Category: Personal finance

- 23.02.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, Seasonal Strategy, SPX

- 15.02.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, s&p500, SPX, SPY, Stocks

Large Cap stocks make up most of the gains this year, far outpacing smaller stocks. A reversal of this trend could come soon, in March even.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, pension, TAX, UK

If you approaching pension age and are resident in a low tax jurisdiction (Russia, for example), you could take advantage of the UK's flexible drawdown regime from age 55. If you are non-resident for tax purposes, although you might in future return to the UK to live, or indeed to another country, you may be able to receive the full value of your fund liability to UK tax and so without deduction of tax at source. By investing the proceeds properly, you could obtain tax free growth whilst you are outside the UK and then benefit from withdrawals of 5% per annum tax free when you are back in the UK.

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, Property, TAX, UK

- 12.02.2020

- Categories: Personal finance

- Tags: Life Policies, Non-Resident, TAX, UK

There are three main tax benefits of using offshore life assurance policies when you are considered a UK tax resident, but do not maintain 'domiciled status' in the UK. These include tax free investments, no Capital Gains Tax, and Tax Deferred Withdrawl Allowances.

There are specific ways that HMRC calculates taxable benefits on proceeds of insurance bonds during retirement. These include Top Slicing and Time Apportioned Relief.

Using trusts can also be a benefit to transferring wealth with reduced tax implications.

- 6.02.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: Momentum, Relative Strength, Sectors, SPX

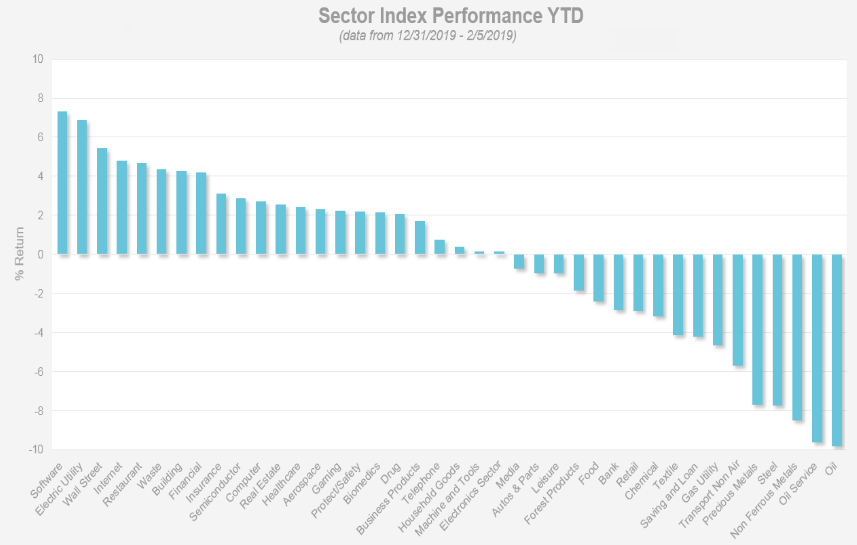

Relative strength-based investing performs best when there is a high level of dispersion between market leaders and laggards. Since the beginning of this year, this has been the case. Semicondutors, software, waste management and computer technology sectors are leading, while oil related stocks are lagging.

Using relative strength-based investing strategies can lead to significant long term market outperfomance compared to 'buy and hold' strategies.

- 5.02.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, January, S&P 500

January finished January down 0.2%. But the does not necessarily meaan the rest of the year will be. We look at the historical record to see how other years performed when January did not do well. It turns out 2 of 3 indicators often are enough to propel the markets higher.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 22.01.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: Copper, COPX, CPER, DIA, FCG, IBB, IYW, IYZ, Natural Gas, QQQ, SOXX, SPX, UNG, VNQ, XLk, XNG

Natural Gas, Energy and Copper still have to show signs of life to fulfill their usual bullish winter runs. Meanwhile, Strong US equity markets have lead to excellent returns in the model portfolios that adhere to seasonal trade stratagies. Expect some modest seasonal weakness soon, though.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 10.01.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: SPX, XLC, XLE, XLF, XLk

With the new year and new decade already here, the markets closed on one of the strongest years for the US equity market in the past decade. The S&P 500 (SPX) was up nearly 29% in 2019 - the second best year in the 2010s, only 2013’s return of just over 29% beat it. All broad sectors produce gains last year, with nine out of the 11 broad sector SPDR ETFs posting gains greater than 20%. The top three sectors, using SPDR ETFs as proxies, were technology (XLK), communication services (XLC, basically a technology ETF), and financials (XLF), returning 47.90%, 29.92%, and 29.22%, respectively. Energy (XLE), on the other hand, was

- 1.01.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: 2020, SPX, Tech

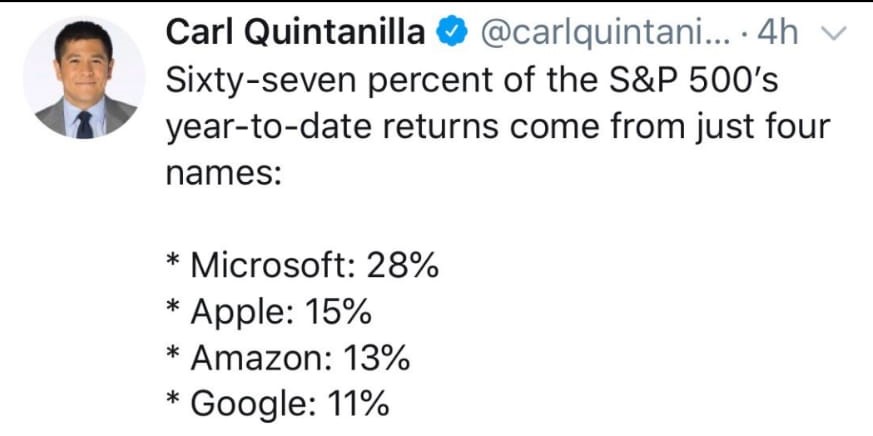

With worldwide central bank rate cuts at record highs and inflated SPX valuations, Wall Street earnings estimates for Q1 2020 look excessive. This is a typical sign of last cycle bull market. Mega-caps are able to outperform and hold earnings margins, but can they continue?

We review what JP Morgan and BAML analysts have to say about the current state of the US economic landscape. Why would they make top recommendations in Energy, Small Caps, Industrials and Transportation for 2020?

To access this post, you must purchase Subscription Plan – AVC Pro.