Tag: vix

September is historically one of the weakest months for equities, and so far, the month is living up to its reputation. Through 9/15, the S&P 500 (SPX) is down about 1.3%, but for the month that holds the “weakest month of the year” title that seems a bit tame. Studies show that it has historically …

- 29.07.2023

- Categories: Analytics, AVC Pro Subscription

- Tags: S&P 500, SPX, vix

With realized market volatility remaining muted in recent weeks and expected volatility (i.e., the VIX) sitting at multi-year lows, today we examined the relationship in the perspective of forward returns.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 3.08.2022

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription

- Tags: market review, NYMO, NYSI, Put/Call Ratios, S&P 500, vix

For about 6 weeks the market has moved higher. This momentum takes many indicators to extremely overbought levels. This typically leads to weak price action going forward.

To access this post, you must purchase Subscription Plan – AVC Pro.

Today's hot CPI numbers burned the market. The Fed's Bullard gets hawkish and may spell problems for the market going forward in February.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 29.01.2022

- Categories: Investment ideas, Personal finance

- Tags: Energy, GLD, SPY, vix

Markets were on a wild ride in January, especially this last week. We expected this would be the 4th negative week for the markets, but strength in the last few hours turned this week positive. On many levels and by many measures the market is extremely oversold, but so far few buy signals have developed. …

Friday Investment Talk: Fear and Market Suffering Read More »

- 26.09.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: Futures, Markets, SPX, vix

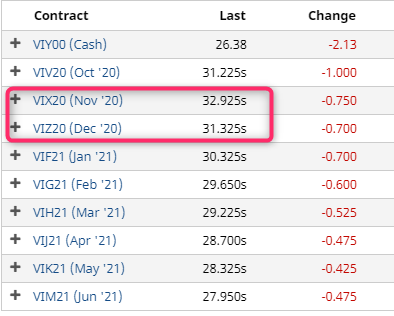

With such a highly divisive election coming in November, a ‘VIX bubble’ has appeared. This is distorting how traders are reacting to the current market sell off.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.03.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: P/C Ratio, SPX, vix

- 8.03.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: CPCE, NYMO, NYSI, P/C Ratio, SKEW, SPX, vix, volatility

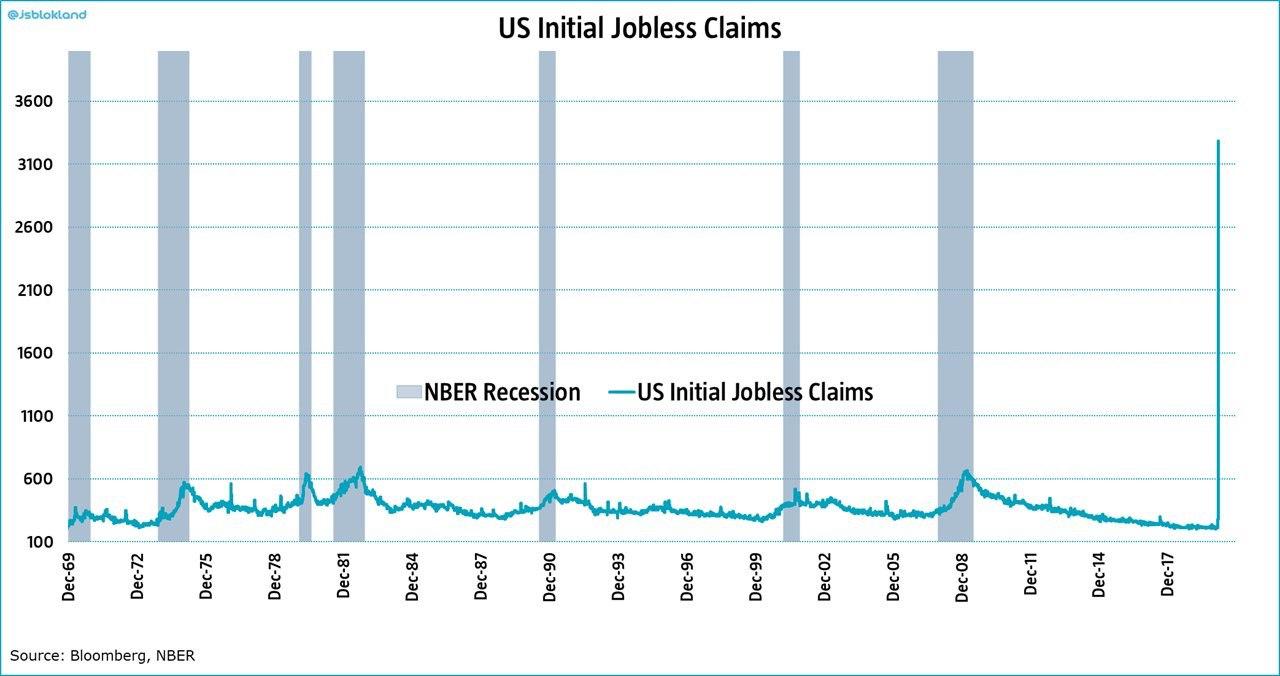

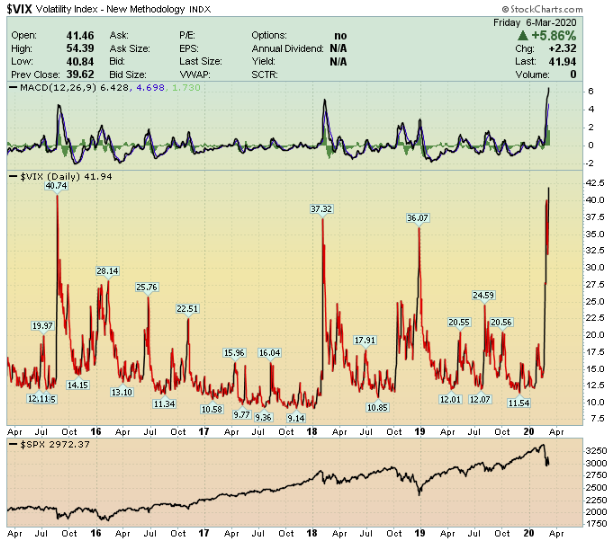

Volatility in the US has exploded, throwing the markets into disarray. The intermediate-term trend is bearish, with extreme oversold conditions likely to produce sharp, but short-lived, rallies. We will look at some important indicators to see how oversold the markets are and what usually happens at times when markets sell off quickly.