Category: Analytics

- 1.10.2019

- 19.09.2019

- Categories: Analytics, AVC Pro Subscription

- Tags: S&P 500

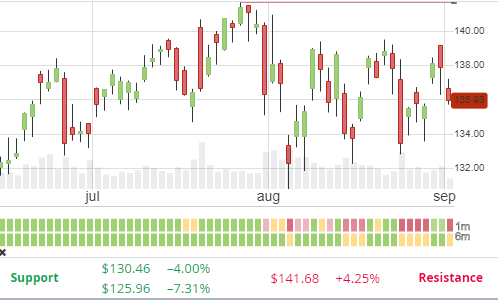

We noted previously that the market would likely work its way higher in the first few weeks of September. Now momentum appears to be fading short of previous all-time highs. With the Fed’s interest rate cut behind us, future price increases need support from alleviating trade issues and more interest rate cuts. Neither of those factors exist yet.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 11.09.2019

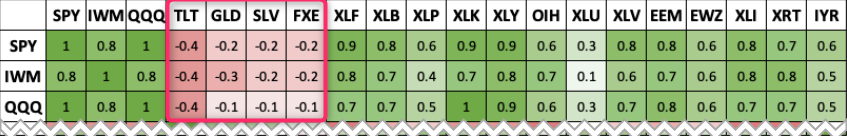

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …

- 9.09.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: AGG, BND, oil, SCO, Seasonal Strategy, TLT, XLP, XLU, XLV

Oil prices usually enter a weak period starting in September. Is it playable? Seasonality holds true this year so far. Trades in defensive sectors doing well so far.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.09.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: MSFT

We look at a short term bullish trade on MSFT, as the stock is outperforming the market. The difficult seasonality make this trade more speculative in nature.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.08.2019

- Categories: Analytics, AVC Pro Subscription

- Tags: SPX

Pending anymore tweets and geopolictical uphevals, we can expect the market to move higher toward the July highs until the last week of the September. Strong bullish market moves will likely remain elusive until November.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.08.2019

September's markets can be much weaker than usual. Investors often looking to precious metals and bonds as areas of safety. Semiconductors are usually the weakest sector.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 23.08.2019

Even during pre-election years in the US, markets are their weakest in September. The last week of the month is extremely weak.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 14.08.2019

- Categories: Analytics, AVC Pro Subscription

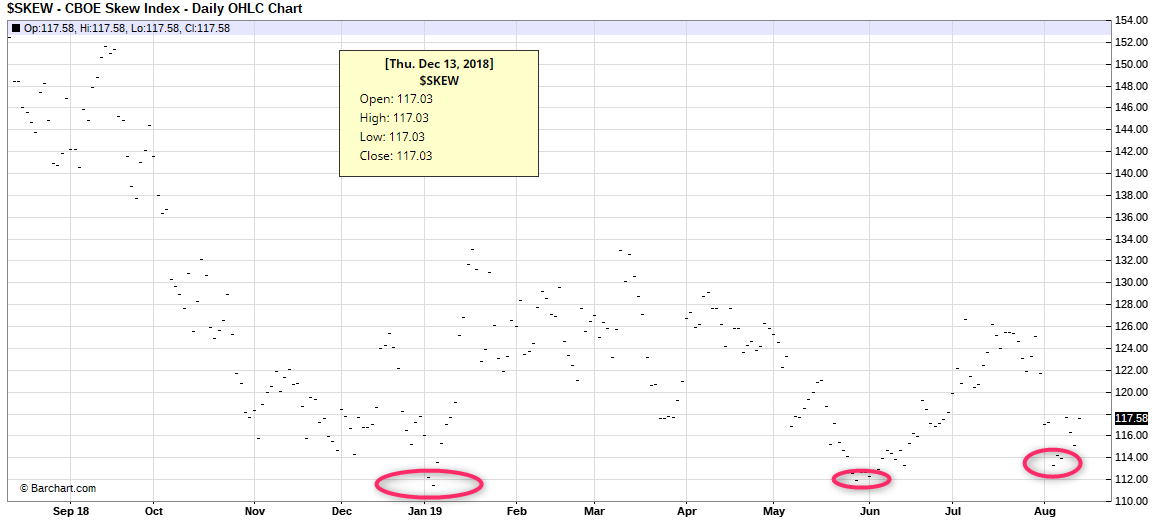

- Tags: SKEW, SPX, vix

Markets traded significantly higher today on large volume. This signals a follow through day from last Monday's lows. Caution is warrented when trading in summer months.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.08.2019

- Categories: Analytics, AVC Pro Subscription, Investing basics

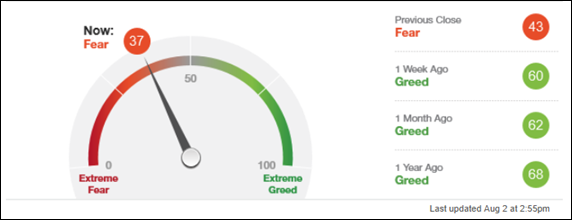

- Tags: NYA50R, NYHL, NYMO, P/C Ratio, SPX

We review common measures of volatility, breadth, volume and investor setiment to determine how much more of a pullback the US markets might witness.

To access this post, you must purchase Subscription Plan – AVC Pro.