Category: News

- 1.03.2021

- Categories: Investment ideas, News, Personal finance

- Tags: $DKNG, inflation, interest rates, TLT, TNX, TSLA

- 21.02.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Biotech, bonds, inflation, interest rates, Medtech, Semiconductors, TBT, TLT

- 13.02.2021

- 11.02.2021

- Categories: News, Personal finance

- Tags: TAX, UK

- 1.02.2021

- Categories: Investment ideas, News, Personal finance

- Tags: COVID, GME, IPOs, SPAC, Stocks, Webinar

- 23.01.2021

- Categories: Analytics, Investment ideas, News, Personal finance

We look at the future trends and technological changes coming in the next ten years that will affect human productivity. Artificial Intelligence, Internet of Things, Robotics, Autonomous Vehicles and Blockchain Technologies all have their place in making workers more productive and changing how we all view wealth, leisure, and healthcare. We look at specific funds …

Friday Investment Talk: The Next 10 Years, Energy, USD and Seasonality Read More »

- 17.01.2021

- Categories: Investment ideas, News, Personal finance

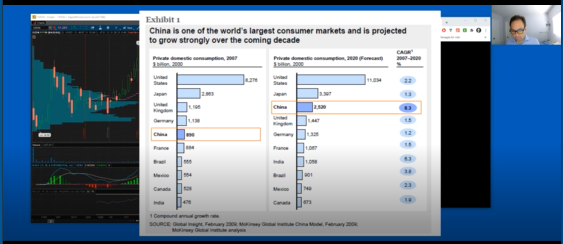

- Tags: bitcoin, china, ETFs, OZON, Russell 2000, russia, Seasonality, SPCE

- 13.01.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: interest rates, TLT, TNX

- 1.01.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, FAANG, IWM, Santa Claus Rally, webinar

Looking beyond 2020 economic strength, forecasts for 2021 are very positive. US cash levels remain elevated as markets hit all time highs. The USD weakens, while emerging markets strengthen and small caps come under pressure. FAAMG stocks take some of the Santa Claus Rally leadership.

- 19.12.2020

- Categories: Analytics, Investment ideas, News, Personal finance

Investment banks are very bullish on economic growth and stock market performance in 2021, with expectations of low inflation, low interest rates, a weakening USD and Asian export growth. Small caps continued to lead in December, piling on gains after a record setting November. Bitcoin bits new highs, but its Fintech that has investment bankers interest. Meanwhile, big tech moves sideways.