Category: News

- 15.05.2021

- 8.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Bitcoin, Stocks

- 7.05.2021

- Categories: Investing basics, News, Personal finance

- Tags: FCA, investment scam

- 7.05.2021

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News, Personal finance

- Tags: COPX, CPER, DIA, ETFs, GLD, IWM, QQQ, Seasonality, SPX, XLU

- 3.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, emerging markets, EMQQ, Russell 2000, S&P 500, SaaS, SPX

- 25.04.2021

- Categories: Analytics, Investment ideas, News

- Tags: bonds, DIA, MACD, Seasonality, SPX

- 11.04.2021

- Categories: Investment ideas, News, Personal finance

- Tags: CSPR, HD, PRPL, RBLX, Stocks, TPX, WWE

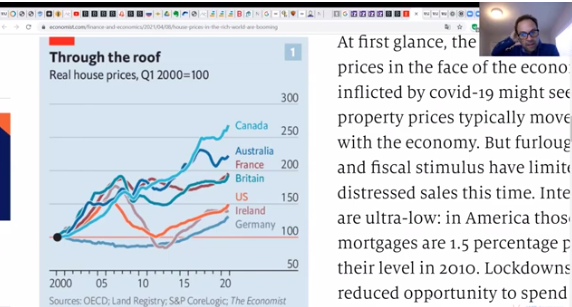

Housing prices rose strongly in 2020, most of the growth in non-Urban areas. Furnishings and additions were also unusually strong as more people used their house for an office and school during COVID lockdowns. Uncertainty around gold’s direction continues, but Bitcoin looks to break out above $60K soon. The US auto manufacturers are suffering from …

Friday Investment Talk: Housing, Gold, Consumer Loans Read More »

- 27.03.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: china, IWM, oil, Seasonality, usd

- 21.03.2021

- Categories: Investment ideas, News, Personal finance

- Tags: Growth, RYCEY, Seasonality, Stocks, Value, VUZI

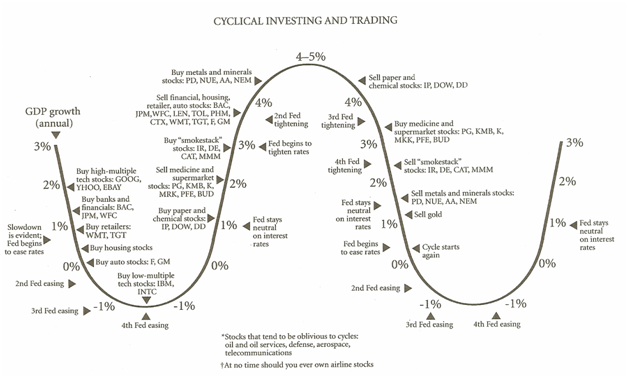

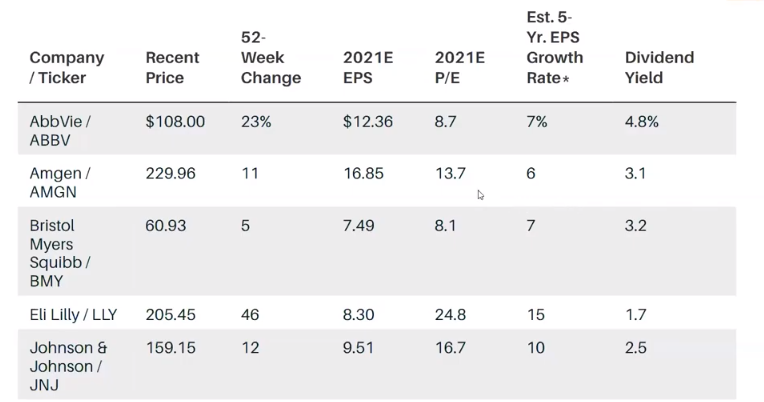

Value stocks have been on a tear, while growth stocks and tech leaders have taken a back seat since late January. This has pressured the overall market indexes, e.g. the S&P 500 and the Nasdaq. March volatility arrived as promised and next week could exacerbate into more weakness as put-call ratios continue to rise and …

Friday Investment Talk: Value Vs Growth, Pharma, Stock Picks Read More »

- 8.03.2021