Tag: market trends

- 25.08.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

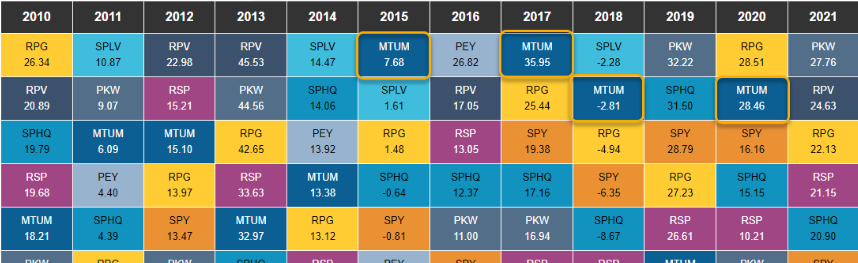

- Tags: market trends, Momentum, Relative Strength

- 4.10.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, Elections, ETFs, GLD, market trends, Stocks

As US elections approach we take a look at how election results move markets. We go through 10 lessons for all investors who are nervous going into the elections. History shows that there is nothing to be afraid of except uncertainty. Markets look bullish for October based on the AAII Investors Sentiment Survey and several …

Friday Investment Talk: US Elections, Market Bullishness, and Fintech Read More »

- 8.02.2019

- Categories: Analytics, News

- Tags: market review, market trends

Technically, all major indexes sit around their 200dMA – which means nothing really, other than everyone is watching it. Therefore, this level becomes a psychologically important level. A retracement from these levels is basically a self-fulfilling prophecy as everyone expects a fall of some sorts from here. Investors Business Daily counts only 2 distribution days …

- 15.01.2019

- Categories: Analytics, News, Personal finance

- Tags: bonds, market trends, usa

Today, Citigroup reported earnings in line with analysts expectations, but warned of weakness in its fixed income business. This resonates with our own concerns for the US debt market. Both government bonds and corporate bond yields have been under pressure for months as we have seen an inversion of the yield curve in some U.S. …

- 5.03.2018

- Categories: Analytics

- Tags: market review, market trends

All the major equity markets saw massive selling in the beginning of February. Correlation between all asset classes rose sharply, as usual during market corrections, making it difficult to find shelter from the retreat. Combined with the unwinding of the short volatility trade which was so popular for the last few years, interest rate fears …

- 12.02.2018

- Categories: Analytics

- Tags: developed markets, emerging markets, market review, market trends

All the major equity markets saw extended bullish action from December lows. This continued through most of January, with only the last few days showing some weakness. The strength of the SPY really picked up in the second half of the month. The end of the month selling was weakest in the SPY. Mid-Cap US …

- 18.10.2017

- Categories: Analytics

- Tags: market trends

The funds can bet on rising or falling prices, and have a low correlation with stocks or bonds Taken as a group, managed futures mutual funds have been wretched over the past five years. But the category has some strong performers, and if you’re looking for an unloved area due for a turn, managed futures …

Managed futures funds have fared poorly, but could shine in a market downturn Read More »

- 7.08.2015

- Categories: Analytics

- Tags: bonds, germany, market review, market trends, usa

Overview Stocks around the world rebounded last week, with the U.S. taking the lead. Investors should be aware, however, that the good times may not last for long. Although last week featured more evidence that U.S. companies are able to beat diminished earnings expectations, several other developments argue for caution. Notably, estimates for growth have …

- 23.06.2015

- Categories: Analytics, Investment ideas

- Tags: market review, market trends, usa

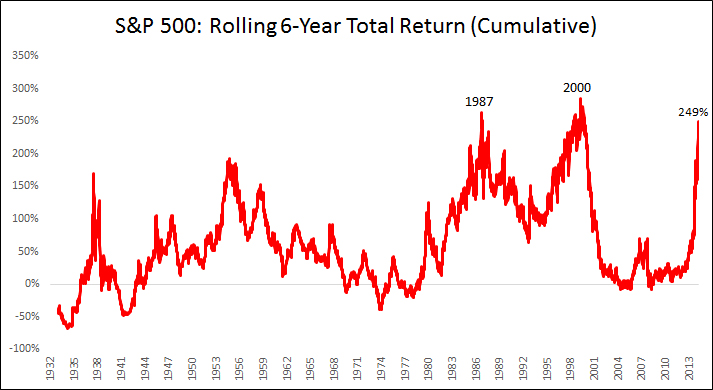

As the US bull market goes into its seventh year, we admire how far we have come. From the dark clutches of fear in March 2009, the S&P 500 has had one of the greatest six year bull market runs in history, more than tripling. Only 1981-1987 and 1994-2000 saw larger gains over a similar …

Review of markets over May Do you hear the markets sing, singing the song of nervous investors? One didn’t need to listen carefully to hear that volatility was the main melody in May. While April’s tune was characterised by fairly sound gains in most asset classes, May began with a European bond market correction, which …