Category: News

- 26.07.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, ECB, ESG, europe, inflation, water

- 18.07.2021

- 10.07.2021

- Categories: Investing basics, Investment ideas, News

- Tags: alternative investments, Investing, investment scam

- 10.07.2021

- Categories: Analytics, Investment ideas, News

- Tags: COVID, SPX

- 5.07.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: AMD, AMZN, COVID, F, GOOG, MSFT, QQQ, Scam

- 28.06.2021

UK equities are trading at a discount to global peers of more than 40%. This has no equivalence within recent living memory. The UK is bouncing back from the twin hits of the Pandemic and Brexit, and with vaccination figures leading the way globally, it seems ripe for the UK economy to re-open and break out.

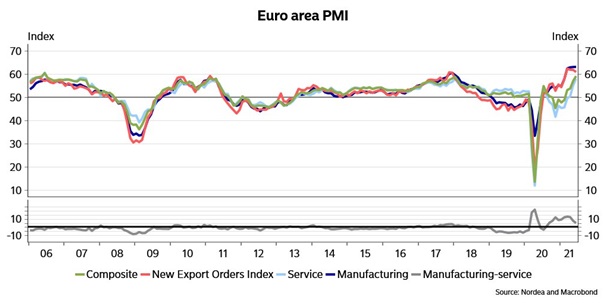

Not to be outdone, the usually anemic Eurozone has seen a raft of positive figures after positive figures.

- 28.06.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: NKE, PAWZ, TRUP, UK

- 20.06.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: $CI, SPX, XLV

- 13.06.2021

- Categories: Investment ideas, News, Personal finance

- Tags: BIIB, Biotech, Energy, IWM, QQQ, RUT, SPX

- 30.05.2021

- Categories: Investment ideas, News, Personal finance

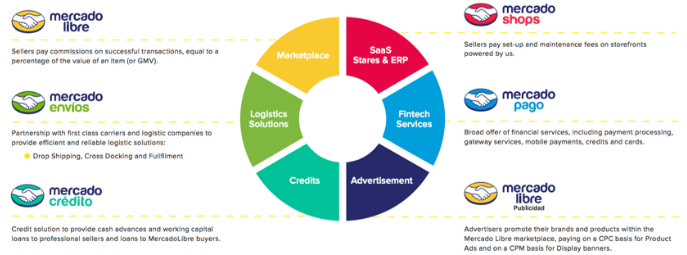

- Tags: dividend, Fintech, MELI, PAGS, Semiconductors, SMH, SOX, T