Tag: GLD

- 21.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: eem, Elections, GLD, Seasonality, SLV, XLI

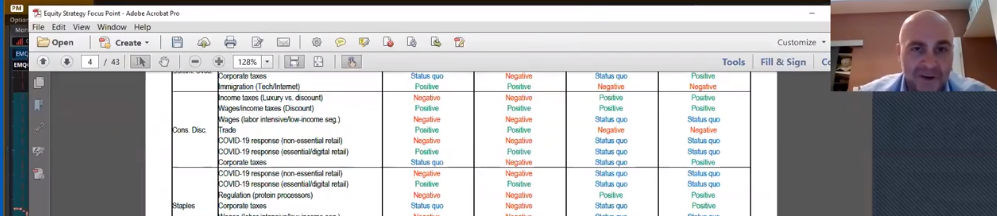

We take a first glance at Bank of America research on which sectors will benefit under the four possible election results in the US. Meanwhile, US sector rotation is visible. Investors are moving from technology to industrials. Emerging markets are holding up, also. Gold and Silver are flat. Barron’s highlights the possibility of Japan and …

Friday Investment Talk: US Elections, Seasonality, Europe, Japan and Emerging Markets Read More »

- 23.08.2020

- Categories: Analytics, Investment ideas, News

- Tags: emerging markets, GLD, IWM, Rubles, SPX, TUR, Turkey

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

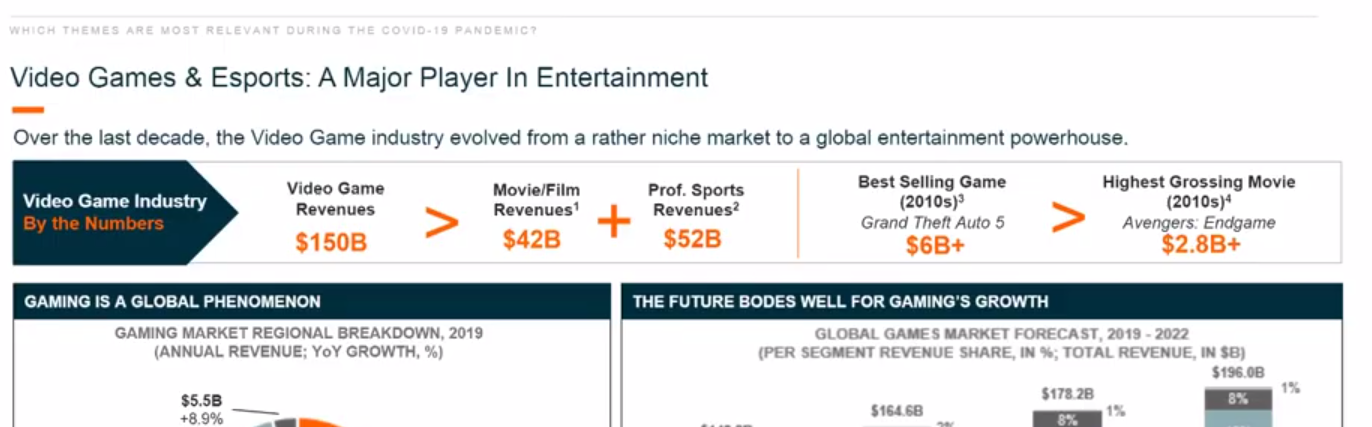

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 3.07.2020

July and the second half of the year have started off consistent with historical trends and patterns. The first trading day was mostly positive with S&P 500 and NASDAQ recording gains. However, July has historically been a month of transition with gains early and weakness in the second half. Meanwhile, three seasonal tredns start in July.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 13.06.2020

- Categories: Analytics, Investment ideas

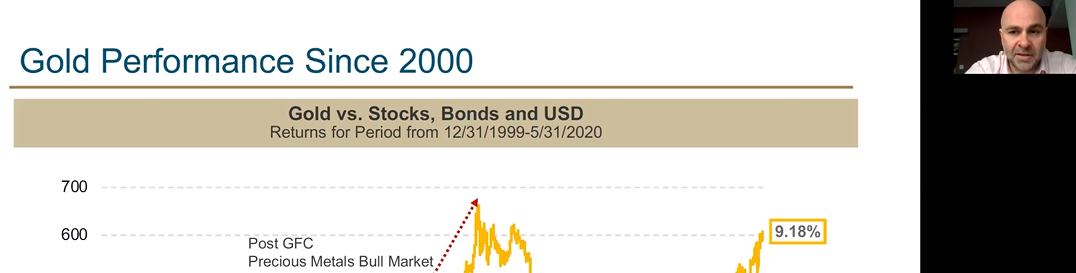

- Tags: bonds, GDX, GDXJ, GLD, HYG, JNK, QQQ, Seasonality

AVC partners discuss corporate bonds from some surprising names now considered "Fallen Angels". Gold, inflation and the undervalued gold miners are discussed in relation to the current overbought market. Thursday's huge sell off is a set up for a last run of strength before real seasonal weakness sets in.

- 24.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EWJ, EWY, FXI, GLD, SPX, TLT

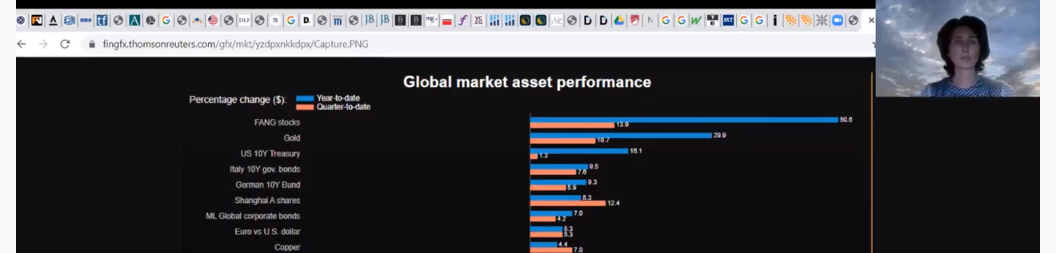

We have a just launched the first session of our new weekly "Friday Investment Talk" series. This week Alan, Mike, and I discuss the continuation of the bull market's posture. Mike speaks of how client's 'fear of missing out' leads to overly concentrated portfolios. Alan highlights how the recent Chinese sell off could be a buying opportunity, as other Asian markets look strong.

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

Usually at this time of the year, early-April, stock markets would have had a nice seasonal rally. Well, there is nothing usual about the market or the economy this time.

As of today, the new bear market closing lows were on March 23. From their highs DJIA was down 37.1% and S&P 500 was down 33.9%.

Since then the market has rebounded to trim those losses.

Now we look to position for the worst months of the year ahead.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.03.2020

Large daily moves in both directions of 2-5% and huge intraday swings have taken a toll on markets and psyches. But the February 28 low has held through this week’s wild swings.

According to sector seasonality, there are two sectors that begin their seasonally favorable periods in March: High-Tech and Utilities.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 7.11.2019

Markets are up strongly since issuing the recent Buy Signal. The next two weeks often have retracements of monst of the gains in the first days of November. This mid-November weakness is a good time to add to positions.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.10.2019

There are 13 sector seasonalities that enter favorable periods in October. some last only a few months, others half the year. Entry levels and expected returns are exposed.

To access this post, you must purchase Subscription Plan – AVC Pro.