Tag: MELI

- 6.03.2022

A hot war has created hot commodity prices. Wheat was a big gainer this week, but also oil and non-ferrous metals took off. Brazil has shown strength this year as its relative strength outperforms many sectors. Healthcare companies such as our favorite BMY have a made a huge comeback this year. Selling continues everywhere else, …

- 6.06.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EPI, EWZ, F, FXI, IBKR, Interactive Brokers, MELI, PAGS, Stocks

- 30.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: dividend, Fintech, MELI, PAGS, Semiconductors, SMH, SOX, T

- 7.02.2021

- 16.12.2020

- Categories: Investment ideas, Personal finance

- Tags: AMZN, BABA, funds, LULU, MELI, MSFT, SE, Tech

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

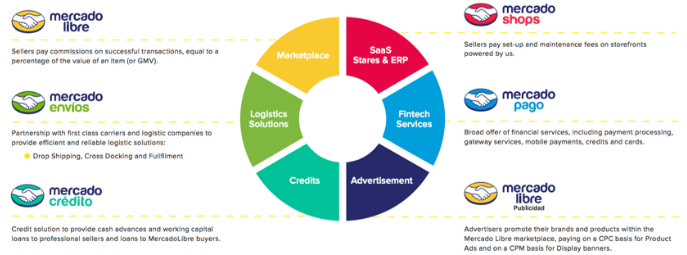

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.

- 27.07.2019

Our article back on on January 16th highlighted Brazil stocks (EWZ) as a place to search for growth companies. We felt that Brazil’s economy should perform well in 2019 after better economic results and decreased regulation. We liked MercadoLibre (MELI) when the stock was trading in a range between $250 and $350 dollars. We then repeated our comments about MELI again in …