Tag: ETFs

- 6.06.2020

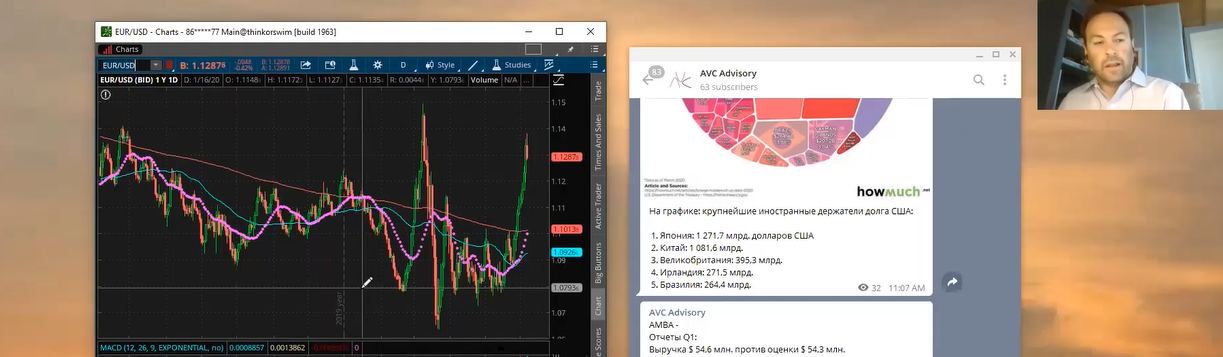

Markets are still bullish, although even more overbought than last week. Today's unexpected employment report provides fuel for higher prices. MLPs are leading momentum in all high dividend paying ETFs. Defense and Transportation (Airlines) showed strength this week. Value plays have rebounded sharply, while software companies look vulnerable with high valuations. Defaults are rising. Investors have piled money into cash equivalents. We look at the EUR/USD and Palladium also.

- 7.03.2020

Large daily moves in both directions of 2-5% and huge intraday swings have taken a toll on markets and psyches. But the February 28 low has held through this week’s wild swings.

According to sector seasonality, there are two sectors that begin their seasonally favorable periods in March: High-Tech and Utilities.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.11.2019

- Categories: AVC Pro Subscription, Investment ideas

- Tags: DIA, ETFs, QQQ, Seasonal Strategy, SPX

Markets are up strongly since we turned bullish. We expect that momentum to continue after a mild pullback. Overbought signals are here.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.11.2019

Markets are up strongly since issuing the recent Buy Signal. The next two weeks often have retracements of monst of the gains in the first days of November. This mid-November weakness is a good time to add to positions.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 8.10.2019

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: ETFs, IYW, QQQ

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.09.2019

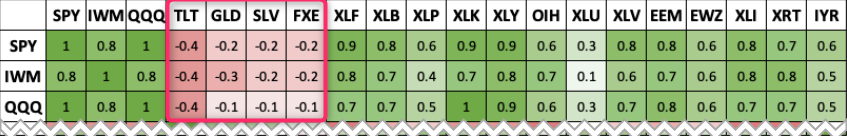

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …