Tag: Relative Strength

- 25.08.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: market trends, Momentum, Relative Strength

- 12.03.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Relative Strength, RUJ, Small Caps

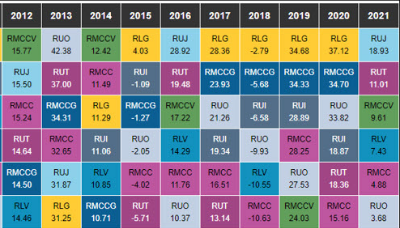

The improvement for Small Cap stocks continues to shine when compared to the rest of the market. This trend can last, in some cases, for years.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.02.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: Momentum, Relative Strength, Sectors, SPX

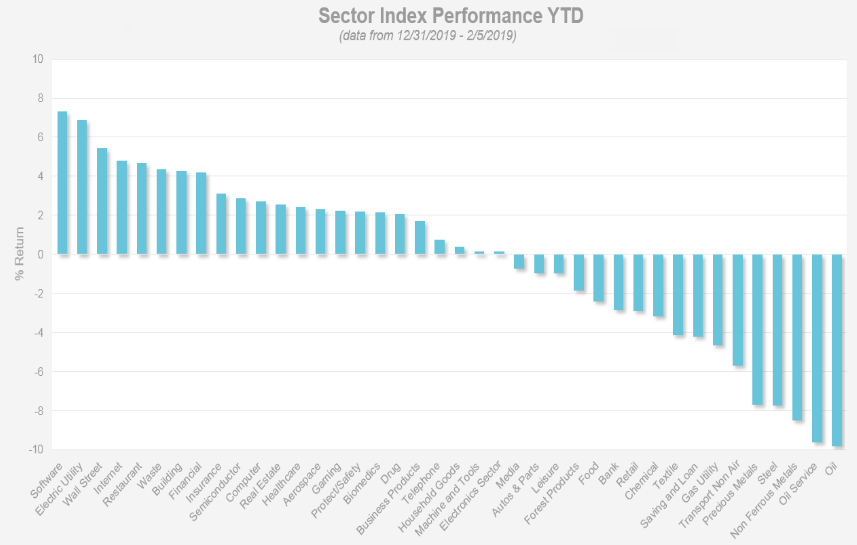

Relative strength-based investing performs best when there is a high level of dispersion between market leaders and laggards. Since the beginning of this year, this has been the case. Semicondutors, software, waste management and computer technology sectors are leading, while oil related stocks are lagging.

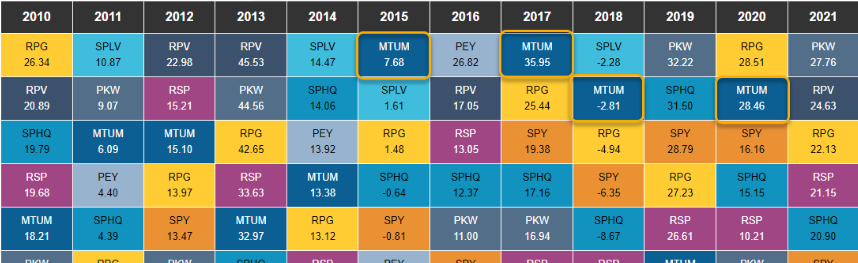

Using relative strength-based investing strategies can lead to significant long term market outperfomance compared to 'buy and hold' strategies.