Category: Analytics

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

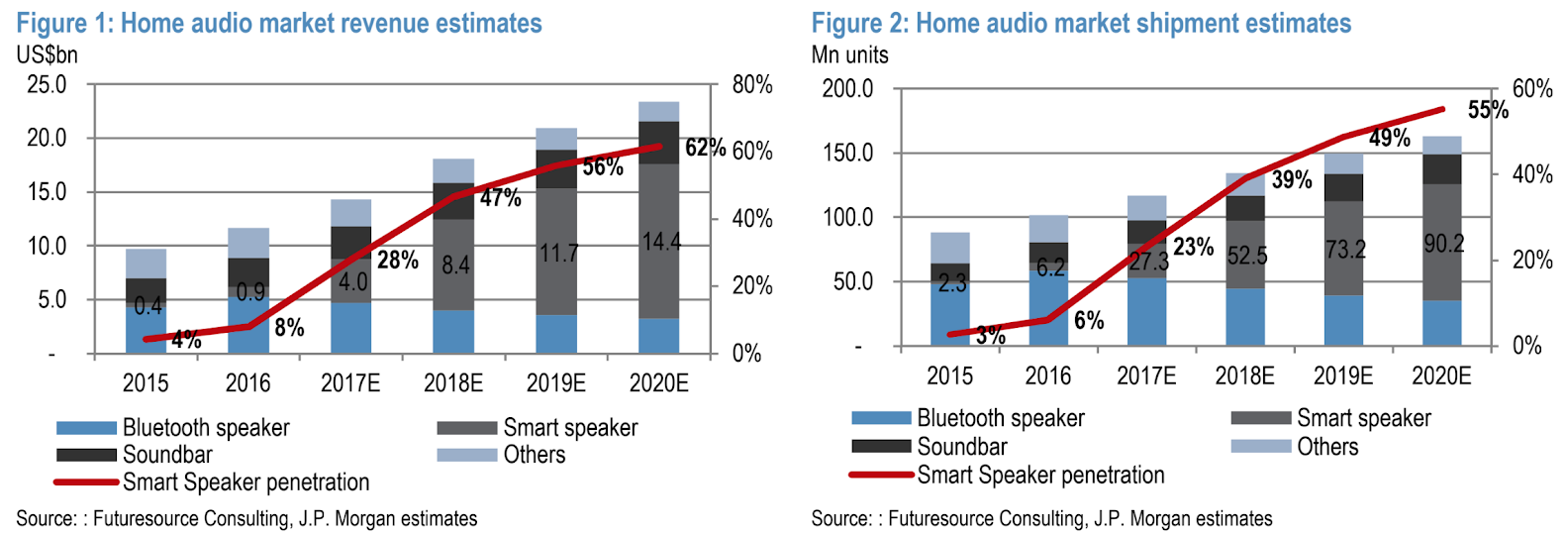

- Tags: AMZN, GOOG

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

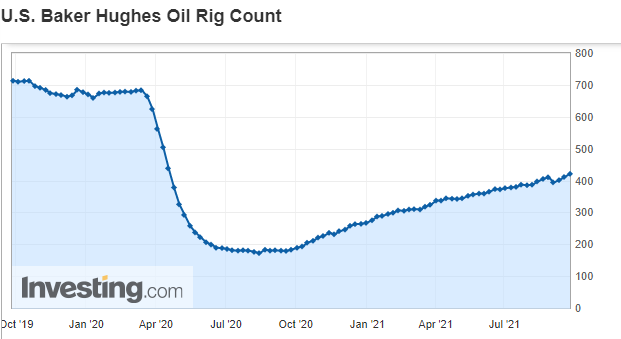

- Tags: ESG, oil

We highlighted this US oil producer as a short term trade recently, but now provide a more long-term, in-depth outlook on its bullish prospects.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

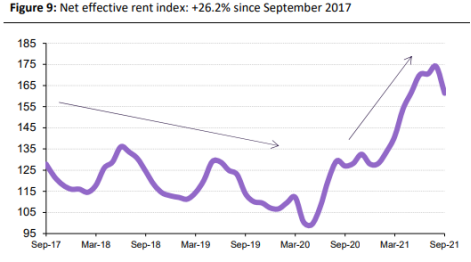

- Tags: COVID, REITs

This REIT has made some interesting acquisitions and is likely to grow robustly as self-storage trends continue as rent rates increase. Currently, the stock has pulled back to an interesting point.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

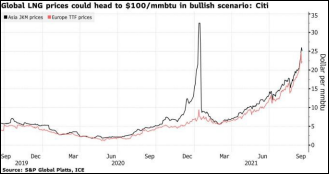

- Tags: Natural Gas, oil, REITs

One of the world’s largest and most diversified alternative asset managers with significant revenue streams from utilities, REITs, oil and gas provides a good entry point.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Mining, oil

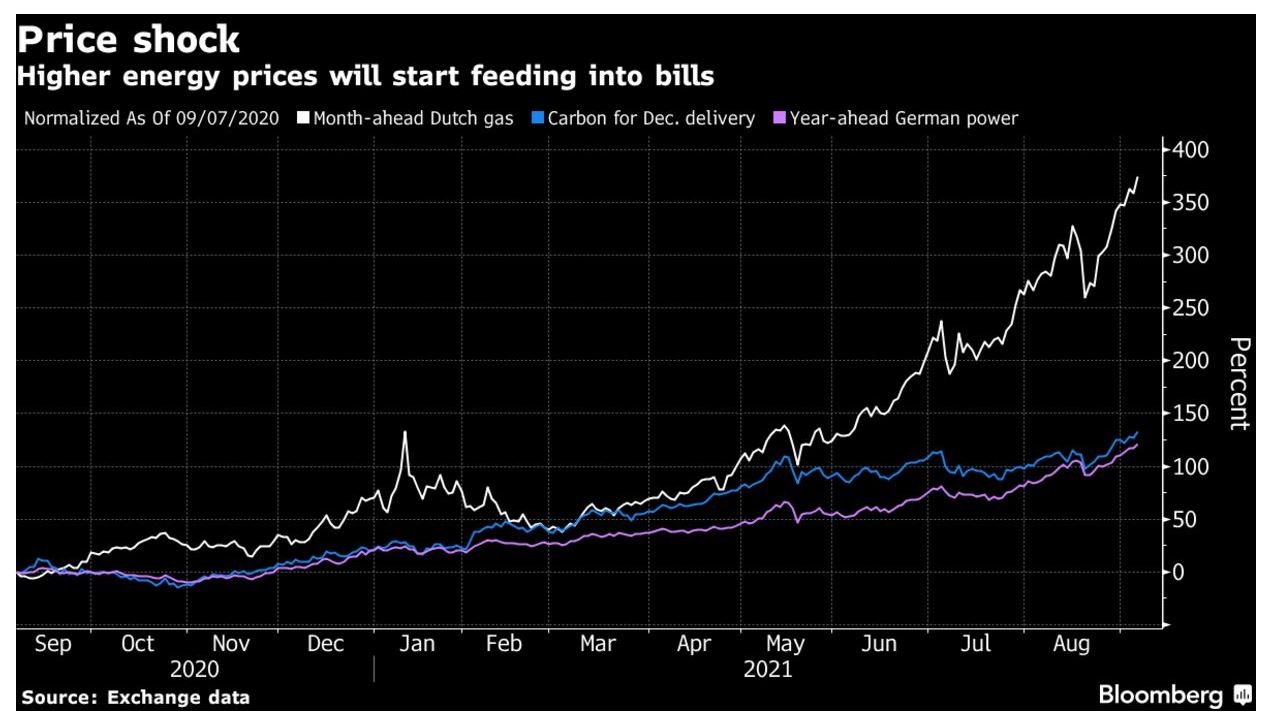

Assuming the world economy is entering a period of global stagflation and/or accelerating inflation, investments in economies that are closest to the earliest stages of supply chains - ones that have direct exposure to oil and commodities - look most attractive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.10.2021

- Categories: Analytics, Investing basics, Investment ideas, News

- Tags: Copper, Energy, ESG, EV, US

- 1.10.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Seasonal Strategy, Seasonality

October is the last month of seasonal weakness for the US equity markets. The recent pullback sets October up for a turn around to start a more bullish period.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.09.2021

- Categories: Analytics, Investment ideas, News

- Tags: etf, europe, Gazprom, Natural Gas

October often evokes fear on Wall Street. Equity market distress can become a self-fulfilling prophecy. October is also a turnaround month often called a “bear killer”.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 10.09.2021

- Categories: Analytics, Investment ideas, News

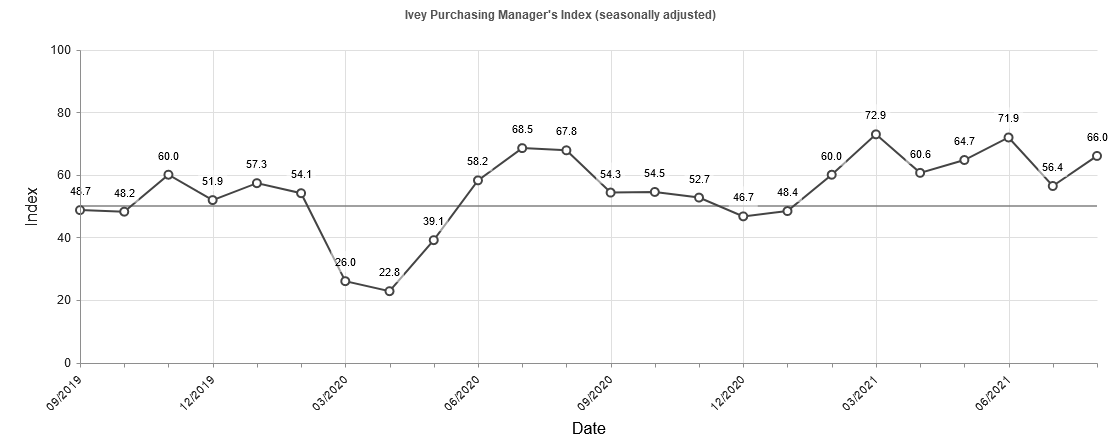

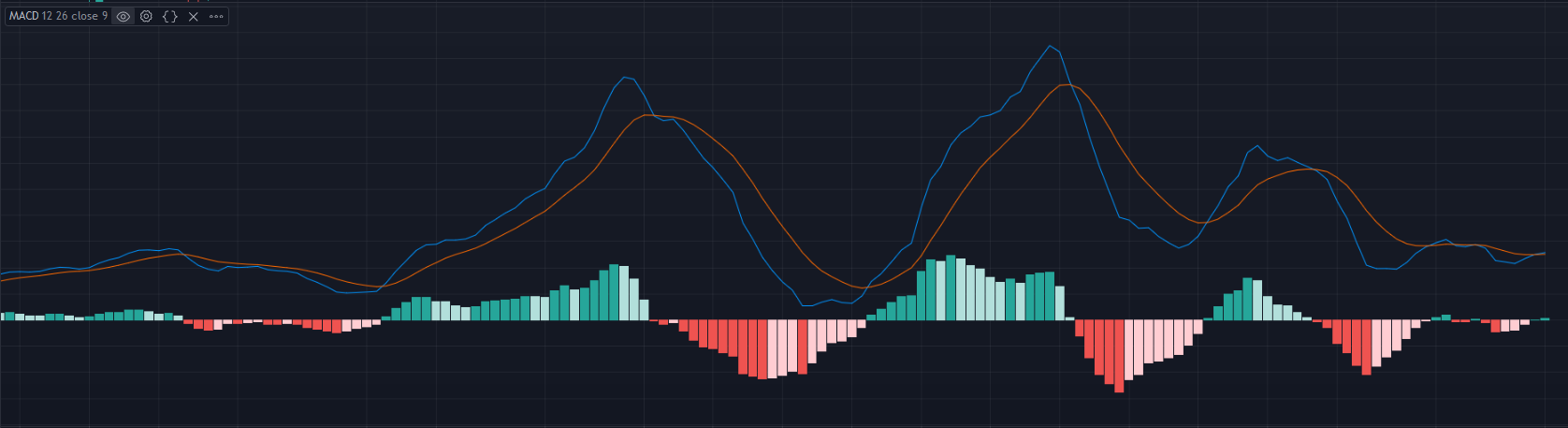

- Tags: china, Commodities, inflation, iron, nickel, palladium, PMI

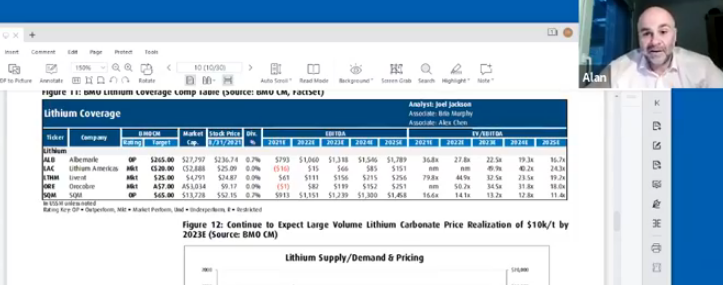

Lithium prices are set to rise over the next decade. We have previously discussed Albemarle (ALB) and Sociedad Química y Minera (SQM) as main beneficiaries of this trend. We review these again during this week’s Live Facebook chat. Other metals, like iron ore and palladium look to have peaked recently after strong runs. Chinese PMI …

Friday Investment Talk: Lithium, Iron Ore, Palladium, Inflation Read More »