Tag: UK

- 21.02.2022

- Categories: News, Personal finance

- Tags: citizenship, Investing, UK

- 3.01.2022

- Categories: News, Personal finance

- Tags: pension, UK

- 8.08.2021

- Categories: Investment ideas, News, Personal finance

- Tags: bitcoin, CNMD, NFLX, UK

- 28.06.2021

UK equities are trading at a discount to global peers of more than 40%. This has no equivalence within recent living memory. The UK is bouncing back from the twin hits of the Pandemic and Brexit, and with vaccination figures leading the way globally, it seems ripe for the UK economy to re-open and break out.

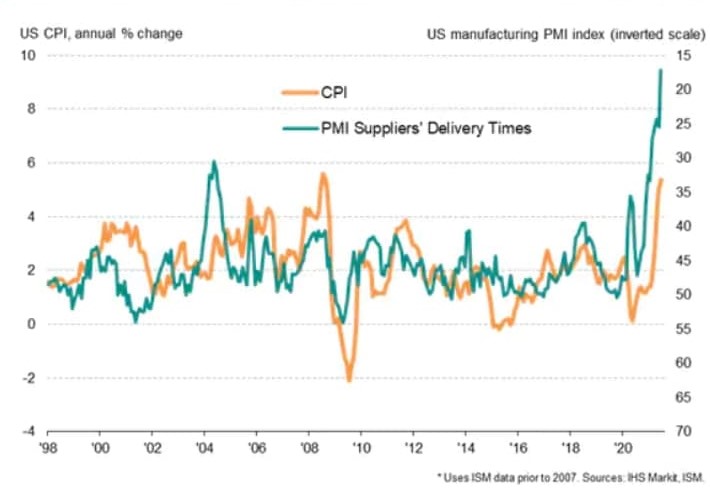

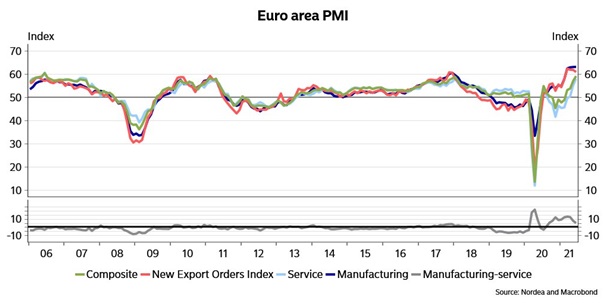

Not to be outdone, the usually anemic Eurozone has seen a raft of positive figures after positive figures.

- 28.06.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: NKE, PAWZ, TRUP, UK

- 8.03.2021

UK budget changes were announced with repercussions for tax payers and pensioners. Buffet on bonds, and SPACs boom.

- 13.02.2021

- 11.02.2021

- Categories: News, Personal finance

- Tags: TAX, UK

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, pension, TAX, UK

If you approaching pension age and are resident in a low tax jurisdiction (Russia, for example), you could take advantage of the UK's flexible drawdown regime from age 55. If you are non-resident for tax purposes, although you might in future return to the UK to live, or indeed to another country, you may be able to receive the full value of your fund liability to UK tax and so without deduction of tax at source. By investing the proceeds properly, you could obtain tax free growth whilst you are outside the UK and then benefit from withdrawals of 5% per annum tax free when you are back in the UK.

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, Property, TAX, UK