Category: Investment ideas

- 10.01.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: SPX, XLC, XLE, XLF, XLk

With the new year and new decade already here, the markets closed on one of the strongest years for the US equity market in the past decade. The S&P 500 (SPX) was up nearly 29% in 2019 - the second best year in the 2010s, only 2013’s return of just over 29% beat it. All broad sectors produce gains last year, with nine out of the 11 broad sector SPDR ETFs posting gains greater than 20%. The top three sectors, using SPDR ETFs as proxies, were technology (XLK), communication services (XLC, basically a technology ETF), and financials (XLF), returning 47.90%, 29.92%, and 29.22%, respectively. Energy (XLE), on the other hand, was

- 25.11.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, IWM, NASDAQ, NDX, Russell 2000, RUT, S&P 500, Santa Claus Rally, SPX, SPY

Novemeber is tracking the seasonal patterns very closely. We still expect a mild pullback early next week, but from then on we are likely to see post-Thanksgiving gains. Early December can be disappointing for bullish traders, but as Christmas approaches the bulls come back to the parade.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.11.2019

- Categories: Analytics, Investment ideas, Personal finance

- Tags: RUT, Seasonal Strategy, SPX

There are several market tendencies or historical biases that we highlight throughout the year. One historical tendency worth noting at this time of year is the "January Effect." The “January Effect” refers to the tendency of small cap stocks (as a group) to outperform their large cap counterparts early in the calendar year.

- 15.11.2019

- Categories: AVC Pro Subscription, Investment ideas

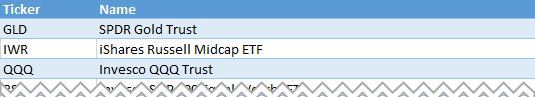

- Tags: DIA, ETFs, QQQ, Seasonal Strategy, SPX

Markets are up strongly since we turned bullish. We expect that momentum to continue after a mild pullback. Overbought signals are here.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.11.2019

Markets are up strongly since issuing the recent Buy Signal. The next two weeks often have retracements of monst of the gains in the first days of November. This mid-November weakness is a good time to add to positions.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 14.10.2019

We lay out the buy points and stop losses for the Tactical ETF Portfolios based on the the Seasonal Trade Strategy

To access this post, you must purchase Subscription Plan – AVC Pro.

- 8.10.2019

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: ETFs, IYW, QQQ

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.10.2019

- Categories: AVC Pro Subscription, Investment ideas

- Tags: AGG, BND, DIA, IWM, QQQ, SPY, TLT

The Seasonal Buy Signal is on Hold. The bull market is still in waiting.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 9.09.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: AGG, BND, oil, SCO, Seasonal Strategy, TLT, XLP, XLU, XLV

Oil prices usually enter a weak period starting in September. Is it playable? Seasonality holds true this year so far. Trades in defensive sectors doing well so far.

To access this post, you must purchase Subscription Plan – AVC Pro.