After a very strong 2019, the S&P 500 (SPX) has gotten off to a relatively good start in 2020 notching a price return of 3.22% year-to-date. However, even this early in the year, there is already significant dispersion between the best and worst-performing sectors in the market. Generally speaking, wider dispersion provides a greater advantage for relative strength strategies to outperform their benchmarks.

Dispersion refers to the performance difference between the best and worst-performing sectors or asset classes and quantifies the opportunity available to tactical strategies. Relative strength-based strategies tend to offer excess return over their benchmarks more readily when the dispersion between the best and worst performers is very wide. The reason for this is fairly straight-forward: the more divergence that exists between the best and worst performer, the more potential value that can be added by owning good performing assets and avoiding the bad performers. When there is more dispersion, there is more potential for a tactical decision to produce a meaningful result. On the other hand, relative strength-based strategies will tend to suffer or at least become muted when the dispersion is narrow. Taken to an extreme, if all investment possibilities were up the same amount each month and each year, tactical management would have no opportunity to add value via rotation.

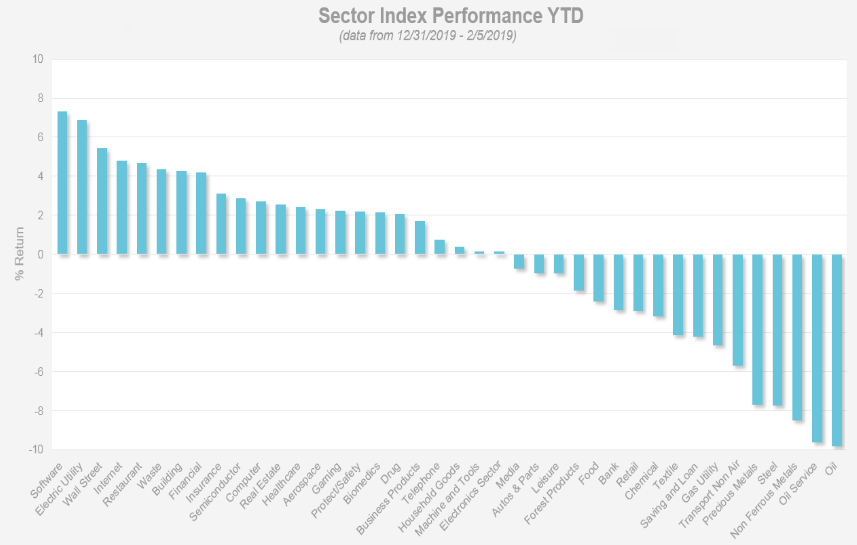

The graph below looks at the year-to-date performance across the market of 40 sectors. As you can see, at just over five weeks into the year, the spread between the best performing sector (software) and the worst-performing sector (oil) currently sits just above 17%, which puts the market on track to potentially reach or exceed the yearly average sector dispersion dating back to 2000, which is about 87%, as well as the median of 76.37%. Although 2019 was a strong year for equities almost across the board, there was still significant dispersion as the worst-performing sector (oil) returned -5.7% and lagged the best performing sector (semiconductors) by about 68%. Even though 2019’s dispersion was below the long-term dispersion average it still provided enough opportunity for some sector rotation strategies to add value.

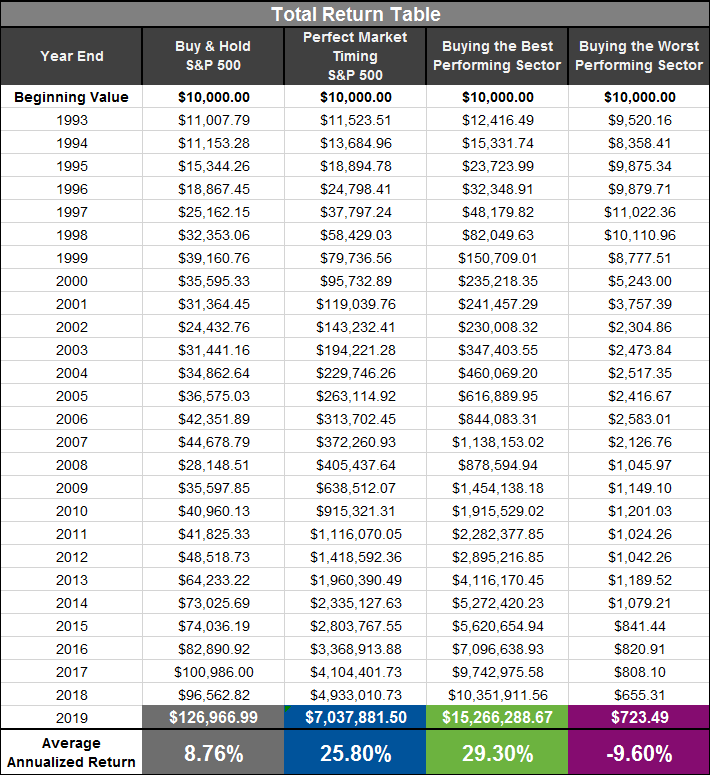

The study below tracks the outcome on a total return basis of four hypothetical investors over the last 26 years. From 1993 – 2019, the first investor, called “Mr. Buy and Hold” simply buys the S&P 500 Index and rides it up and down, making no movements at all in the portfolio. “Mr. Perfect Market Timer”, the second investor, is assumed to be clairvoyant and is only invested during months in which the S&P 500 Index is up. In 2008, for example, this investor would have only been invested in April, May, August, and December, as those were the only positive months that year. In our view, this is about as “perfect” as any “market timer” could ever hope to be, and thus we feel this quantifies well as the best-case scenario for market timing.

Our last two investors are both sector investors, one of whom, “Ms. Perfect Sector”, has the ability to know each and every year what the best performing sector will be for that year, and invests 100% of her portfolio in just that one sector. The fourth investor, “Mr. Worst Sector”, is an unfortunate fellow, who perhaps just follows a favorite magazine cover and is on the wrong side of things each and every year. He manages to invest only in the single worst-performing sector.

As you might imagine, each of the investors has seen dramatically different results over the years from their initial investments of $10,000 back in 1993. At the end of 2019, Mr. Buy and Hold had a portfolio value of about $127,000 while Mr. Perfect Market Timer had a portfolio value of over $7 million. Ms. Perfect Sector saw her portfolio swell to $15.27 million, all while poor Mr. Worst Sector’s portfolio was worth only $723! Yes, you read that right – $723 from the starting point of $10,000.

So, it’s easy, right? All you have to do is invest in the best performing sector each year and simply walk away. Unfortunately, it is not that easy, nor are we advocating that you try to pick the absolute best performing sector and put all your eggs in one basket; rather, this is simply a powerful illustration of just how important incorporating a sector rotation plan can be into your overall portfolio strategy. It can also be an eye-opener for clients in that the magnitude of buying the best sectors is even greater than that of being able to perfectly time the overall market.

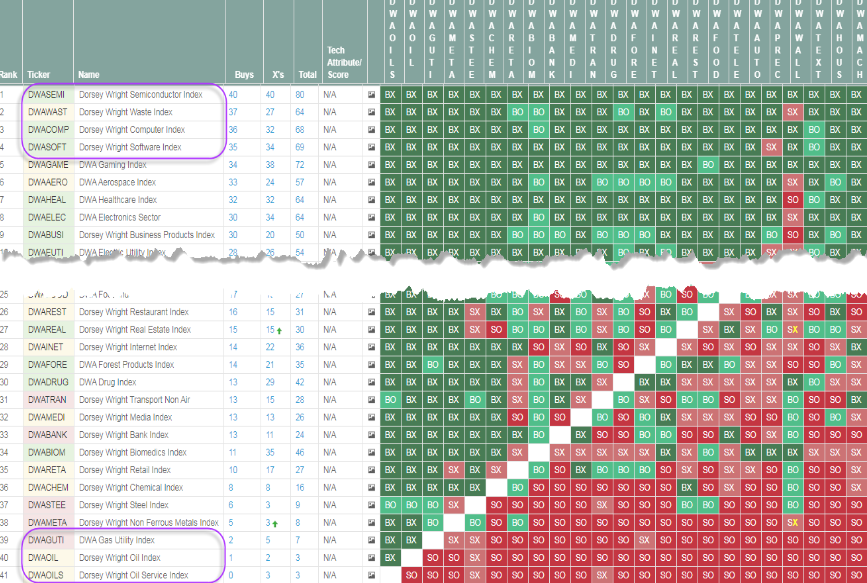

We use numerous tools and indicators, and even systemically managed ETFs, to but the right sectors. We can easily rank all 40 sectors, along with the S&P 500 Equal-Weighted Index (SPXEWI). We measure each sectors relative strength within a matrix. Those sectors at the top of the matrix possess superior relative strength compared to the others on the list. Typically, an investor would want to focus their attention on those sectors toward the top of the matrix, while underweighting those found at the bottom.

When we look at the Relative Strength Matrix today (pictured below), we find that semiconductors, waste management, and computers occupy the top three spots, with gas utilities, oil, and oil service at the bottom of the matrix. Recall that earlier, we mentioned that the worst-performing DWA group so far in 2019 is oil. It is currently ranked second-to-last in the matrix, only above the old oil services sector. The lowest-ranked group in the matrix and second worst-performing group year-to-date. The message the group matrix is sending us is pretty clear – at this point, we should be favoring exposure to technology (semis, computers, and software are all near the top) while avoiding most of the energy sector (gas utilities, oil, and oil services sit at the very bottom of the matrix).