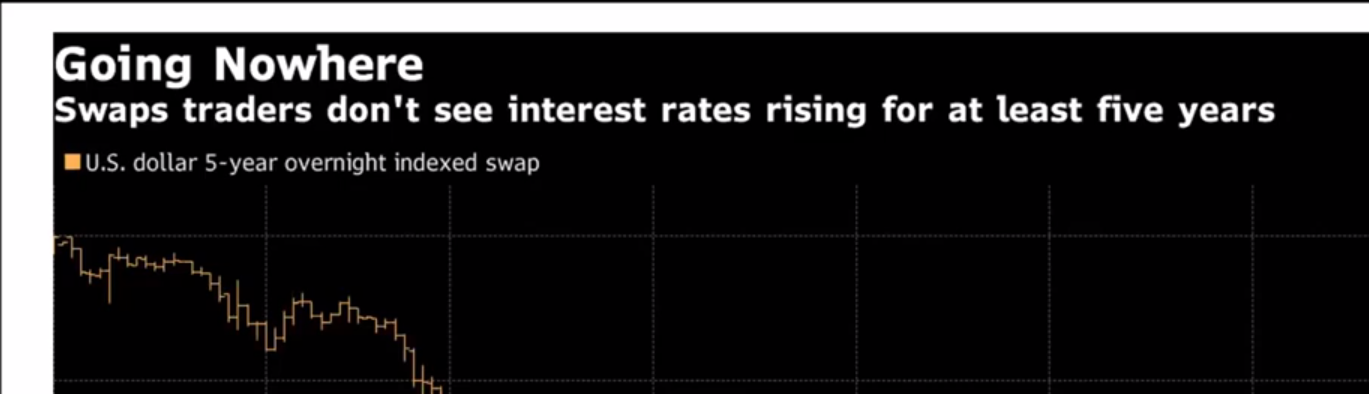

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.

- 3.08.2020

- Categories: Investment ideas, Personal finance

- Tags: $VNM, china, COVID, Gold, oil, Rubles, SLV, usd

- 29.07.2020

- Categories: Investment ideas, Personal finance

- Tags: COVID, inflation, interview

- 27.07.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: COVID, DJIA, dow jones, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonality

The month of August is usually one of the worst months of the year for US stocks. In years of a US presidential election (like 2020), August holds a special spot in the calendar for certain stocks.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

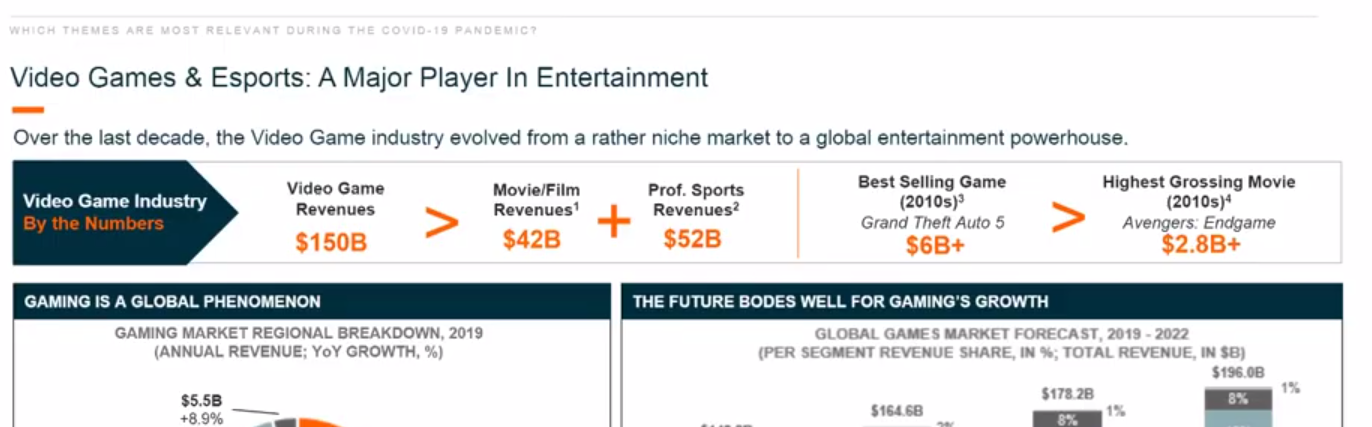

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG