Category: Investment ideas

- 22.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance, Подписка AVC Про

- Tags: DJIA, IWM, NASDAQ, SPX

The month of June ranks near the bottom of all months for most of the US indexes. Expect volatility during the third week. After that it tends to only get worse.

- 20.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: dividend

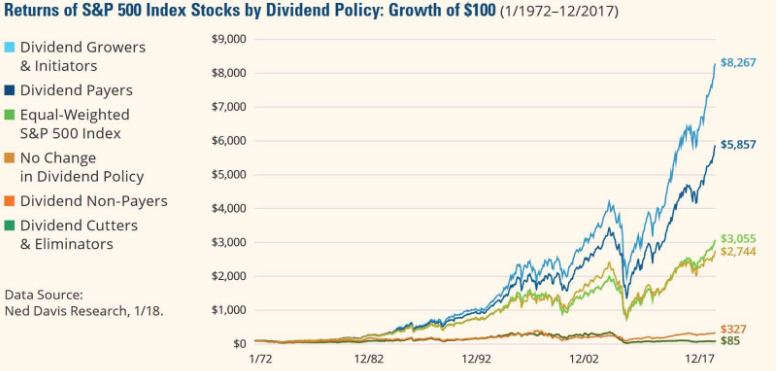

This is the first of a new series of monthly research articles designed to help investors build high quality dividend growth stock portfolios for the long term.

AVC Advisory’s Dividend Investing

Research (DIR) uses momentum trading strategies to identify which dividend securities are trading in a positive manner relative to both the market and other income investements.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 18.05.2020

- Categories: Investment ideas, Personal finance, Личные финансы

- Tags: Gold, interest rates, Rubles, russia, Tech

Having one’s cake and not eating it. When I came to Russia, my first summer was hot and sunny and I took to cycling, exploring the city’s cycle paths, one of my favourites being the one that runs along Bolshaya Nikitskaya up to the Garden Ring. For those unfamiliar, the Garden Ring is a ring …

COVID Emergency Funds, the Price of Gold, and the Stock Market Read More »

- 15.05.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, IBB, IWM, QQQ, SPX, SPY, XLP, XLU

The best six months of the year for certain US stock indexes has ended. A defensive stance is warranted as the summer months arrive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: April, CoronaVirus, DJIA, NASDAQ, Russell 2000, SPX, Tech

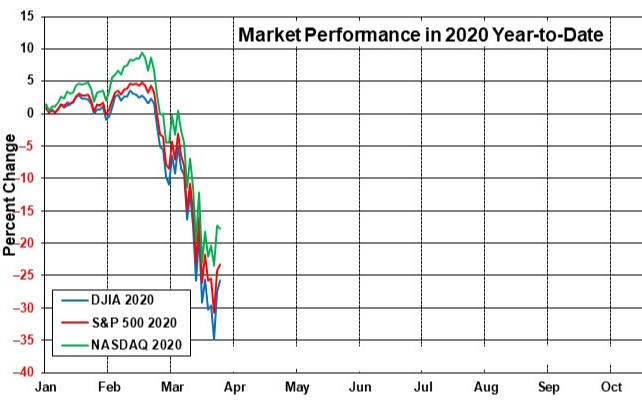

Everyone seems to be hoping for the stock market to find support here, already so much damage has been done.

A great deal of uncertainty remains for the world economy and health crisis. April looks like a good time for a bear market bounce.

Further out, investors should experience a rough ride in the market this year with quite a bit of choppy trading.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.03.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: P/C Ratio, SPX, vix

Today, US stocks were finally able to stage a rally that lasted from opening bell to the close. That has not been the case for a very long time.

Remember, a one day move does not make a trend. We need to see if the bulls can even hold this rally for more than a day. Our feeling is they likely will be able to.

- 17.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: IWM, Russell 2000, SPX, SPY

After stocks suffer large declines, certain companies perform better during a rebound. Besides focusing on timing the bottom, investors need to know what is likely to perform best. We show some historical statistics to get investors ready.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 17.03.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: SPX, Stocks

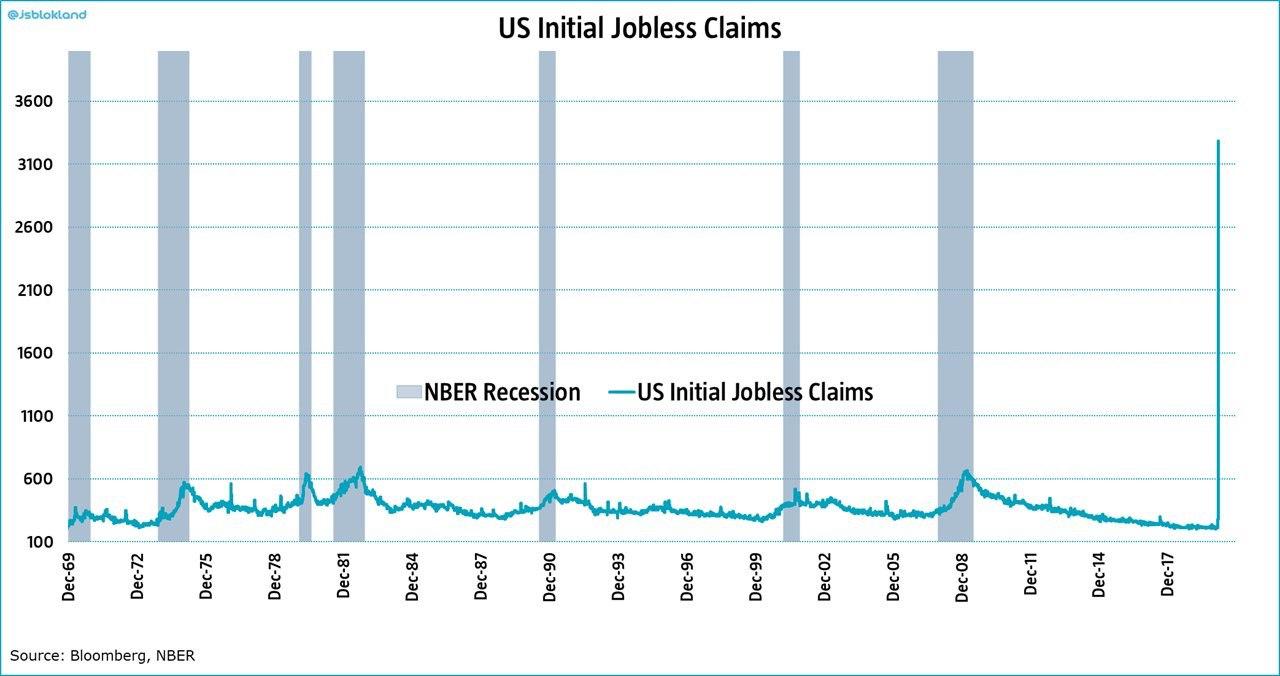

Volaitlity is spiking to levels not seen since 2008. Should long-term minded investors run for shelter?

With no light at the end of the tunnel these bleak times seem desperate. But what happens usually after VIX spikes like the one we are currently experiencing? We look at the months and years after intense volaitility to find solace in the future of the economy.

- 22.01.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

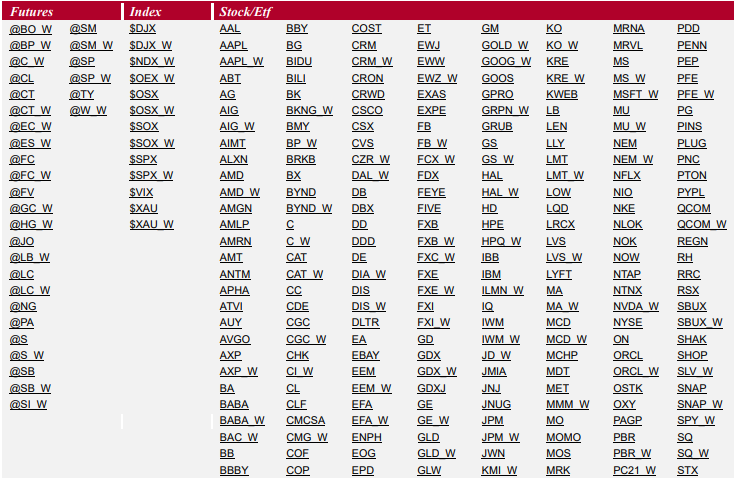

- Tags: Copper, COPX, CPER, DIA, FCG, IBB, IYW, IYZ, Natural Gas, QQQ, SOXX, SPX, UNG, VNQ, XLk, XNG

Natural Gas, Energy and Copper still have to show signs of life to fulfill their usual bullish winter runs. Meanwhile, Strong US equity markets have lead to excellent returns in the model portfolios that adhere to seasonal trade stratagies. Expect some modest seasonal weakness soon, though.

To access this post, you must purchase Subscription Plan – AVC Pro.