Tag: pension

- 3.01.2022

- Categories: News, Personal finance

- Tags: pension, UK

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, pension, TAX, UK

- 23.04.2015

- Categories: Personal finance

- Tags: accumulation, pension

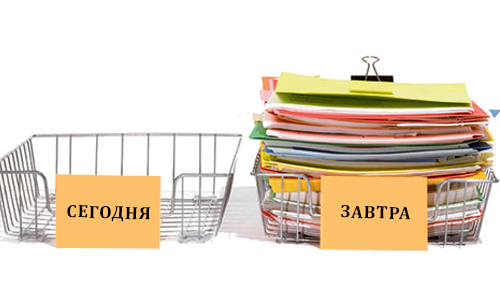

With the start of every new year comes all of those resolutions that you’re absolutely, positively, definitely going to tackle. You’ll finally kick your retirement savings into high gear. And you’re not going to let that financial paperwork pile up again. Yet while you have a game plan for just how to get there in …

6 Ways to Help Beat Financial Procrastination in 2015 Read More »

- 19.02.2015

- Categories: Personal finance

- Tags: pension

Millions of people will need to lower their standard of living in retirement because they haven’t saved enough, according to a recent report by the Center for American Progress. The report found Americans struggling to prepare for retirement and less prepared than previous generations. In addition, a large portion of individuals may have to rely …

Golden Years May Be A Bust For Millions Of Retirees Read More »